Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

Tesco plc Annual Report and Financial Statements 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

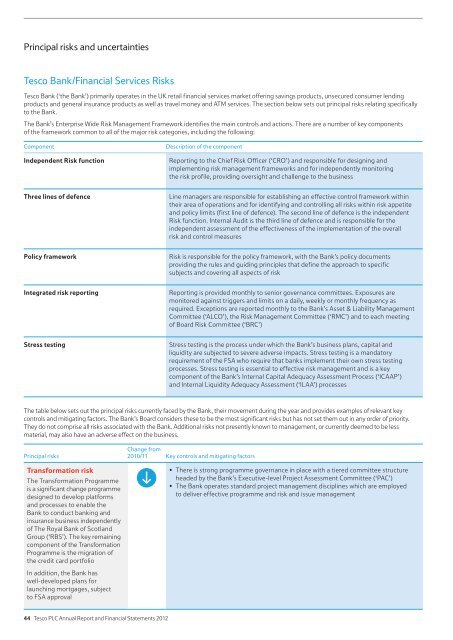

Principal risks <strong>and</strong> uncertainties<br />

<strong>Tesco</strong> Bank/<strong>Financial</strong> Services Risks<br />

<strong>Tesco</strong> Bank (‘the Bank’) primarily operates in the UK retail financial services market offering savings products, unsecured consumer lending<br />

products <strong>and</strong> general insurance products as well as travel money <strong>and</strong> ATM services. The section below sets out principal risks relating specifically<br />

to the Bank.<br />

The Bank’s Enterprise Wide Risk Management Framework identifies the main controls <strong>and</strong> actions. There are a number of key components<br />

of the framework common to all of the major risk categories, including the following:<br />

Component Description of the component<br />

Independent Risk function <strong>Report</strong>ing to the Chief Risk Officer (‘CRO’) <strong>and</strong> responsible for designing <strong>and</strong><br />

implementing risk management frameworks <strong>and</strong> for independently monitoring<br />

the risk profile, providing oversight <strong>and</strong> challenge to the business<br />

Three lines of defence Line managers are responsible for establishing an effective control framework within<br />

their area of operations <strong>and</strong> for identifying <strong>and</strong> controlling all risks within risk appetite<br />

<strong>and</strong> policy limits (first line of defence). The second line of defence is the independent<br />

Risk function. Internal Audit is the third line of defence <strong>and</strong> is responsible for the<br />

independent assessment of the effectiveness of the implementation of the overall<br />

risk <strong>and</strong> control measures<br />

Policy framework Risk is responsible for the policy framework, with the Bank’s policy documents<br />

providing the rules <strong>and</strong> guiding principles that define the approach to specific<br />

subjects <strong>and</strong> covering all aspects of risk<br />

Integrated risk reporting <strong>Report</strong>ing is provided monthly to senior governance committees. Exposures are<br />

monitored against triggers <strong>and</strong> limits on a daily, weekly or monthly frequency as<br />

required. Exceptions are reported monthly to the Bank’s Asset & Liability Management<br />

Committee (‘ALCO’), the Risk Management Committee (‘RMC’) <strong>and</strong> to each meeting<br />

of Board Risk Committee (‘BRC’)<br />

Stress testing Stress testing is the process under which the Bank’s business plans, capital <strong>and</strong><br />

liquidity are subjected to severe adverse impacts. Stress testing is a m<strong>and</strong>atory<br />

requirement of the FSA who require that banks implement their own stress testing<br />

processes. Stress testing is essential to effective risk management <strong>and</strong> is a key<br />

component of the Bank’s Internal Capital Adequacy Assessment Process (‘ICAAP’)<br />

<strong>and</strong> Internal Liquidity Adequacy Assessment (‘ILAA’) processes<br />

The table below sets out the principal risks currently faced by the Bank, their movement during the year <strong>and</strong> provides examples of relevant key<br />

controls <strong>and</strong> mitigating factors. The Bank’s Board considers these to be the most significant risks but has not set them out in any order of priority.<br />

They do not comprise all risks associated with the Bank. Additional risks not presently known to management, or currently deemed to be less<br />

material, may also have an adverse effect on the business.<br />

Principal risks<br />

Transformation risk<br />

The Transformation Programme<br />

is a significant change programme<br />

designed to develop platforms<br />

<strong>and</strong> processes to enable the<br />

Bank to conduct banking <strong>and</strong><br />

insurance business independently<br />

of The Royal Bank of Scotl<strong>and</strong><br />

Group (‘RBS’). The key remaining<br />

component of the Transformation<br />

Programme is the migration of<br />

the credit card portfolio<br />

In addition, the Bank has<br />

well-developed plans for<br />

launching mortgages, subject<br />

to FSA approval<br />

44 <strong>Tesco</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2012</strong><br />

Change from<br />

2010/11 Key controls <strong>and</strong> mitigating factors<br />

�� There is strong programme governance in place with a tiered committee structure<br />

headed by the Bank’s Executive-level Project Assessment Committee (‘PAC’)<br />

�� The Bank operates st<strong>and</strong>ard project management disciplines which are employed<br />

to deliver effective programme <strong>and</strong> risk <strong>and</strong> issue management