Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

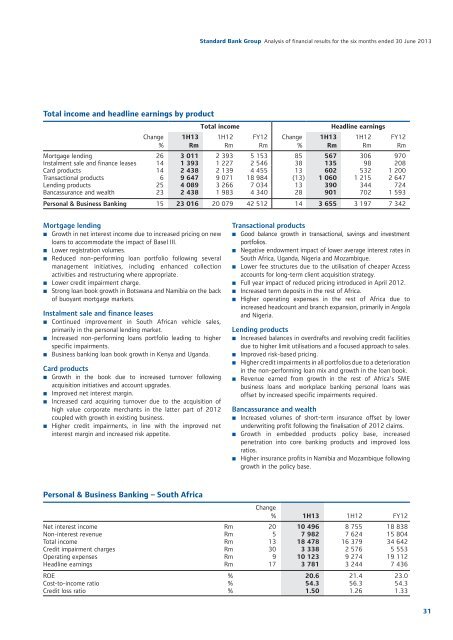

Total income and headline earnings by product<br />

Change<br />

%<br />

1H13<br />

Rm<br />

Total income<br />

1H12<br />

Rm<br />

FY12<br />

Rm<br />

Change<br />

%<br />

1H13<br />

Rm<br />

Headline earnings<br />

Mortgage lending 26 3 011 2 393 5 153 85 567 306 970<br />

Instalment sale and finance leases 14 1 393 1 227 2 546 38 135 98 208<br />

Card products 14 2 438 2 139 4 455 13 602 532 1 200<br />

Transactional products 6 9 647 9 071 18 984 (13) 1 060 1 215 2 647<br />

Lending products 25 4 089 3 266 7 034 13 390 344 724<br />

Bancassurance and wealth 23 2 438 1 983 4 340 28 901 702 1 593<br />

Personal & Business <strong>Bank</strong>ing 15 23 016 20 079 42 512 14 3 655 3 197 7 342<br />

1H12<br />

Rm<br />

FY12<br />

Rm<br />

Mortgage lending<br />

• Growth in net interest income due to increased pricing on new<br />

loans to accommodate the impact <strong>of</strong> Basel III.<br />

• Lower registration volumes.<br />

• Reduced non-performing loan portfolio following several<br />

management initiatives, including enhanced collection<br />

activities and restructuring where appropriate.<br />

• Lower credit impairment charge.<br />

• Strong loan book growth in Botswana and Namibia on the back<br />

<strong>of</strong> buoyant mortgage markets.<br />

Instalment sale and finance leases<br />

• Continued improvement in South African vehicle sales,<br />

primarily in the personal lending market.<br />

• Increased non-performing loans portfolio leading to higher<br />

specific impairments.<br />

• Business banking loan book growth in Kenya and Uganda.<br />

Card products<br />

• Growth in the book due to increased turnover following<br />

acquisition initiatives and account upgrades.<br />

• Improved net interest margin.<br />

• Increased card acquiring turnover due to the acquisition <strong>of</strong><br />

high value corporate merchants in the latter part <strong>of</strong> 2012<br />

coupled with growth in existing business.<br />

• Higher credit impairments, in line with the improved net<br />

interest margin and increased risk appetite.<br />

Transactional products<br />

• Good balance growth in transactional, savings and investment<br />

portfolios.<br />

• Negative endowment impact <strong>of</strong> lower average interest rates in<br />

South Africa, Uganda, Nigeria and Mozambique.<br />

• Lower fee structures due to the utilisation <strong>of</strong> cheaper Access<br />

accounts for long-term client acquisition strategy.<br />

• Full year impact <strong>of</strong> reduced pricing introduced in April 2012.<br />

• Increased term deposits in the rest <strong>of</strong> Africa.<br />

• Higher operating expenses in the rest <strong>of</strong> Africa due to<br />

increased headcount and branch expansion, primarily in Angola<br />

and Nigeria.<br />

Lending products<br />

• Increased balances in overdrafts and revolving credit facilities<br />

due to higher limit utilisations and a focused approach to sales.<br />

• Improved risk-based pricing.<br />

• Higher credit impairments in all portfolios due to a deterioration<br />

in the non-performing loan mix and growth in the loan book.<br />

• Revenue earned from growth in the rest <strong>of</strong> Africa’s SME<br />

business loans and workplace banking personal loans was<br />

<strong>of</strong>fset by increased specific impairments required.<br />

Bancassurance and wealth<br />

• Increased volumes <strong>of</strong> short-term insurance <strong>of</strong>fset by lower<br />

underwriting pr<strong>of</strong>it following the finalisation <strong>of</strong> 2012 claims.<br />

• Growth in embedded products policy base, increased<br />

penetration into core banking products and improved loss<br />

ratios.<br />

• Higher insurance pr<strong>of</strong>its in Namibia and Mozambique following<br />

growth in the policy base.<br />

Personal & Business <strong>Bank</strong>ing – South Africa<br />

Change<br />

% 1H13 1H12 FY12<br />

Net interest income Rm 20 10 496 8 755 18 838<br />

Non-interest revenue Rm 5 7 982 7 624 15 804<br />

Total income Rm 13 18 478 16 379 34 642<br />

Credit impairment charges Rm 30 3 338 2 576 5 553<br />

Operating expenses Rm 9 10 123 9 274 19 112<br />

Headline earnings Rm 17 3 781 3 244 7 436<br />

ROE % 20.6 21.4 23.0<br />

Cost-to-income ratio % 54.3 56.3 54.3<br />

Credit loss ratio % 1.50 1.26 1.33<br />

31