Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

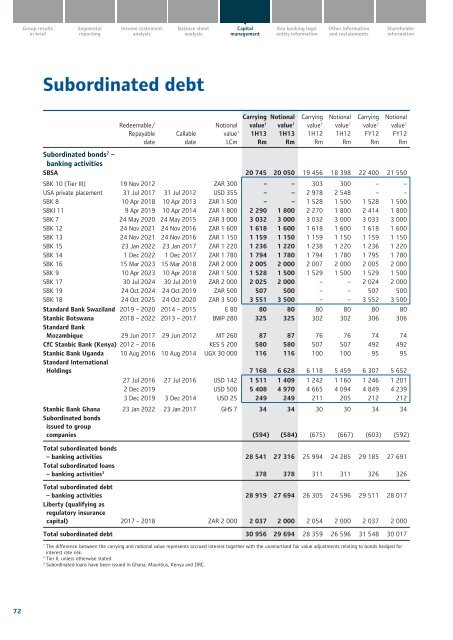

Subordinated debt<br />

Redeemable/<br />

Repayable<br />

date<br />

Callable<br />

date<br />

Notional<br />

value 1<br />

LCm<br />

Carrying<br />

value 1<br />

1H13<br />

Rm<br />

Notional<br />

value 1<br />

1H13<br />

Rm<br />

Carrying<br />

value 1<br />

1H12<br />

Rm<br />

Notional<br />

value 1<br />

1H12<br />

Rm<br />

Carrying<br />

value 1<br />

FY12<br />

Rm<br />

Notional<br />

value 1<br />

FY12<br />

Rm<br />

Subordinated bonds 2 –<br />

banking activities<br />

SBSA 20 745 20 050 19 456 18 398 22 400 21 550<br />

SBK 10 (Tier III) 19 Nov 2012 ZAR 300 – – 303 300 – –<br />

USA private placement 31 Jul 2017 31 Jul 2012 USD 355 – – 2 978 2 548 – –<br />

SBK 8 10 Apr 2018 10 Apr 2013 ZAR 1 500 – – 1 528 1 500 1 528 1 500<br />

SBKI 11 9 Apr 2019 10 Apr 2014 ZAR 1 800 2 290 1 800 2 270 1 800 2 414 1 800<br />

SBK 7 24 May 2020 24 May 2015 ZAR 3 000 3 032 3 000 3 032 3 000 3 033 3 000<br />

SBK 12 24 Nov 2021 24 Nov 2016 ZAR 1 600 1 618 1 600 1 618 1 600 1 618 1 600<br />

SBK 13 24 Nov 2021 24 Nov 2016 ZAR 1 150 1 159 1 150 1 159 1 150 1 159 1 150<br />

SBK 15 23 Jan 2022 23 Jan 2017 ZAR 1 220 1 236 1 220 1 238 1 220 1 236 1 220<br />

SBK 14 1 Dec 2022 1 Dec 2017 ZAR 1 780 1 794 1 780 1 794 1 780 1 795 1 780<br />

SBK 16 15 Mar 2023 15 Mar 2018 ZAR 2 000 2 005 2 000 2 007 2 000 2 005 2 000<br />

SBK 9 10 Apr 2023 10 Apr 2018 ZAR 1 500 1 528 1 500 1 529 1 500 1 529 1 500<br />

SBK 17 30 Jul 2024 30 Jul 2019 ZAR 2 000 2 025 2 000 – – 2 024 2 000<br />

SBK 19 24 Oct 2024 24 Oct 2019 ZAR 500 507 500 – – 507 500<br />

SBK 18 24 Oct 2025 24 Oct 2020 ZAR 3 500 3 551 3 500 – – 3 552 3 500<br />

<strong>Standard</strong> <strong>Bank</strong> Swaziland 2019 – 2020 2014 – 2015 E 80 80 80 80 80 80 80<br />

Stanbic Botswana 2018 – 2022 2013 – 2017 BWP 280 325 325 302 302 306 306<br />

<strong>Standard</strong> <strong>Bank</strong><br />

Mozambique 29 Jun 2017 29 Jun 2012 MT 260 87 87 76 76 74 74<br />

CfC Stanbic <strong>Bank</strong> (Kenya) 2012 – 2016 KES 5 200 580 580 507 507 492 492<br />

Stanbic <strong>Bank</strong> Uganda 10 Aug 2016 10 Aug 2014 UGX 30 000 116 116 100 100 95 95<br />

<strong>Standard</strong> International<br />

Holdings 7 168 6 628 6 118 5 459 6 307 5 652<br />

27 Jul 2016 27 Jul 2016 USD 142 1 511 1 409 1 242 1 160 1 246 1 201<br />

2 Dec 2019 USD 500 5 408 4 970 4 665 4 094 4 849 4 239<br />

3 Dec 2019 3 Dec 2014 USD 25 249 249 211 205 212 212<br />

Stanbic <strong>Bank</strong> Ghana 23 Jan 2022 23 Jan 2017 GHS 7 34 34 30 30 34 34<br />

Subordinated bonds<br />

issued to group<br />

companies (594) (584) (675) (667) (603) (592)<br />

Total subordinated bonds<br />

– banking activities 28 541 27 316 25 994 24 285 29 185 27 691<br />

Total subordinated loans<br />

– banking activities 3 378 378 311 311 326 326<br />

Total subordinated debt<br />

– banking activities 28 919 27 694 26 305 24 596 29 511 28 017<br />

Liberty (qualifying as<br />

regulatory insurance<br />

capital) 2017 – 2018 ZAR 2 000 2 037 2 000 2 054 2 000 2 037 2 000<br />

Total subordinated debt 30 956 29 694 28 359 26 596 31 548 30 017<br />

1<br />

The difference between the carrying and notional value represents accrued interest together with the unamortised fair value adjustments relating to bonds hedged for<br />

interest rate risk.<br />

2<br />

Tier II, unless otherwise stated.<br />

3<br />

Subordinated loans have been issued in Ghana, Mauritius, Kenya and DRC.<br />

72