Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

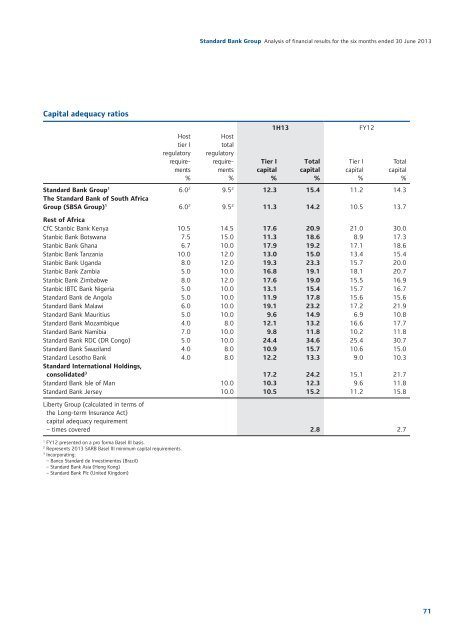

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

Capital adequacy ratios<br />

Host<br />

tier I<br />

regulatory<br />

requirements<br />

%<br />

Host<br />

total<br />

regulatory<br />

requirements<br />

%<br />

Tier I<br />

capital<br />

%<br />

1H13<br />

Total<br />

capital<br />

%<br />

Tier I<br />

capital<br />

%<br />

FY12<br />

Total<br />

capital<br />

%<br />

<strong>Standard</strong> <strong>Bank</strong> Group 1 6.0 2 9.5 2 12.3 15.4 11.2 14.3<br />

The <strong>Standard</strong> <strong>Bank</strong> <strong>of</strong> South Africa<br />

Group (SBSA Group) 1 6.0 2 9.5 2 11.3 14.2 10.5 13.7<br />

Rest <strong>of</strong> Africa<br />

CfC Stanbic <strong>Bank</strong> Kenya 10.5 14.5 17.6 20.9 21.0 30.0<br />

Stanbic <strong>Bank</strong> Botswana 7.5 15.0 11.3 18.6 8.9 17.3<br />

Stanbic <strong>Bank</strong> Ghana 6.7 10.0 17.9 19.2 17.1 18.6<br />

Stanbic <strong>Bank</strong> Tanzania 10.0 12.0 13.0 15.0 13.4 15.4<br />

Stanbic <strong>Bank</strong> Uganda 8.0 12.0 19.3 23.3 15.7 20.0<br />

Stanbic <strong>Bank</strong> Zambia 5.0 10.0 16.8 19.1 18.1 20.7<br />

Stanbic <strong>Bank</strong> Zimbabwe 8.0 12.0 17.6 19.0 15.5 16.9<br />

Stanbic IBTC <strong>Bank</strong> Nigeria 5.0 10.0 13.1 15.4 15.7 16.7<br />

<strong>Standard</strong> <strong>Bank</strong> de Angola 5.0 10.0 11.9 17.8 15.6 15.6<br />

<strong>Standard</strong> <strong>Bank</strong> Malawi 6.0 10.0 19.1 23.2 17.2 21.9<br />

<strong>Standard</strong> <strong>Bank</strong> Mauritius 5.0 10.0 9.6 14.9 6.9 10.8<br />

<strong>Standard</strong> <strong>Bank</strong> Mozambique 4.0 8.0 12.1 13.2 16.6 17.7<br />

<strong>Standard</strong> <strong>Bank</strong> Namibia 7.0 10.0 9.8 11.8 10.2 11.8<br />

<strong>Standard</strong> <strong>Bank</strong> RDC (DR Congo) 5.0 10.0 24.4 34.6 25.4 30.7<br />

<strong>Standard</strong> <strong>Bank</strong> Swaziland 4.0 8.0 10.9 15.7 10.6 15.0<br />

<strong>Standard</strong> Lesotho <strong>Bank</strong> 4.0 8.0 12.2 13.3 9.0 10.3<br />

<strong>Standard</strong> International Holdings,<br />

consolidated 3 17.2 24.2 15.1 21.7<br />

<strong>Standard</strong> <strong>Bank</strong> Isle <strong>of</strong> Man 10.0 10.3 12.3 9.6 11.8<br />

<strong>Standard</strong> <strong>Bank</strong> Jersey 10.0 10.5 15.2 11.2 15.8<br />

Liberty Group (calculated in terms <strong>of</strong><br />

the Long-term Insurance Act)<br />

capital adequacy requirement<br />

– times covered 2.8 2.7<br />

1<br />

FY12 presented on a pro forma Basel III basis.<br />

2<br />

Represents 2013 SARB Basel III minimum capital requirements.<br />

3<br />

Incorporating:<br />

– Banco <strong>Standard</strong> de Investimentos (Brazil)<br />

– <strong>Standard</strong> <strong>Bank</strong> Asia (Hong Kong)<br />

– <strong>Standard</strong> <strong>Bank</strong> Plc (United Kingdom)<br />

71