Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

Personal & Business <strong>Bank</strong>ing<br />

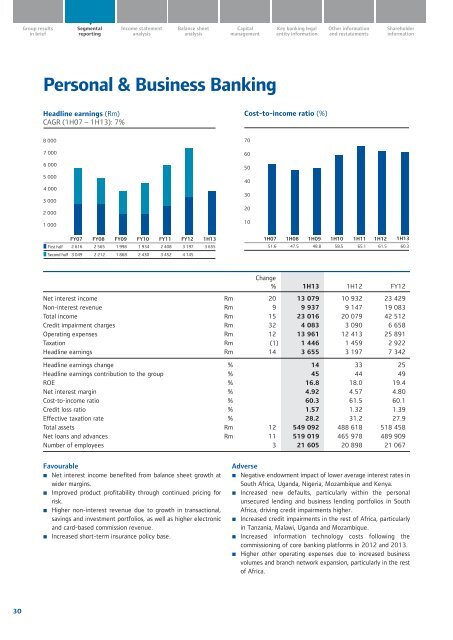

Headline earnings (Rm)<br />

CAGR (1H07 – 1H13): 7%<br />

Cost-to-income ratio (%)<br />

8 000<br />

7 000<br />

6 000<br />

5 000<br />

4 000<br />

3 000<br />

2 000<br />

1 000<br />

FY07 FY08 FY09 FY10 FY11 FY12 1H13<br />

First half 2 616 2 565 1 998 1 934 2 408 3 197 3 655<br />

Second half 3 049 2 212 1 868 2 430 3 452 4 145<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

1H07 1H08 1H09 1H10 1H11 1H12 1H13<br />

51.6 47.5 48.8 58.5 65.1 61.5 60.3<br />

Change<br />

% 1H13 1H12 FY12<br />

Net interest income Rm 20 13 079 10 932 23 429<br />

Non-interest revenue Rm 9 9 937 9 147 19 083<br />

Total income Rm 15 23 016 20 079 42 512<br />

Credit impairment charges Rm 32 4 083 3 090 6 658<br />

Operating expenses Rm 12 13 961 12 413 25 891<br />

Taxation Rm (1) 1 446 1 459 2 922<br />

Headline earnings Rm 14 3 655 3 197 7 342<br />

Headline earnings change % 14 33 25<br />

Headline earnings contribution to the group % 45 44 49<br />

ROE % 16.8 18.0 19.4<br />

Net interest margin % 4.92 4.57 4.80<br />

Cost-to-income ratio % 60.3 61.5 60.1<br />

Credit loss ratio % 1.57 1.32 1.39<br />

Effective taxation rate % 28.2 31.2 27.9<br />

Total assets Rm 12 549 092 488 618 518 458<br />

Net loans and advances Rm 11 519 019 465 978 489 909<br />

Number <strong>of</strong> employees 3 21 605 20 898 21 067<br />

Favourable<br />

• Net interest income benefited from balance sheet growth at<br />

wider margins.<br />

• Improved product pr<strong>of</strong>itability through continued pricing for<br />

risk.<br />

• Higher non-interest revenue due to growth in transactional,<br />

savings and investment portfolios, as well as higher electronic<br />

and card-based commission revenue.<br />

• Increased short-term insurance policy base.<br />

Adverse<br />

• Negative endowment impact <strong>of</strong> lower average interest rates in<br />

South Africa, Uganda, Nigeria, Mozambique and Kenya.<br />

• Increased new defaults, particularly within the personal<br />

unsecured lending and business lending portfolios in South<br />

Africa, driving credit impairments higher.<br />

• Increased credit impairments in the rest <strong>of</strong> Africa, particularly<br />

in Tanzania, Malawi, Uganda and Mozambique.<br />

• Increased information technology costs following the<br />

commissioning <strong>of</strong> core banking platforms in 2012 and 2013.<br />

• Higher other operating expenses due to increased business<br />

volumes and branch network expansion, particularly in the rest<br />

<strong>of</strong> Africa.<br />

30