Download our latest Annual Report - Bakkavor

Download our latest Annual Report - Bakkavor

Download our latest Annual Report - Bakkavor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BAKKAVOR ANNUAL REPORT AND ACCOUNTS 2012<br />

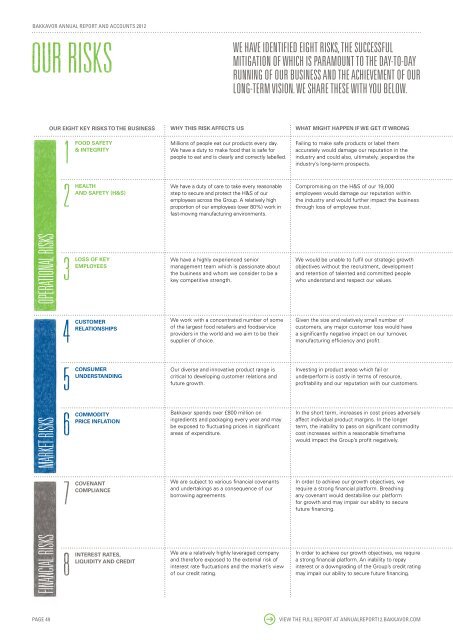

<strong>our</strong> risks<br />

WE HAVE IDENTIFIED EIGHT RISKS, THE SUCCESSFUL<br />

MITIGATION OF WHICH IS PARAMOUNT TO THE DAY-TO-DAY<br />

RUNNING OF OUR BUSINESS AND THE ACHIEVEMENT OF OUR<br />

LONG-TERM VISION. WE SHARE THESE WITH YOU BELOW.<br />

OUR EIGHT KEY RISKS TO THE BUSINESS<br />

1<br />

2<br />

FOOD SAFETY<br />

& INTEGRITY<br />

HEALTH<br />

AND SAFETY (H&S)<br />

WHY THIS RISK AFFECTS US<br />

Millions of people eat <strong>our</strong> products every day.<br />

We have a duty to make food that is safe for<br />

people to eat and is clearly and correctly labelled.<br />

We have a duty of care to take every reasonable<br />

step to secure and protect the H&S of <strong>our</strong><br />

employees across the Group. A relatively high<br />

proportion of <strong>our</strong> employees (over 80%) work in<br />

fast-moving manufacturing environments.<br />

WHAT MIGHT HAPPEN IF WE GET IT WRONG<br />

Failing to make safe products or label them<br />

accurately would damage <strong>our</strong> reputation in the<br />

industry and could also, ultimately, jeopardise the<br />

industry’s long-term prospects.<br />

Compromising on the H&S of <strong>our</strong> 19,000<br />

employees would damage <strong>our</strong> reputation within<br />

the industry and would further impact the business<br />

through loss of employee trust.<br />

FINANCIAL RISKS MARKET RISKS OPERATIONAL RISKS<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

LOSS OF KEY<br />

EMPLOYEES<br />

CUSTOMER<br />

RELATIONSHIPS<br />

CONSUMER<br />

UNDERSTANDING<br />

COMMODITY<br />

PRICE INFLATION<br />

COVENANT<br />

COMPLIANCE<br />

INTEREST RATES,<br />

LIQUIDITY AND CREDIT<br />

We have a highly experienced senior<br />

management team which is passionate about<br />

the business and whom we consider to be a<br />

key competitive strength.<br />

We work with a concentrated number of some<br />

of the largest food retailers and foodservice<br />

providers in the world and we aim to be their<br />

supplier of choice.<br />

Our diverse and innovative product range is<br />

critical to developing customer relations and<br />

future growth.<br />

<strong>Bakkavor</strong> spends over £800 million on<br />

ingredients and packaging every year and may<br />

be exposed to fluctuating prices in significant<br />

areas of expenditure.<br />

We are subject to various financial covenants<br />

and undertakings as a consequence of <strong>our</strong><br />

borrowing agreements.<br />

We are a relatively highly leveraged company<br />

and therefore exposed to the external risk of<br />

interest rate fluctuations and the market’s view<br />

of <strong>our</strong> credit rating.<br />

We would be unable to fulfil <strong>our</strong> strategic growth<br />

objectives without the recruitment, development<br />

and retention of talented and committed people<br />

who understand and respect <strong>our</strong> values.<br />

Given the size and relatively small number of<br />

customers, any major customer loss would have<br />

a significantly negative impact on <strong>our</strong> turnover,<br />

manufacturing efficiency and profit.<br />

Investing in product areas which fail or<br />

underperform is costly in terms of res<strong>our</strong>ce,<br />

profitability and <strong>our</strong> reputation with <strong>our</strong> customers.<br />

In the short term, increases in cost prices adversely<br />

affect individual product margins. In the longer<br />

term, the inability to pass on significant commodity<br />

cost increases within a reasonable timeframe<br />

would impact the Group’s profit negatively.<br />

In order to achieve <strong>our</strong> growth objectives, we<br />

require a strong financial platform. Breaching<br />

any covenant would destabilise <strong>our</strong> platform<br />

for growth and may impair <strong>our</strong> ability to secure<br />

future financing.<br />

In order to achieve <strong>our</strong> growth objectives, we require<br />

a strong financial platform. An inability to repay<br />

interest or a downgrading of the Group’s credit rating<br />

may impair <strong>our</strong> ability to secure future financing.<br />

PAGE 49 VIEW THE FULL REPORT AT ANNUALREPORT12.BAKKAVOR.COM