Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

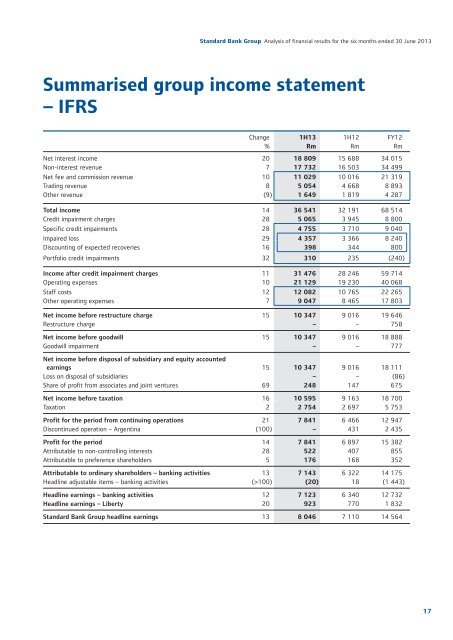

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

Summarised group income statement<br />

– IFRS<br />

Change 1H13 1H12 FY12<br />

% Rm Rm Rm<br />

Net interest income 20 18 809 15 688 34 015<br />

Non-interest revenue 7 17 732 16 503 34 499<br />

Net fee and commission revenue 10 11 029 10 016 21 319<br />

Trading revenue 8 5 054 4 668 8 893<br />

Other revenue (9) 1 649 1 819 4 287<br />

Total income 14 36 541 32 191 68 514<br />

Credit impairment charges 28 5 065 3 945 8 800<br />

Specific credit impairments 28 4 755 3 710 9 040<br />

Impaired loss 29 4 357 3 366 8 240<br />

Discounting <strong>of</strong> expected recoveries 16 398 344 800<br />

Portfolio credit impairments 32 310 235 (240)<br />

Income after credit impairment charges 11 31 476 28 246 59 714<br />

Operating expenses 10 21 129 19 230 40 068<br />

Staff costs 12 12 082 10 765 22 265<br />

Other operating expenses 7 9 047 8 465 17 803<br />

Net income before restructure charge 15 10 347 9 016 19 646<br />

Restructure charge – – 758<br />

Net income before goodwill 15 10 347 9 016 18 888<br />

Goodwill impairment – – 777<br />

Net income before disposal <strong>of</strong> subsidiary and equity accounted<br />

earnings 15 10 347 9 016 18 111<br />

Loss on disposal <strong>of</strong> subsidiaries – – (86)<br />

Share <strong>of</strong> pr<strong>of</strong>it from associates and joint ventures 69 248 147 675<br />

Net income before taxation 16 10 595 9 163 18 700<br />

Taxation 2 2 754 2 697 5 753<br />

Pr<strong>of</strong>it for the period from continuing operations 21 7 841 6 466 12 947<br />

Discontinued operation – Argentina (100) – 431 2 435<br />

Pr<strong>of</strong>it for the period 14 7 841 6 897 15 382<br />

Attributable to non-controlling interests 28 522 407 855<br />

Attributable to preference shareholders 5 176 168 352<br />

Attributable to ordinary shareholders – banking activities 13 7 143 6 322 14 175<br />

Headline adjustable items – banking activities (>100) (20) 18 (1 443)<br />

Headline earnings – banking activities 12 7 123 6 340 12 732<br />

Headline earnings – Liberty 20 923 770 1 832<br />

<strong>Standard</strong> <strong>Bank</strong> Group headline earnings 13 8 046 7 110 14 564<br />

17