Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OVERVIEW<br />

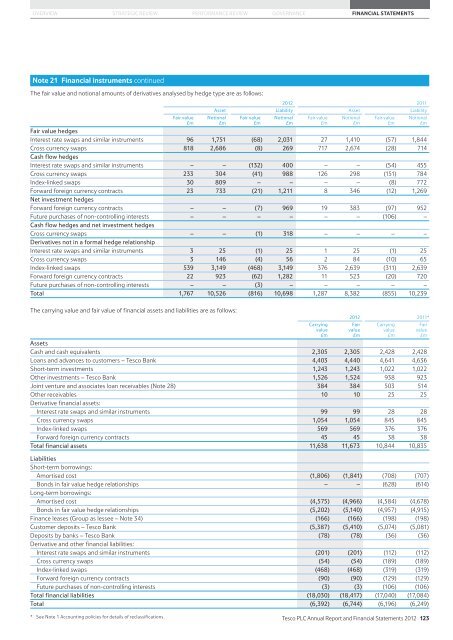

Note 21 <strong>Financial</strong> instruments continued<br />

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

The fair value <strong>and</strong> notional amounts of derivatives analysed by hedge type are as follows:<br />

Fair value<br />

£m<br />

<strong>2012</strong> 2011<br />

Asset Liability Asset Liability<br />

Notional<br />

£m<br />

Fair value<br />

£m<br />

Notional<br />

£m<br />

Fair value<br />

£m<br />

Notional<br />

£m<br />

Fair value<br />

£m<br />

Fair value hedges<br />

Interest rate swaps <strong>and</strong> similar instruments 96 1,751 (68) 2,031 27 1,410 (57) 1,844<br />

Cross currency swaps 818 2,686 (8) 269 717 2,674 (28) 714<br />

Cash flow hedges<br />

Interest rate swaps <strong>and</strong> similar instruments – – (132) 400 – – (54) 455<br />

Cross currency swaps 233 304 (41) 988 126 298 (151) 784<br />

Index-linked swaps 30 809 – – – – (8) 772<br />

Forward foreign currency contracts 23 733 (21) 1,211 8 346 (12) 1,269<br />

Net investment hedges<br />

Forward foreign currency contracts – – (7) 969 19 383 (97) 952<br />

Future purchases of non-controlling interests – – – – – – (106) –<br />

Cash flow hedges <strong>and</strong> net investment hedges<br />

Cross currency swaps – – (1) 318 – – – –<br />

Derivatives not in a formal hedge relationship<br />

Interest rate swaps <strong>and</strong> similar instruments 3 25 (1) 25 1 25 (1) 25<br />

Cross currency swaps 3 146 (4) 56 2 84 (10) 65<br />

Index-linked swaps 539 3,149 (468) 3,149 376 2,639 (311) 2,639<br />

Forward foreign currency contracts 22 923 (62) 1,282 11 523 (20) 720<br />

Future purchases of non-controlling interests – – (3) – – – – –<br />

Total 1,767 10,526 (816) 10,698 1,287 8,382 (855) 10,239<br />

The carrying value <strong>and</strong> fair value of financial assets <strong>and</strong> liabilities are as follows:<br />

Carrying<br />

value<br />

£m<br />

Notional<br />

£m<br />

<strong>2012</strong> 2011*<br />

Assets<br />

Cash <strong>and</strong> cash equivalents 2,305 2,305 2,428 2,428<br />

Loans <strong>and</strong> advances to customers – <strong>Tesco</strong> Bank 4,403 4,440 4,641 4,636<br />

Short-term investments 1,243 1,243 1,022 1,022<br />

Other investments – <strong>Tesco</strong> Bank 1,526 1,524 938 923<br />

Joint venture <strong>and</strong> associates loan receivables (Note 28) 384 384 503 514<br />

Other receivables 10 10 25 25<br />

Derivative financial assets:<br />

Interest rate swaps <strong>and</strong> similar instruments 99 99 28 28<br />

Cross currency swaps 1,054 1,054 845 845<br />

Index-linked swaps 569 569 376 376<br />

Forward foreign currency contracts 45 45 38 38<br />

Total financial assets 11,638 11,673 10,844 10,835<br />

Liabilities<br />

Short-term borrowings:<br />

Amortised cost (1,806) (1,841) (708) (707)<br />

Bonds in fair value hedge relationships – – (628) (614)<br />

Long-term borrowings:<br />

Amortised cost (4,575) (4,966) (4,584) (4,678)<br />

Bonds in fair value hedge relationships (5,202) (5,140) (4,957) (4,915)<br />

Finance leases (Group as lessee – Note 34) (166) (166) (198) (198)<br />

Customer deposits – <strong>Tesco</strong> Bank (5,387) (5,410) (5,074) (5,081)<br />

Deposits by banks – <strong>Tesco</strong> Bank (78) (78) (36) (36)<br />

Derivative <strong>and</strong> other financial liabilities:<br />

Interest rate swaps <strong>and</strong> similar instruments (201) (201) (112) (112)<br />

Cross currency swaps (54) (54) (189) (189)<br />

Index-linked swaps (468) (468) (319) (319)<br />

Forward foreign currency contracts (90) (90) (129) (129)<br />

Future purchases of non-controlling interests (3) (3) (106) (106)<br />

Total financial liabilities (18,030) (18,417) (17,040) (17,084)<br />

Total (6,392) (6,744) (6,196) (6,249)<br />

* See Note 1 Accounting policies for details of reclassifications. <strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong> 123<br />

Fair<br />

value<br />

£m<br />

Carrying<br />

value<br />

£m<br />

Fair<br />

value<br />

£m