Download our latest Annual Report - Bakkavor

Download our latest Annual Report - Bakkavor

Download our latest Annual Report - Bakkavor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BAKKAVOR ANNUAL REPORT AND ACCOUNTS 2012<br />

notes to the consolidated financial statements<br />

continued<br />

28<br />

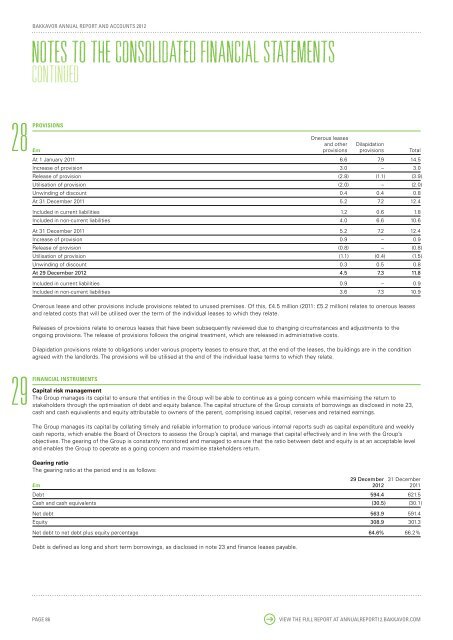

PROVISIONS<br />

Onerous leases<br />

and other Dilapidation<br />

£m provisions provisions Total<br />

At 1 January 2011 6.6 7.9 14.5<br />

Increase of provision 3.0 – 3.0<br />

Release of provision (2.8) (1.1) (3.9)<br />

Utilisation of provision (2.0) – (2.0)<br />

Unwinding of discount 0.4 0.4 0.8<br />

At 31 December 2011 5.2 7.2 12.4<br />

Included in current liabilities 1.2 0.6 1.8<br />

Included in non-current liabilities 4.0 6.6 10.6<br />

At 31 December 2011 5.2 7.2 12.4<br />

Increase of provision 0.9 – 0.9<br />

Release of provision (0.8) – (0.8)<br />

Utilisation of provision (1.1) (0.4) (1.5)<br />

Unwinding of discount 0.3 0.5 0.8<br />

At 29 December 2012 4.5 7.3 11.8<br />

Included in current liabilities 0.9 – 0.9<br />

Included in non-current liabilities 3.6 7.3 10.9<br />

Onerous lease and other provisions include provisions related to unused premises. Of this, £4.5 million (2011: £5.2 million) relates to onerous leases<br />

and related costs that will be utilised over the term of the individual leases to which they relate.<br />

Releases of provisions relate to onerous leases that have been subsequently reviewed due to changing circumstances and adjustments to the<br />

ongoing provisions. The release of provisions follows the original treatment, which are released in administrative costs.<br />

Dilapidation provisions relate to obligations under various property leases to ensure that, at the end of the leases, the buildings are in the condition<br />

agreed with the landlords. The provisions will be utilised at the end of the individual lease terms to which they relate.<br />

29<br />

FINANCIAL INSTRUMENTS<br />

Capital risk management<br />

The Group manages its capital to ensure that entities in the Group will be able to continue as a going concern while maximising the return to<br />

stakeholders through the optimisation of debt and equity balance. The capital structure of the Group consists of borrowings as disclosed in note 23,<br />

cash and cash equivalents and equity attributable to owners of the parent, comprising issued capital, reserves and retained earnings.<br />

The Group manages its capital by collating timely and reliable information to produce various internal reports such as capital expenditure and weekly<br />

cash reports, which enable the Board of Directors to assess the Group’s capital, and manage that capital effectively and in line with the Group’s<br />

objectives. The gearing of the Group is constantly monitored and managed to ensure that the ratio between debt and equity is at an acceptable level<br />

and enables the Group to operate as a going concern and maximise stakeholders return.<br />

Gearing ratio<br />

The gearing ratio at the period end is as follows:<br />

29 December 31 December<br />

£m 2012 2011<br />

Debt 594.4 621.5<br />

Cash and cash equivalents (30.5) (30.1)<br />

Net debt 563.9 591.4<br />

Equity 308.9 301.3<br />

Net debt to net debt plus equity percentage 64.6% 66.2%<br />

Debt is defined as long and short term borrowings, as disclosed in note 23 and finance leases payable.<br />

PAGE 86 VIEW THE FULL REPORT AT ANNUALREPORT12.BAKKAVOR.COM