Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

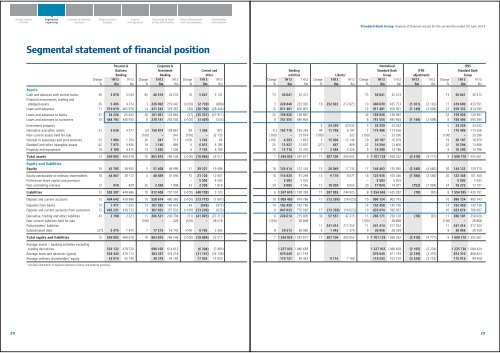

Segmental statement <strong>of</strong> <strong>financial</strong> position<br />

Change<br />

%<br />

Personal &<br />

Business<br />

<strong>Bank</strong>ing<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Change<br />

%<br />

Corporate &<br />

Investment<br />

<strong>Bank</strong>ing<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Change<br />

%<br />

Central and<br />

other<br />

1H13 1H12<br />

Rm Rm<br />

Assets<br />

Cash and balances with central banks 28 3 878 3 034 92 46 516 24 232 10 5 647 5 147<br />

Financial investments, trading and<br />

pledged assets 26 5 495 4 374 3 226 092 219 442 (>100) (2 739) (886)<br />

Loans and advances 11 519 019 465 978 14 431 242 379 367 (36) (38 780) (28 444)<br />

Loans and advances to banks 37 34 226 25 043 30 161 051 123 865 (27) (35 351) (27 911)<br />

Loans and advances to customers 10 484 793 440 935 6 270 191 255 502 (>100) (3 429) (533)<br />

Investment property<br />

Derivative and other assets 23 5 636 4 577 (2) 156 814 159 861 38 1 268 921<br />

Non-current assets held for sale (100) – 941 (100) – 32 133<br />

Interest in associates and joint ventures 52 1 904 1 254 26 647 513 >100 1 742 66<br />

Goodwill and other intangible assets 62 7 972 4 926 16 1 140 986 0 6 815 6 785<br />

Property and equipment 16 5 188 4 475 13 1 365 1 206 6 7 163 6 789<br />

Total assets 12 549 092 488 618 10 863 816 786 548 (>100) (18 884) 22 511<br />

Equity and liabilities<br />

Equity 18 45 785 38 932 5 51 408 48 998 51 29 221 19 388<br />

Equity attributable to ordinary shareholders 18 44 867 38 112 4 48 839 47 090 75 21 120 12 067<br />

Preference share capital and premium – 5 503 5 503<br />

Non-controlling interest 12 918 820 35 2 569 1 908 43 2 598 1 818<br />

Liabilities 12 503 307 449 686 10 812 408 737 550 (>100) (48 105) 3 123<br />

Deposit and current accounts 12 494 642 439 988 10 528 614 480 385 (>100) (13 773) (1 607)<br />

Deposits from banks 12 1 411 1 255 13 161 582 142 453 44 (543) (972)<br />

Deposit and current accounts from customers 12 493 231 438 733 9 367 032 337 932 (>100) (13 230) (635)<br />

Derivative, trading and other liabilities 43 3 190 2 223 11 266 521 240 794 (51) (41 097) (27 212)<br />

Non-current liabilities held for sale (100) – 229 (100) – 28 579<br />

Policyholders’ liabilities<br />

Subordinated debt (27) 5 475 7 475 7 17 273 16 142 >100 6 765 3 363<br />

Total equity and liabilities 12 549 092 488 618 10 863 816 786 548 (>100) (18 884) 22 511<br />

Average assets – banking activities excluding<br />

trading derivatives 536 132 479 729 698 105 614 812 (6 304) (7 883)<br />

Average loans and advances (gross) 524 443 470 113 383 367 374 218 (31 161) (33 138)<br />

Average ordinary shareholders’ equity 43 814 35 740 48 379 44 782 17 934 14 920<br />

1<br />

Includes elimination <strong>of</strong> balances between Liberty and banking activities.<br />

Change<br />

%<br />

<strong>Bank</strong>ing<br />

activities Liberty 1 Normalised<br />

<strong>Standard</strong> <strong>Bank</strong><br />

Group<br />

1H12 Change 1H13 1H12 Change 1H13<br />

Rm % Rm Rm % Rm<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

IFRS<br />

adjustments<br />

1H13 1H12<br />

Rm Rm<br />

Change<br />

%<br />

IFRS<br />

<strong>Standard</strong> <strong>Bank</strong><br />

Group<br />

73 56 041 32 413 73 56 041 32 413 73 56 041 32 413<br />

3 228 848 222 930 18 252 022 212 823 10 480 870 435 753 (1 261) (2 162) 11 479 609 433 591<br />

12 911 481 816 901 12 911 481 816 901 (1 149) (2 609) 12 910 332 814 292<br />

32 159 926 120 997 32 159 926 120 997 32 159 926 120 997<br />

8 751 555 695 904 8 751 555 695 904 (1 149) (2 609) 8 750 406 693 295<br />

5 24 259 23 032 5 24 259 23 032 5 24 259 23 032<br />

(1) 163 718 165 359 44 11 768 8 197 1 175 486 173 556 1 175 486 173 556<br />

(100) – 33 074 (100) – 222 (100) – 33 296 (100) – 33 296<br />

>100 4 293 1 833 5 15 904 15 146 19 20 197 16 979 19 20 197 16 979<br />

25 15 927 12 697 (27) 667 909 22 16 594 13 606 22 16 594 13 606<br />

10 13 716 12 470 7 2 484 2 326 9 16 200 14 796 9 16 200 14 796<br />

7 1 394 024 1 297 677 17 307 104 262 655 9 1 701 128 1 560 332 (2 410) (4 771) 9 1 698 718 1 555 561<br />

18 126 414 107 318 13 20 049 17 732 17 146 463 125 050 (2 340) (4 680) 20 144 123 120 370<br />

18 114 826 97 269 13 9 110 8 077 18 123 936 105 346 (1 588) (3 586) 20 122 348 101 760<br />

– 5 503 5 503 – 5 503 5 503 – 5 503 5 503<br />

34 6 085 4 546 13 10 939 9 655 20 17 024 14 201 (752) (1 094) 24 16 272 13 107<br />

6 1 267 610 1 190 359 17 287 055 244 923 8 1 554 665 1 435 282 (70) (91) 8 1 554 595 1 435 191<br />

10 1 009 483 918 766 17 (13 359) (16 023) 10 996 124 902 743 10 996 124 902 743<br />

14 162 450 142 736 14 162 450 142 736 14 162 450 142 736<br />

9 847 033 776 030 17 (13 359) (16 023) 10 833 674 760 007 10 833 674 760 007<br />

6 228 614 215 805 36 57 557 42 315 11 286 171 258 120 (70) (91) 11 286 101 258 029<br />

(100) – 28 808 (100) – 28 808 (100) – 28 808<br />

11 241 414 217 252 11 241 414 217 252 11 241 414 217 252<br />

9 29 513 26 980 5 1 443 1 379 9 30 956 28 359 9 30 956 28 359<br />

7 1 394 024 1 297 677 17 307 104 262 655 9 1 701 128 1 560 332 (2 410) (4 771) 9 1 698 718 1 555 561<br />

1 227 933 1 086 658 1 227 933 1 086 658 (2 195) (2 234) 1 225 738 1 084 424<br />

876 649 811 193 876 649 811 193 (2 339) (2 370) 874 310 808 823<br />

110 127 95 442 9 116 7 768 119 243 103 210 (3 329) (3 752) 115 914 99 458<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

28<br />

29