Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

Diversified funding base<br />

• The group’s funding strategy is determined after reviewing<br />

the group’s projected balance sheet, which includes taking<br />

into account the forecast <strong>of</strong> PBB and CIB funding requirements,<br />

the maturity pr<strong>of</strong>ile <strong>of</strong> existing funding and anticipated<br />

changes in the deposit base. Funding requirements and<br />

initiatives are assessed in accordance with the group asset and<br />

liability committee requirements for diversification, maturity<br />

pr<strong>of</strong>ile, interbank reliance and currency exposure, as well as<br />

the availability and pricing <strong>of</strong> alternative liquidity sources.<br />

• Concentration risk limits are used within the group to ensure<br />

funding diversification across products, sectors, geographic<br />

regions and counterparties.<br />

• Primary sources <strong>of</strong> funding consist <strong>of</strong> deposits from a wide<br />

range <strong>of</strong> retail and wholesale clients as well as long-term<br />

capital market funding.<br />

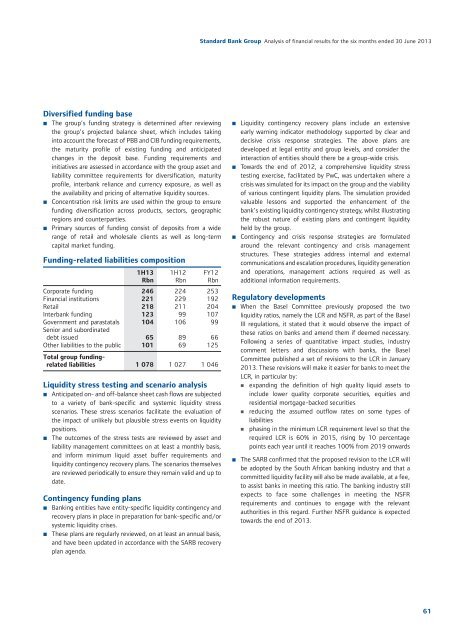

Funding-related liabilities composition<br />

1H13<br />

Rbn<br />

1H12<br />

Rbn<br />

FY12<br />

Rbn<br />

Corporate funding 246 224 253<br />

Financial institutions 221 229 192<br />

Retail 218 211 204<br />

Interbank funding 123 99 107<br />

Government and parastatals 104 106 99<br />

Senior and subordinated<br />

debt issued 65 89 66<br />

Other liabilities to the public 101 69 125<br />

Total group fundingrelated<br />

liabilities 1 078 1 027 1 046<br />

Liquidity stress testing and scenario analysis<br />

• Anticipated on- and <strong>of</strong>f-balance sheet cash flows are subjected<br />

to a variety <strong>of</strong> bank-specific and systemic liquidity stress<br />

scenarios. These stress scenarios facilitate the evaluation <strong>of</strong><br />

the impact <strong>of</strong> unlikely but plausible stress events on liquidity<br />

positions.<br />

• The outcomes <strong>of</strong> the stress tests are reviewed by asset and<br />

liability management committees on at least a monthly basis,<br />

and inform minimum liquid asset buffer requirements and<br />

liquidity contingency recovery plans. The scenarios themselves<br />

are reviewed periodically to ensure they remain valid and up to<br />

date.<br />

Contingency funding plans<br />

• <strong>Bank</strong>ing entities have entity-specific liquidity contingency and<br />

recovery plans in place in preparation for bank-specific and/or<br />

systemic liquidity crises.<br />

• These plans are regularly reviewed, on at least an annual basis,<br />

and have been updated in accordance with the SARB recovery<br />

plan agenda.<br />

• Liquidity contingency recovery plans include an extensive<br />

early warning indicator methodology supported by clear and<br />

decisive crisis response strategies. The above plans are<br />

developed at legal entity and group levels, and consider the<br />

interaction <strong>of</strong> entities should there be a group-wide crisis.<br />

• Towards the end <strong>of</strong> 2012, a comprehensive liquidity stress<br />

testing exercise, facilitated by PwC, was undertaken where a<br />

crisis was simulated for its impact on the group and the viability<br />

<strong>of</strong> various contingent liquidity plans. The simulation provided<br />

valuable lessons and supported the enhancement <strong>of</strong> the<br />

bank’s existing liquidity contingency strategy, whilst illustrating<br />

the robust nature <strong>of</strong> existing plans and contingent liquidity<br />

held by the group.<br />

• Contingency and crisis response strategies are formulated<br />

around the relevant contingency and crisis management<br />

structures. These strategies address internal and external<br />

communications and escalation procedures, liquidity generation<br />

and operations, management actions required as well as<br />

additional information requirements.<br />

Regulatory developments<br />

• When the Basel Committee previously proposed the two<br />

liquidity ratios, namely the LCR and NSFR, as part <strong>of</strong> the Basel<br />

III regulations, it stated that it would observe the impact <strong>of</strong><br />

these ratios on banks and amend them if deemed necessary.<br />

Following a series <strong>of</strong> quantitative impact studies, industry<br />

comment letters and discussions with banks, the Basel<br />

Committee published a set <strong>of</strong> revisions to the LCR in January<br />

2013. These revisions will make it easier for banks to meet the<br />

LCR, in particular by:<br />

• expanding the definition <strong>of</strong> high quality liquid assets to<br />

include lower quality corporate securities, equities and<br />

residential mortgage-backed securities<br />

• reducing the assumed outflow rates on some types <strong>of</strong><br />

liabilities<br />

• phasing in the minimum LCR requirement level so that the<br />

required LCR is 60% in 2015, rising by 10 percentage<br />

points each year until it reaches 100% from 2019 onwards<br />

• The SARB confirmed that the proposed revision to the LCR will<br />

be adopted by the South African banking industry and that a<br />

committed liquidity facility will also be made available, at a fee,<br />

to assist banks in meeting this ratio. The banking industry still<br />

expects to face some challenges in meeting the NSFR<br />

requirements and continues to engage with the relevant<br />

authorities in this regard. Further NSFR guidance is expected<br />

towards the end <strong>of</strong> 2013.<br />

61