Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Group financial statements<br />

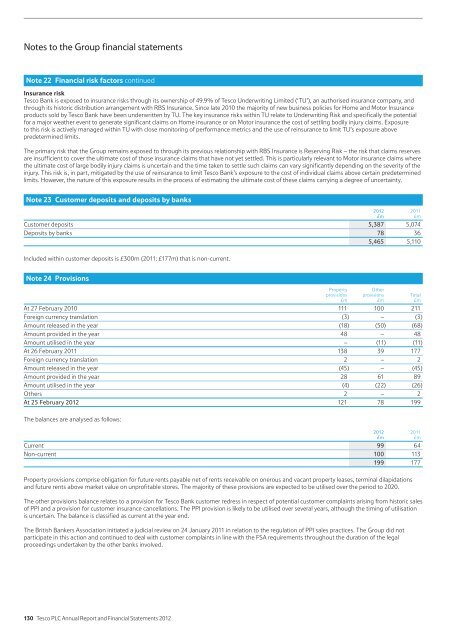

Note 22 <strong>Financial</strong> risk factors continued<br />

Insurance risk<br />

<strong>Tesco</strong> Bank is exposed to insurance risks through its ownership of 49.9% of <strong>Tesco</strong> Underwriting Limited (‘TU’), an authorised insurance company, <strong>and</strong><br />

through its historic distribution arrangement with RBS Insurance. Since late 2010 the majority of new business policies for Home <strong>and</strong> Motor Insurance<br />

products sold by <strong>Tesco</strong> Bank have been underwritten by TU. The key insurance risks within TU relate to Underwriting Risk <strong>and</strong> specifically the potential<br />

for a major weather event to generate significant claims on Home insurance or on Motor insurance the cost of settling bodily injury claims. Exposure<br />

to this risk is actively managed within TU with close monitoring of performance metrics <strong>and</strong> the use of reinsurance to limit TU’s exposure above<br />

predetermined limits.<br />

The primary risk that the Group remains exposed to through its previous relationship with RBS Insurance is Reserving Risk – the risk that claims reserves<br />

are insufficient to cover the ultimate cost of those insurance claims that have not yet settled. This is particularly relevant to Motor insurance claims where<br />

the ultimate cost of large bodily injury claims is uncertain <strong>and</strong> the time taken to settle such claims can vary significantly depending on the severity of the<br />

injury. This risk is, in part, mitigated by the use of reinsurance to limit <strong>Tesco</strong> Bank’s exposure to the cost of individual claims above certain predetermined<br />

limits. However, the nature of this exposure results in the process of estimating the ultimate cost of these claims carrying a degree of uncertainty.<br />

Note 23 Customer deposits <strong>and</strong> deposits by banks<br />

Customer deposits 5,387 5,074<br />

Deposits by banks 78 36<br />

5,465 5,110<br />

Included within customer deposits is £300m (2011: £177m) that is non-current.<br />

Note 24 Provisions<br />

Property<br />

provisions<br />

£m<br />

<strong>2012</strong><br />

£m<br />

Other<br />

provisions<br />

£m<br />

At 27 February 2010 111 100 211<br />

Foreign currency translation (3) – (3)<br />

Amount released in the year (18) (50) (68)<br />

Amount provided in the year 48 – 48<br />

Amount utilised in the year – (11) (11)<br />

At 26 February 2011 138 39 177<br />

Foreign currency translation 2 – 2<br />

Amount released in the year (45) – (45)<br />

Amount provided in the year 28 61 89<br />

Amount utilised in the year (4) (22) (26)<br />

Others 2 – 2<br />

At 25 February <strong>2012</strong> 121 78 199<br />

The balances are analysed as follows:<br />

Current 99 64<br />

Non-current 100 113<br />

199 177<br />

Property provisions comprise obligation for future rents payable net of rents receivable on onerous <strong>and</strong> vacant property leases, terminal dilapidations<br />

<strong>and</strong> future rents above market value on unprofitable stores. The majority of these provisions are expected to be utilised over the period to 2020.<br />

The other provisions balance relates to a provision for <strong>Tesco</strong> Bank customer redress in respect of potential customer complaints arising from historic sales<br />

of PPI <strong>and</strong> a provision for customer insurance cancellations. The PPI provision is likely to be utilised over several years, although the timing of utilisation<br />

is uncertain. The balance is classified as current at the year end.<br />

The British Bankers Association initiated a judicial review on 24 January 2011 in relation to the regulation of PPI sales practices. The Group did not<br />

participate in this action <strong>and</strong> continued to deal with customer complaints in line with the FSA requirements throughout the duration of the legal<br />

proceedings undertaken by the other banks involved.<br />

130 <strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong><br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Total<br />

£m<br />

2011<br />

£m