Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other<br />

information and<br />

restatements<br />

Shareholder<br />

information<br />

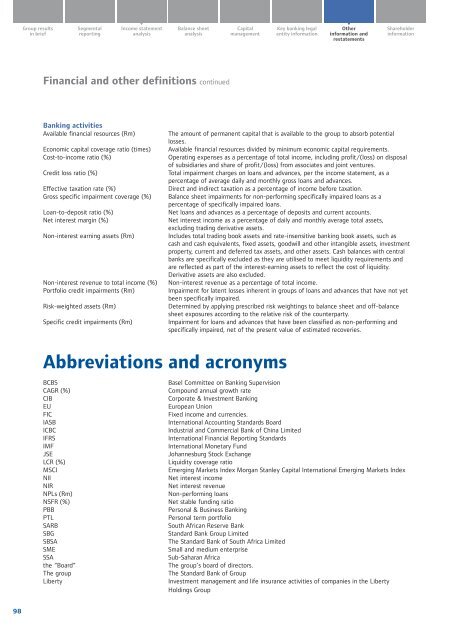

Financial and other definitions continued<br />

<strong>Bank</strong>ing activities<br />

Available <strong>financial</strong> resources (Rm)<br />

Economic capital coverage ratio (times)<br />

Cost-to-income ratio (%)<br />

Credit loss ratio (%)<br />

Effective taxation rate (%)<br />

Gross specific impairment coverage (%)<br />

Loan-to-deposit ratio (%)<br />

Net interest margin (%)<br />

Non-interest earning assets (Rm)<br />

Non-interest revenue to total income (%)<br />

Portfolio credit impairments (Rm)<br />

Risk-weighted assets (Rm)<br />

Specific credit impairments (Rm)<br />

The amount <strong>of</strong> permanent capital that is available to the group to absorb potential<br />

losses.<br />

Available <strong>financial</strong> resources divided by minimum economic capital requirements.<br />

Operating expenses as a percentage <strong>of</strong> total income, including pr<strong>of</strong>it/(loss) on disposal<br />

<strong>of</strong> subsidiaries and share <strong>of</strong> pr<strong>of</strong>it/(loss) from associates and joint ventures.<br />

Total impairment charges on loans and advances, per the income statement, as a<br />

percentage <strong>of</strong> average daily and monthly gross loans and advances.<br />

Direct and indirect taxation as a percentage <strong>of</strong> income before taxation.<br />

Balance sheet impairments for non-performing specifically impaired loans as a<br />

percentage <strong>of</strong> specifically impaired loans.<br />

Net loans and advances as a percentage <strong>of</strong> deposits and current accounts.<br />

Net interest income as a percentage <strong>of</strong> daily and monthly average total assets,<br />

excluding trading derivative assets.<br />

Includes total trading book assets and rate-insensitive banking book assets, such as<br />

cash and cash equivalents, fixed assets, goodwill and other intangible assets, investment<br />

property, current and deferred tax assets, and other assets. Cash balances with central<br />

banks are specifically excluded as they are utilised to meet liquidity requirements and<br />

are reflected as part <strong>of</strong> the interest-earning assets to reflect the cost <strong>of</strong> liquidity.<br />

Derivative assets are also excluded.<br />

Non-interest revenue as a percentage <strong>of</strong> total income.<br />

Impairment for latent losses inherent in groups <strong>of</strong> loans and advances that have not yet<br />

been specifically impaired.<br />

Determined by applying prescribed risk weightings to balance sheet and <strong>of</strong>f-balance<br />

sheet exposures according to the relative risk <strong>of</strong> the counterparty.<br />

Impairment for loans and advances that have been classified as non-performing and<br />

specifically impaired, net <strong>of</strong> the present value <strong>of</strong> estimated recoveries.<br />

Abbreviations and acronyms<br />

BCBS<br />

CAGR (%)<br />

CIB<br />

EU<br />

FIC<br />

IASB<br />

ICBC<br />

IFRS<br />

IMF<br />

JSE<br />

LCR (%)<br />

MSCI<br />

NII<br />

NIR<br />

NPLs (Rm)<br />

NSFR (%)<br />

PBB<br />

PTL<br />

SARB<br />

SBG<br />

SBSA<br />

SME<br />

SSA<br />

the “Board”<br />

The group<br />

Liberty<br />

Basel Committee on <strong>Bank</strong>ing Supervision<br />

Compound annual growth rate<br />

Corporate & Investment <strong>Bank</strong>ing<br />

European Union<br />

Fixed income and currencies.<br />

International Accounting <strong>Standard</strong>s Board<br />

Industrial and Commercial <strong>Bank</strong> <strong>of</strong> China Limited<br />

International Financial Reporting <strong>Standard</strong>s<br />

International Monetary Fund<br />

Johannesburg Stock Exchange<br />

Liquidity coverage ratio<br />

Emerging Markets Index Morgan Stanley Capital International Emerging Markets Index<br />

Net interest income<br />

Net interest revenue<br />

Non-performing loans<br />

Net stable funding ratio<br />

Personal & Business <strong>Bank</strong>ing<br />

Personal term portfolio<br />

South African Reserve <strong>Bank</strong><br />

<strong>Standard</strong> <strong>Bank</strong> Group Limited<br />

The <strong>Standard</strong> <strong>Bank</strong> <strong>of</strong> South Africa Limited<br />

Small and medium enterprise<br />

Sub-Saharan Africa<br />

The group’s board <strong>of</strong> directors.<br />

The <strong>Standard</strong> <strong>Bank</strong> <strong>of</strong> Group<br />

Investment management and life insurance activities <strong>of</strong> companies in the Liberty<br />

Holdings Group<br />

98