Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

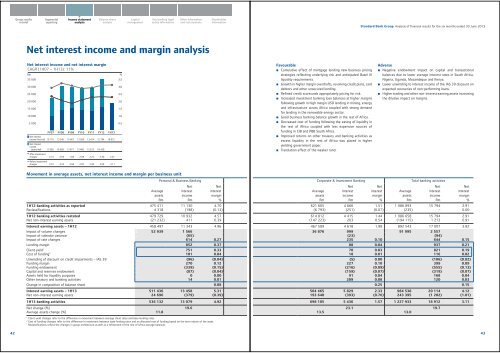

Net interest income and margin analysis<br />

Net interest income and net interest margin<br />

CAGR (1H07 – 1H13): 11%<br />

Rm %<br />

35 000<br />

30 000<br />

25 000<br />

20 000<br />

15 000<br />

10 000<br />

5 000<br />

FY07<br />

FY08<br />

FY09<br />

FY10<br />

FY11<br />

FY12<br />

1H13<br />

Net interest<br />

income-first half 10 110 13 740 15 467 13 568 13 414 15 794 18 912<br />

Net interest<br />

income<br />

- second half 11 958 16 589 13 971 13 460 15 613 18 439<br />

After impairment<br />

charges 2.31 2.05 1.84 2.09 2.27 2.30 2.27<br />

Before impairment<br />

charges 2.91 3.23 3.06 2.87 2.92 3.09 3.11<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

Favourable<br />

Cumulative effect <strong>of</strong> mortgage lending new business pricing<br />

strategies reflecting underlying risk and anticipated Basel III<br />

liquidity requirements.<br />

Growth in higher margin overdrafts, revolving credit plans, card<br />

debtors and other unsecured lending.<br />

Refined credit scorecards appropriately pricing for risk.<br />

Increased investment banking loan balances at higher margins<br />

following growth in high margin USD lending in mining, energy<br />

and infrastructure across Africa coupled with strong demand<br />

for lending in the renewable energy sector.<br />

Good business banking balance growth in the rest <strong>of</strong> Africa.<br />

Decreased cost <strong>of</strong> funding following the easing <strong>of</strong> liquidity in<br />

the rest <strong>of</strong> Africa coupled with less expensive sources <strong>of</strong><br />

funding in CIB and PBB South Africa.<br />

Improved returns on other treasury and banking activities as<br />

excess liquidity in the rest <strong>of</strong> Africa was placed in higher<br />

yielding government paper.<br />

Translation effect <strong>of</strong> the weaker rand.<br />

Adverse<br />

Negative endowment impact on capital and transactional<br />

balances due to lower average interest rates in South Africa,<br />

Nigeria, Uganda, Mozambique and Kenya.<br />

Lower unwinding to interest income <strong>of</strong> the IAS 39 discount on<br />

expected recoveries <strong>of</strong> non-performing loans.<br />

Higher trading and other non-interest earning assets increasing<br />

the dilutive impact on margins.<br />

Movement in average assets, net interest income and margin per business unit<br />

Personal & Business <strong>Bank</strong>ing<br />

Average<br />

assets<br />

Rm<br />

Net<br />

interest<br />

income<br />

Rm<br />

Net<br />

interest<br />

margin<br />

%<br />

1H12 banking activities as reported 475 411 11 130 4.70<br />

Reclassifications 4 318 (198) (0.13)<br />

1H12 banking activities restated 479 729 10 932 4.57<br />

Net non-interest earning assets (21 232) 411 0.39<br />

Interest earning assets – 1H12 458 497 11 343 4.96<br />

Impact <strong>of</strong> volume changes 52 939 1 566<br />

Impact <strong>of</strong> calendar variance (65)<br />

Impact <strong>of</strong> rate changes 614 0.27<br />

Lending margin 852 0.37<br />

Client yield 1 751 0.33<br />

Cost <strong>of</strong> funding 2 101 0.04<br />

Unwinding <strong>of</strong> discount on credit impairments – IAS 39 (96) (0.04)<br />

Funding margin 270 0.12<br />

Funding endowment (339) (0.15)<br />

Capital and reserves endowment (87) (0.04)<br />

Assets held for liquidity purposes 0 0.00<br />

Other treasury and banking activities 14 0.01<br />

Change in composition <strong>of</strong> balance sheet 0.08<br />

Interest earning assets – 1H13 511 436 13 458 5.31<br />

Net non-interest earning assets 24 696 (379) (0.39)<br />

1H13 banking activities 536 132 13 079 4.92<br />

Net change (%) 19.6<br />

Average assets change (%) 11.8<br />

1<br />

Client yield changes refer to the difference in movement between average client rates and base lending rates.<br />

2<br />

Cost <strong>of</strong> funding changes refer to the difference in movement between base lending rates and an allocated cost <strong>of</strong> funding based on the term nature <strong>of</strong> the asset.<br />

*<br />

Reclassifications reflect the changes in group architecture as well as a refinement <strong>of</strong> the rest <strong>of</strong> Africa average balances<br />

Corporate & Investment <strong>Bank</strong>ing<br />

Average<br />

assets<br />

Rm<br />

Net<br />

interest<br />

income<br />

Rm<br />

Net<br />

interest<br />

margin<br />

%<br />

Average<br />

assets<br />

Rm<br />

Total banking activities<br />

Net<br />

interest<br />

income<br />

Rm<br />

Net<br />

interest<br />

margin<br />

%<br />

621 605 4 666 1.51 1 086 893 15 794 2.91<br />

(6 793) (251) (0.07) (235) – 0.00<br />

614 812 4 415 1.44 1 086 658 15 794 2.91<br />

(147 223) 203 0.54 (194 115) 1 213 0.91<br />

467 589 4 618 1.98 892 543 17 007 3.82<br />

36 876 999 91 995 2 557<br />

(23) (94)<br />

235 0.10 644 0.15<br />

88 0.04 937 0.21<br />

70 0.03 821 0.19<br />

18 0.01 116 0.02<br />

(5) 0.00 (106) (0.02)<br />

227 0.10 399 0.09<br />

(216) (0.09) (555) (0.13)<br />

(159) (0.07) (319) (0.07)<br />

91 0.04 168 0.04<br />

209 0.08 120 0.03<br />

0.25 0.15<br />

504 465 5 829 2.33 984 538 20 114 4.12<br />

193 640 (393) (0.76) 243 395 (1 202) (1.01)<br />

698 105 5 436 1.57 1 227 933 18 912 3.11<br />

23.1 19.7<br />

13.5 13.0<br />

42<br />

43