Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

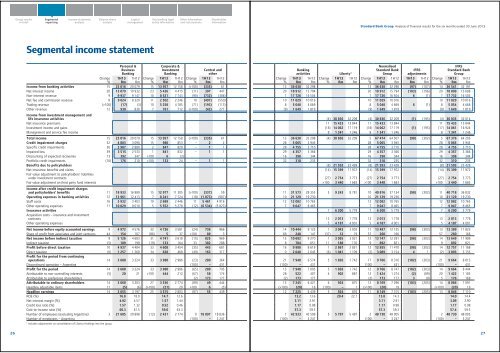

Segmental income statement<br />

Personal &<br />

Business<br />

<strong>Bank</strong>ing<br />

Corporate &<br />

Investment<br />

<strong>Bank</strong>ing<br />

Central and<br />

other<br />

Change<br />

%<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Change<br />

%<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Change<br />

%<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Income from banking activities 15 23 016 20 079 15 13 957 12 158 (>100) (335) 61<br />

Net interest income 20 13 079 10 932 23 5 436 4 415 (11) 397 447<br />

Non-interest revenue 9 9 937 9 147 10 8 521 7 743 (90) (732) (386)<br />

Net fee and commission revenue 8 9 024 8 320 11 2 502 2 246 10 (497) (550)<br />

Trading revenue (>100) (17) (3) 10 5 258 4 785 (71) (193) (113)<br />

Other revenue 12 930 830 7 761 712 (>100) (42) 277<br />

Income from investment management and<br />

life insurance activities<br />

Net insurance premiums<br />

Investment income and gains<br />

Management and service fee income<br />

Total income 15 23 016 20 079 15 13 957 12 158 (>100) (335) 61<br />

Credit impairment charges 32 4 083 3 090 15 980 853 – 2 2<br />

Specific credit impairments 36 3 907 2 880 2 847 829 – 1 1<br />

Impaired loss 39 3 515 2 533 1 841 832 – 1 1<br />

Discounting <strong>of</strong> expected recoveries 13 392 347 >100 6 (3)<br />

Portfolio credit impairments (16) 176 210 >100 133 24 – 1 1<br />

Benefits due to policyholders<br />

Net insurance benefits and claims<br />

Fair value adjustment to policyholders’ liabilities<br />

under investment contracts<br />

Fair value adjustment on third party fund interests<br />

Income after credit impairment charges<br />

and policyholders’ benefits 11 18 933 16 989 15 12 977 11 305 (>100) (337) 59<br />

Operating expenses in banking activities 12 13 961 12 413 7 8 241 7 724 (18) (1 073) (907)<br />

Staff costs 16 3 932 3 403 10 2 689 2 446 11 5 461 4 916<br />

Other operating expenses 11 10 029 9 010 5 5 552 5 278 (12) (6 534) (5 823)<br />

Insurance activities<br />

Acquisition costs – insurance and investment<br />

contracts<br />

Other operating expenses<br />

Net income before equity accounted earnings 9 4 972 4 576 32 4 736 3 581 (24) 736 966<br />

Share <strong>of</strong> pr<strong>of</strong>it from associates and joint ventures 44 154 107 (86) 5 37 >100 89 3<br />

Net income before indirect taxation 9 5 126 4 683 31 4 741 3 618 (15) 825 969<br />

Indirect taxation (5) 189 199 (19) 133 164 33 382 288<br />

Pr<strong>of</strong>it before direct taxation 10 4 937 4 484 33 4 608 3 454 (35) 443 681<br />

Direct taxation (0) 1 257 1 260 34 628 468 (49) 163 317<br />

Pr<strong>of</strong>it for the period from continuing<br />

operations 14 3 680 3 224 33 3 980 2 986 (23) 280 364<br />

Discontinued operation – Argentina (100) – 431<br />

Pr<strong>of</strong>it for the period 14 3 680 3 224 33 3 980 2 986 (65) 280 795<br />

Attributable to non-controlling interests (5) 20 21 >100 444 212 (67) 58 174<br />

Attributable to preference shareholders (2) 173 177<br />

Attributable to ordinary shareholders 14 3 660 3 203 27 3 536 2 774 (89) 49 444<br />

Headline adjustable items 17 (5) (6) (>100) (21) 29 >100 6 (5)<br />

Headline earnings 14 3 655 3 197 25 3 515 2 803 (87) 55 439<br />

ROE (%) 16.8 18.0 14.7 12.6<br />

Net interest margin (%) 4.92 4.57 1.57 1.44<br />

Credit loss ratio (%) 1.57 1.32 0.52 0.46<br />

Cost-to-income ratio (%) 60.3 61.5 59.0 63.3<br />

Number <strong>of</strong> employees (excluding Argentina) 3 21 605 20 898 (12) 2 431 2 774 0 18 897 18 836<br />

Number <strong>of</strong> employees – Argentina (100) – 3 247<br />

1<br />

Includes adjustments on consolidation <strong>of</strong> Liberty Holdings into the group.<br />

Liberty 1 Group adjustments<br />

Group<br />

Normalised<br />

IFRS<br />

<strong>Bank</strong>ing<br />

activities<br />

<strong>Standard</strong> <strong>Bank</strong> IFRS<br />

<strong>Standard</strong> <strong>Bank</strong><br />

Change<br />

%<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Change<br />

%<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Change<br />

%<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

Change<br />

%<br />

1H13<br />

Rm<br />

1H12<br />

Rm<br />

13 36 638 32 298 13 36 638 32 298 (97) (107) 14 36 541 32 191<br />

20 18 912 15 794 20 18 912 15 794 (103) (106) 20 18 809 15 688<br />

7 17 726 16 504 7 17 726 16 504 6 (1) 7 17 732 16 503<br />

10 11 029 10 016 10 11 029 10 016 10 11 029 10 016<br />

8 5 048 4 669 8 5 048 4 669 6 (1) 8 5 054 4 668<br />

(9) 1 649 1 819 (9) 1 649 1 819 (9) 1 649 1 819<br />

(4) 30 836 32 209 (4) 30 836 32 209 (1) (195) (4) 30 835 32 014<br />

11 15 433 13 844 11 15 433 13 844 11 15 433 13 844<br />

(18) 14 062 17 119 (18) 14 062 17 119 (1) (195) (17) 14 061 16 924<br />

8 1 341 1 246 8 1 341 1 246 8 1 341 1 246<br />

13 36 638 32 298 (4) 30 836 32 209 5 67 474 64 507 (98) (302) 5 67 376 64 205<br />

28 5 065 3 945 28 5 065 3 945 28 5 065 3 945<br />

28 4 755 3 710 28 4 755 3 710 28 4 755 3 710<br />

29 4 357 3 366 29 4 357 3 366 29 4 357 3 366<br />

16 398 344 16 398 344 16 398 344<br />

32 310 235 32 310 235 32 310 235<br />

(8) 21 593 23 428 (8) 21 593 23 428 (8) 21 593 23 428<br />

(14) 15 399 17 972 (14) 15 399 17 972 (14) 15 399 17 972<br />

(27) 2 754 3 773 (27) 2 754 3 773 (27) 2 754 3 773<br />

>100 3 440 1 683 >100 3 440 1 683 >100 3 440 1 683<br />

11 31 573 28 353 5 9 243 8 781 10 40 816 37 134 (98) (302) 11 40 718 36 832<br />

10 21 129 19 230 10 21 129 19 230 10 21 129 19 230<br />

12 12 082 10 765 12 12 082 10 765 12 12 082 10 765<br />

7 9 047 8 465 7 9 047 8 465 7 9 047 8 465<br />

7 6 200 5 779 7 6 200 5 779 7 6 200 5 779<br />

13 2 013 1 778 13 2 013 1 778 13 2 013 1 778<br />

5 4 187 4 001 5 4 187 4 001 5 4 187 4 001<br />

14 10 444 9 123 1 3 043 3 002 11 13 487 12 125 (98) (302) 13 13 389 11 823<br />

69 248 147 (37) 12 19 57 260 166 57 260 166<br />

15 10 692 9 270 1 3 055 3 021 12 13 747 12 291 (98) (302) 14 13 649 11 989<br />

8 704 651 11 188 170 9 892 821 9 892 821<br />

16 9 988 8 619 1 2 867 2 851 12 12 855 11 470 (98) (302) 14 12 757 11 168<br />

0 2 048 2 045 (6) 1 041 1 109 (2) 3 089 3 154 4 1 (2) 3 093 3 155<br />

21 7 940 6 574 5 1 826 1 742 17 9 766 8 316 (102) (303) 21 9 664 8 013<br />

(100) – 431 (100) – 431 (100) – 431<br />

13 7 940 7 005 5 1 826 1 742 12 9 766 8 747 (102) (303) 14 9 664 8 444<br />

28 522 407 4 902 867 12 1 424 1 274 (2) (89) 20 1 422 1 185<br />

(2) 173 177 (2) 173 177 3 (9) 5 176 168<br />

13 7 245 6 421 6 924 875 12 8 169 7 296 (103) (205) 14 8 066 7 091<br />

(>100) (20) 18 (100) – 1 (>100) (20) 19 (>100) (20) 19<br />

12 7 225 6 439 5 924 876 11 8 149 7 315 (103) (205) 13 8 046 7 110<br />

13.2 13.6 20.4 22.7 13.8 14.3 14.0 14.4<br />

3.11 2.91 3.11 2.91 3.09 2.90<br />

1.17 0.98 1.17 0.98 1.17 0.98<br />

57.3 59.3 57.3 59.3 57.4 59.5<br />

1 42 933 42 508 5 5 797 5 497 2 48 730 48 005 2 48 730 48 005<br />

(100) – 3 247 (100) – 3 247 (100) – 3 247<br />

26<br />

27