Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

Liquidity management<br />

Liquidity market overview<br />

• The group’s liquidity risk management framework requires the<br />

group to measure and manage its liquidity position, and ensure<br />

that pipeline funding requirements and payment obligations<br />

can be met at all times, under both normal and stressed<br />

conditions. The group’s liquidity risk standard is reviewed<br />

annually by the group risk oversight committee and the<br />

group’s board <strong>of</strong> directors (the board).<br />

• The group’s overall liquidity risk appetite has remained<br />

unchanged over the first half <strong>of</strong> 2013 with continued active<br />

management <strong>of</strong> <strong>financial</strong> resources within the group’s stated<br />

risk tolerance.<br />

• New term lending volumes and investment activities are<br />

monitored and priced to take into account liquidity costs relating<br />

to anticipated regulatory changes and funding costs that will<br />

impact the group.<br />

• The group continues to plan and prepare for Basel III and other<br />

regulatory changes, as well as assess and manage the potential<br />

impact <strong>of</strong> events in local and international markets on<br />

the bank.<br />

Liquidity buffer<br />

• Portfolios <strong>of</strong> highly marketable liquid securities, over and<br />

above prudential requirements, are maintained as protection<br />

against unexpected disruptions in cash flows. These holdings<br />

are considered in the context <strong>of</strong> internal stress tests and<br />

discounts assumed on certain securities in a stressed sale.<br />

• The amount <strong>of</strong> contingent liquidity required by the group’s<br />

liquidity risk standard is influenced by the nature <strong>of</strong> the depositor<br />

and the contractual terms <strong>of</strong> the deposit, stress testing<br />

requirements as well as prevailing and anticipated regulation.<br />

• The contingent liquidity amounted to R174,1 billion as at 1H13<br />

(1H12: R142,8 billion).<br />

Total liquidity<br />

1H13<br />

Rbn<br />

1H12<br />

Rbn<br />

FY12<br />

Rbn<br />

Contingent liquidity 174,1 142,8 143,5<br />

Prudential requirements 59,3 42,1 42,5<br />

Total liquidity 233,4 184,9 186,0<br />

Contingent liquidity<br />

as % <strong>of</strong> funding<br />

related liabilities 16% 14% 14%<br />

Structural liquidity requirements<br />

• Behavioural pr<strong>of</strong>iling is applied to assets, liabilities and<br />

<strong>of</strong>f-balance sheet commitments with an indeterminable<br />

maturity or drawdown period, as well as to certain liquid assets<br />

across the group.<br />

• In respect <strong>of</strong> liabilities, behavioural pr<strong>of</strong>iling assigns probable<br />

maturities based on historically observed actual customer<br />

behaviour. This process is used to identify core deposits, such<br />

as current and savings accounts. These core deposits, although<br />

repayable on demand or at short notice, contribute towards<br />

stable funding based on their behaviour.<br />

• In respect <strong>of</strong> assets, pr<strong>of</strong>iling is used to identify additional<br />

sources <strong>of</strong> structural liquidity in the form <strong>of</strong> liquid assets or<br />

assets that could be used to generate liquidity within a specific<br />

time frame.<br />

• Limits and guidelines are set by the board to restrict the<br />

cumulative liquidity mismatch between expected inflows and<br />

outflows <strong>of</strong> funds in different time buckets based on<br />

contractual and behavioural analysis.<br />

• The behaviourally adjusted cumulative liquidity mismatch<br />

remains within the group’s liquidity risk appetite.<br />

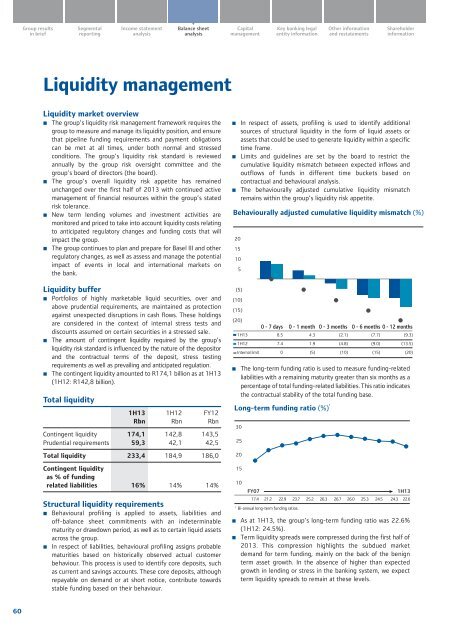

Behaviourally adjusted cumulative liquidity mismatch (%)<br />

20<br />

15<br />

10<br />

5<br />

(5)<br />

(10)<br />

(15)<br />

(20)<br />

1H13 8.5 4.3 (2.1) (7.7) (9.3)<br />

1H12 7.4 1.9 (4.8) (9.0) (13.5)<br />

Internal limit 0 (5) (10) (15) (20)<br />

• The long-term funding ratio is used to measure funding-related<br />

liabilities with a remaining maturity greater than six months as a<br />

percentage <strong>of</strong> total funding-related liabilities. This ratio indicates<br />

the contractual stability <strong>of</strong> the total funding base.<br />

Long-term funding ratio (%) 1<br />

30<br />

25<br />

20<br />

15<br />

10<br />

FY07<br />

0 - 7 days 0 - 1 month 0 - 3 months 0 - 6 months 0 - 12 months<br />

1H13<br />

17.4 21.2 22.9 23.7 25.2 26.3 26.7 26.0 25.3 24.5 24.3 22.6<br />

1<br />

Bi-annual long-term funding ratios.<br />

• As at 1H13, the group’s long-term funding ratio was 22.6%<br />

(1H12: 24.5%).<br />

• Term liquidity spreads were compressed during the first half <strong>of</strong><br />

2013. This compression highlights the subdued market<br />

demand for term funding, mainly on the back <strong>of</strong> the benign<br />

term asset growth. In the absence <strong>of</strong> higher than expected<br />

growth in lending or stress in the banking system, we expect<br />

term liquidity spreads to remain at these levels.<br />

60