Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

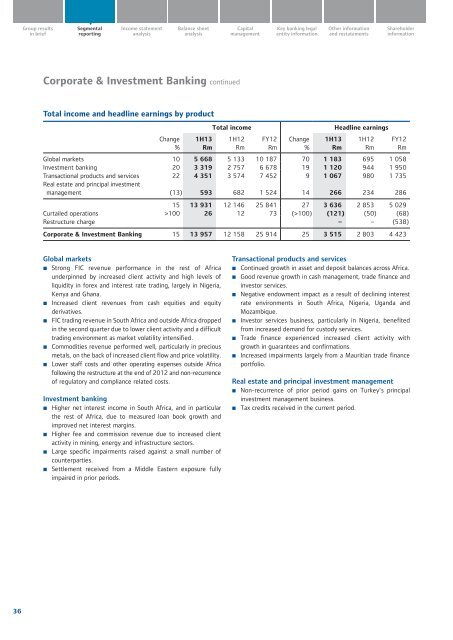

Corporate & Investment <strong>Bank</strong>ing continued<br />

Total income and headline earnings by product<br />

Change<br />

%<br />

1H13<br />

Rm<br />

Total income<br />

1H12<br />

Rm<br />

FY12<br />

Rm<br />

Change<br />

%<br />

Headline earnings<br />

Global markets 10 5 668 5 133 10 187 70 1 183 695 1 058<br />

Investment banking 20 3 319 2 757 6 678 19 1 120 944 1 950<br />

Transactional products and services 22 4 351 3 574 7 452 9 1 067 980 1 735<br />

Real estate and principal investment<br />

management (13) 593 682 1 524 14 266 234 286<br />

15 13 931 12 146 25 841 27 3 636 2 853 5 029<br />

Curtailed operations >100 26 12 73 (>100) (121) (50) (68)<br />

Restructure charge – – (538)<br />

Corporate & Investment <strong>Bank</strong>ing 15 13 957 12 158 25 914 25 3 515 2 803 4 423<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

FY12<br />

Rm<br />

Global markets<br />

• Strong FIC revenue performance in the rest <strong>of</strong> Africa<br />

underpinned by increased client activity and high levels <strong>of</strong><br />

liquidity in forex and interest rate trading, largely in Nigeria,<br />

Kenya and Ghana.<br />

• Increased client revenues from cash equities and equity<br />

derivatives.<br />

• FIC trading revenue in South Africa and outside Africa dropped<br />

in the second quarter due to lower client activity and a difficult<br />

trading environment as market volatility intensified.<br />

• Commodities revenue performed well, particularly in precious<br />

metals, on the back <strong>of</strong> increased client flow and price volatility.<br />

• Lower staff costs and other operating expenses outside Africa<br />

following the restructure at the end <strong>of</strong> 2012 and non-recurrence<br />

<strong>of</strong> regulatory and compliance related costs.<br />

Investment banking<br />

• Higher net interest income in South Africa, and in particular<br />

the rest <strong>of</strong> Africa, due to measured loan book growth and<br />

improved net interest margins.<br />

• Higher fee and commission revenue due to increased client<br />

activity in mining, energy and infrastructure sectors.<br />

• Large specific impairments raised against a small number <strong>of</strong><br />

counterparties.<br />

• Settlement received from a Middle Eastern exposure fully<br />

impaired in prior periods.<br />

Transactional products and services<br />

• Continued growth in asset and deposit balances across Africa.<br />

• Good revenue growth in cash management, trade finance and<br />

investor services.<br />

• Negative endowment impact as a result <strong>of</strong> declining interest<br />

rate environments in South Africa, Nigeria, Uganda and<br />

Mozambique.<br />

• <strong>Investor</strong> services business, particularly in Nigeria, benefited<br />

from increased demand for custody services.<br />

• Trade finance experienced increased client activity with<br />

growth in guarantees and confirmations.<br />

• Increased impairments largely from a Mauritian trade finance<br />

portfolio.<br />

Real estate and principal investment management<br />

• Non-recurrence <strong>of</strong> prior period gains on Turkey’s principal<br />

investment management business.<br />

• Tax credits received in the current period.<br />

36