SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 38 -<br />

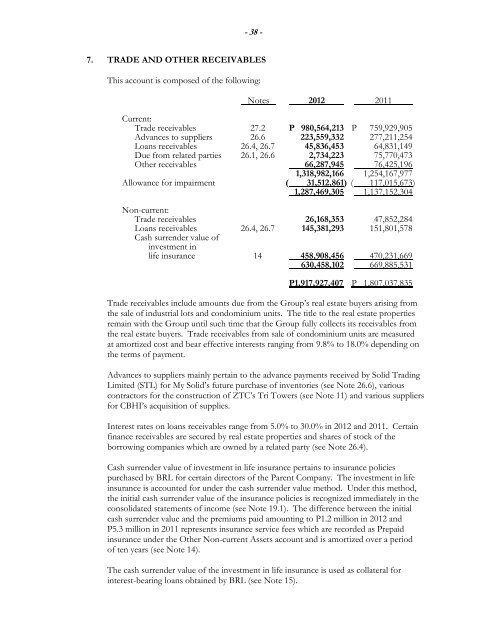

7. TRADE AND OTHER RECEIVABLES<br />

This account is composed of <strong>the</strong> following:<br />

Notes 2012 2011<br />

Current:<br />

Trade receivables 27.2 P 980,564,213 P 759,929,905<br />

Advances to suppliers 26.6 223,559,332 277,211,254<br />

Loans receivables 26.4, 26.7 45,836,453 64,831,149<br />

Due from related parties 26.1, 26.6 2,734,223 75,770,473<br />

O<strong>the</strong>r receivables 66,287,945 76,425,196<br />

1,318,982,166 1,254,167,977<br />

Allowance for impairment ( 31,512,861) ( 1<strong>17</strong>,015,673 )<br />

1,287,469,305 1,137,152,304<br />

Non-current:<br />

Trade receivables<br />

Loans receivables 26.4, 26.7<br />

26,168,353<br />

145,381,293<br />

47,852,284<br />

151,801,578<br />

Cash surrender value of<br />

investment in<br />

life insurance 14 458,908,456<br />

630,458,102<br />

470,231,669<br />

669,885,531<br />

P1,9<strong>17</strong>,927,407 P 1,807,037,835<br />

Trade receivables <strong>inc</strong>lude amounts due from <strong>the</strong> Group’s real estate buyers arising from<br />

<strong>the</strong> sale of industrial lots and condominium units. The title to <strong>the</strong> real estate properties<br />

remain with <strong>the</strong> Group until such time that <strong>the</strong> Group fully collects its receivables from<br />

<strong>the</strong> real estate buyers. Trade receivables from sale of condominium units are measured<br />

at amortized cost and bear effective interests ranging from 9.8% to 18.0% depending on<br />

<strong>the</strong> terms of payment.<br />

Advances to suppliers mainly pertain to <strong>the</strong> advance payments received by Solid Trading<br />

Limited (STL) for My Solid’s future purchase of inventories (see Note 26.6), various<br />

contractors for <strong>the</strong> construction of ZTC’s Tri Towers (see Note 11) and various suppliers<br />

for CBHI’s acquisition of supplies.<br />

Interest rates on loans receivables range from 5.0% to 30.0% in 2012 and 2011. Certain<br />

finance receivables are secured by real estate properties and shares of stock of <strong>the</strong><br />

borrowing companies which are owned by a related party (see Note 26.4).<br />

Cash surrender value of investment in life insurance pertains to insurance policies<br />

purchased by BRL for certain directors of <strong>the</strong> Parent Company. The investment in life<br />

insurance is accounted for under <strong>the</strong> cash surrender value method. Under this method,<br />

<strong>the</strong> initial cash surrender value of <strong>the</strong> insurance policies is recognized immediately in <strong>the</strong><br />

con<strong>solid</strong>ated statements of <strong>inc</strong>ome (see Note 19.1). The difference between <strong>the</strong> initial<br />

cash surrender value and <strong>the</strong> premiums paid amounting to P1.2 million in 2012 and<br />

P5.3 million in 2011 represents insurance service fees which are recorded as Prepaid<br />

insurance under <strong>the</strong> O<strong>the</strong>r Non-current Assets account and is amortized over a period<br />

of ten years (see Note 14).<br />

The cash surrender value of <strong>the</strong> investment in life insurance is used as collateral for<br />

interest-bearing loans obtained by BRL (see Note 15).