Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

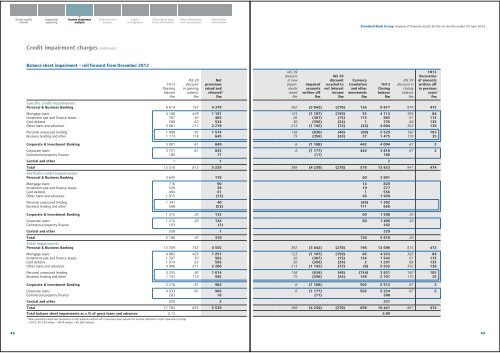

Credit impairment charges continued<br />

Balance sheet impairment – roll forward from December 2012<br />

1H13<br />

Opening<br />

balance<br />

Rm<br />

IAS 39<br />

discount<br />

in opening<br />

balance<br />

Rm<br />

Net<br />

provisions<br />

raised and<br />

released 1<br />

Rm<br />

Specific credit impairments<br />

Personal & Business <strong>Bank</strong>ing 8 614 752 4 379<br />

Mortgage loans 4 166 429 1 161<br />

Instalment sale and finance leases 787 50 465<br />

Card debtors 580 62 534<br />

Other loans and advances 3 081 211 2 219<br />

Personal unsecured lending 1 908 92 1 574<br />

Business lending and other 1 173 119 645<br />

Corporate & Investment <strong>Bank</strong>ing 3 901 61 849<br />

Corporate loans 3 721 61 832<br />

Commercial property finance 180 17<br />

Central and other 1 1<br />

Total 12 516 813 5 229<br />

Portfolio credit impairments<br />

Personal & Business <strong>Bank</strong>ing 3 645 176<br />

Mortgage loans 716 90<br />

Instalment sale and finance leases 520 38<br />

Card debtors 494 61<br />

Other loans and advances 1 915 (13)<br />

Personal unsecured lending 1 347 40<br />

Business lending and other 568 (53)<br />

Corporate & Investment <strong>Bank</strong>ing 1 315 20 133<br />

Corporate loans 1 212 20 134<br />

Commercial property finance 103 (1)<br />

Central and other 228 1<br />

Total 5 188 20 310<br />

Total impairments<br />

Personal & Business <strong>Bank</strong>ing 12 259 752 4 555<br />

Mortgage loans 4 882 429 1 251<br />

Instalment sale and finance leases 1 307 50 503<br />

Card debtors 1 074 62 595<br />

Other loans and advances 4 996 211 2 206<br />

Personal unsecured lending 3 255 92 1 614<br />

Business lending and other 1 741 119 592<br />

Corporate & Investment <strong>Bank</strong>ing 5 216 81 982<br />

Corporate loans 4 933 81 966<br />

Commercial property finance 283 16<br />

Central and other 229 2<br />

Total 17 704 833 5 539<br />

Total balance sheet impairments as a % <strong>of</strong> gross loans and advances 2.13<br />

1<br />

New provisions raised less recoveries on the amounts written <strong>of</strong>f in previous years equals the income statement credit impairment charge<br />

(1H13: R5 539 million – R474 million = R5 065 million).<br />

IAS 39<br />

discount<br />

in new<br />

impairments<br />

raised<br />

Rm<br />

Impaired<br />

accounts<br />

written <strong>of</strong>f<br />

Rm<br />

IAS 39<br />

discount<br />

recycled to<br />

net interest<br />

income<br />

Rm<br />

Currency<br />

translation<br />

and other<br />

movements<br />

Rm<br />

1H13<br />

Closing<br />

balance<br />

Rm<br />

IAS 39<br />

discount in<br />

closing<br />

balance<br />

Rm<br />

1H13<br />

Recoveries<br />

<strong>of</strong> amounts<br />

written <strong>of</strong>f<br />

in previous<br />

years 1<br />

Rm<br />

392 (3 042) (270) 136 9 817 874 472<br />

123 (1 107) (159) 52 4 113 393 84<br />

26 (387) (15) 115 965 61 115<br />

30 (356) (24) 1 735 68 135<br />

213 (1 192) (72) (32) 4 004 352 138<br />

138 (836) (48) (69) 2 529 182 103<br />

75 (356) (24) 37 1 475 170 35<br />

6 (1 188) 442 4 004 67 2<br />

6 (1 177) 442 3 818 67 2<br />

(11) 186<br />

2<br />

398 (4 230) (270) 578 13 823 941 474<br />

60 3 881<br />

14 820<br />

19 577<br />

1 556<br />

26 1 928<br />

(85) 1 302<br />

111 626<br />

60 1 508 20<br />

60 1 406 20<br />

102<br />

229<br />

120 5 618 20<br />

392 (3 042) (270) 196 13 698 874 472<br />

123 (1 107) (159) 66 4 933 393 84<br />

26 (387) (15) 134 1 542 61 115<br />

30 (356) (24) 2 1 291 68 135<br />

213 (1 192) (72) (6) 5 932 352 138<br />

138 (836) (48) (154) 3 831 182 103<br />

75 (356) (24) 148 2 101 170 35<br />

6 (1 188) 502 5 512 87 2<br />

6 (1 177) 502 5 224 87 2<br />

(11) 288<br />

231<br />

398 (4 230) (270) 698 19 441 961 474<br />

2.09<br />

48<br />

49