Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

The <strong>Standard</strong> <strong>Bank</strong> <strong>of</strong> South Africa<br />

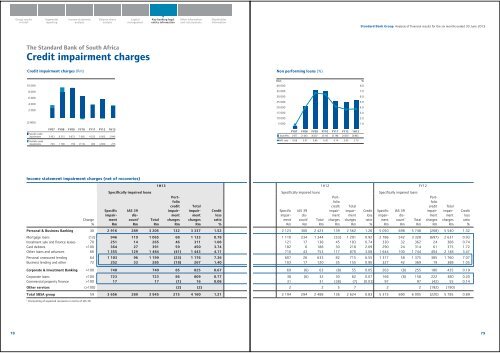

Credit impairment charges<br />

Credit impairment charges (Rm)<br />

Non performing loans (%)<br />

10 000<br />

8 000<br />

6 000<br />

4 000<br />

2 000<br />

(2 000)<br />

FY07<br />

FY08<br />

FY09<br />

FY10<br />

FY11<br />

FY12<br />

1H13<br />

Specific credit<br />

impairments 3 453 8 315 9 672 7 065 4 223 6 005 3 945<br />

Portfolio credit<br />

impairments 743 1 700 159 (713) 400 (220) 215<br />

Rbn %<br />

40 000<br />

35 000<br />

8.0<br />

7.0<br />

30 000<br />

6.0<br />

25 000<br />

5.0<br />

20 000<br />

4.0<br />

15 000<br />

3.0<br />

10 000<br />

2.0<br />

5 000<br />

1.0<br />

FY07 FY08 FY09 FY10 FY11 FY12 1H13<br />

Total NPLs 2977 21 043 36 037 35 193 25 798 24 550 26 963<br />

NPL ratio 0.66 3.97 6.66 6.40 4.14 3.65 3.70<br />

Income statement impairment charges (net <strong>of</strong> recoveries)<br />

Change<br />

%<br />

Specifically impaired loans<br />

Specific<br />

impairment<br />

Rm<br />

IAS 39<br />

discount<br />

1<br />

Rm<br />

Total<br />

Rm<br />

1H13<br />

Portfolio<br />

credit<br />

impairment<br />

charges<br />

Rm<br />

Total<br />

impairment<br />

charges<br />

Rm<br />

Credit<br />

loss<br />

ratio<br />

%<br />

Personal & Business <strong>Bank</strong>ing 30 2 916 289 3 205 132 3 337 1.52<br />

Mortgage loans (12) 946 119 1 065 68 1 133 0.78<br />

Instalment sale and finance leases 70 251 14 265 46 311 1.08<br />

Card debtors >100 364 27 391 59 450 3.74<br />

Other loans and advances 66 1 355 129 1 484 (41) 1 443 4.11<br />

Personal unsecured lending 64 1 103 96 1 199 (23) 1 176 7.36<br />

Business lending and other 72 252 33 285 (18) 267 1.40<br />

Corporate & Investment <strong>Bank</strong>ing >100 740 740 85 825 0.67<br />

Corporate loans >100 723 723 86 809 0.77<br />

Commercial property finance >100 17 17 (1) 16 0.08<br />

Other services (>100) (2) (2)<br />

Total SBSA group 59 3 656 289 3 945 215 4 160 1.21<br />

1H12<br />

Specifically impaired loans<br />

Specific<br />

impairment<br />

Rm<br />

IAS 39<br />

discount<br />

1<br />

Rm<br />

Total<br />

Rm<br />

Portfolio<br />

credit<br />

impairment<br />

charges<br />

Rm<br />

Total<br />

impairment<br />

charges<br />

Rm<br />

Credit<br />

loss<br />

ratio<br />

%<br />

FY12<br />

Specifically impaired loans<br />

Specific<br />

impairment<br />

Rm<br />

IAS 39<br />

discount<br />

1<br />

Rm<br />

Total<br />

Rm<br />

Portfolio<br />

credit<br />

impairment<br />

charges<br />

Rm<br />

Total<br />

impairment<br />

charges<br />

Rm<br />

Credit<br />

loss<br />

ratio<br />

%<br />

2 123 300 2 423 139 2 562 1.26 5 050 698 5 748 (208) 5 540 1.32<br />

1 110 234 1 344 (53) 1 291 0.92 2 786 542 3 328 (697) 2 631 0.93<br />

121 17 138 45 183 0.74 330 32 362 24 386 0.74<br />

182 6 188 30 218 2.09 290 24 314 61 375 1.72<br />

710 43 753 117 870 3.08 1 644 100 1 744 404 2 148 3.47<br />

607 26 633 82 715 6.55 1 317 58 1 375 385 1 760 7.07<br />

103 17 120 35 155 0.90 327 42 369 19 388 1.05<br />

69 (6) 63 (8) 55 0.05 263 (8) 255 180 435 0.19<br />

38 (6) 32 30 62 0.07 166 (8) 158 222 380 0.20<br />

31 31 (38) (7) (0.03) 97 97 (42) 55 0.14<br />

2 2 5 7 2 2 (192) (190)<br />

2 194 294 2 488 136 2 624 0.83 5 315 690 6 005 (220) 5 785 0.89<br />

1<br />

Discounting <strong>of</strong> expected recoveries in terms <strong>of</strong> IAS 39.<br />

78<br />

79