SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 59 -<br />

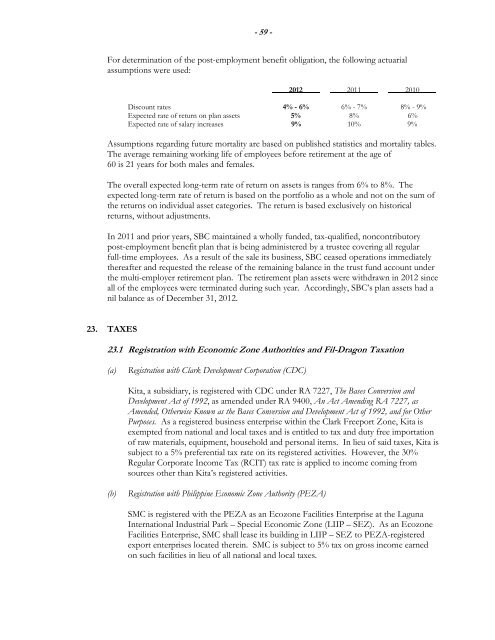

For determination of <strong>the</strong> post-employment benefit obligation, <strong>the</strong> following actuarial<br />

assumptions were used:<br />

2012 2011 2010<br />

Discount rates 4% - 6% 6% - 7% 8% - 9%<br />

Expected rate of return on plan assets 5% 8% 6%<br />

Expected rate of salary <strong>inc</strong>reases 9% 10% 9%<br />

Assumptions regarding future mortality are based on published statistics and mortality tables.<br />

The average remaining working life of employees before retirement at <strong>the</strong> age of<br />

60 is 21 years for both males and females.<br />

The overall expected long-term rate of return on assets is ranges from 6% to 8%. The<br />

expected long-term rate of return is based on <strong>the</strong> portfolio as a whole and not on <strong>the</strong> sum of<br />

<strong>the</strong> returns on individual asset categories. The return is based exclusively on historical<br />

returns, without adjustments.<br />

In 2011 and prior years, SBC maintained a wholly funded, tax-qualified, noncontributory<br />

post-employment benefit plan that is being administered by a trustee covering all regular<br />

full-time employees. As a result of <strong>the</strong> sale its business, SBC ceased operations immediately<br />

<strong>the</strong>reafter and requested <strong>the</strong> release of <strong>the</strong> remaining balance in <strong>the</strong> trust fund account under<br />

<strong>the</strong> multi-employer retirement plan. The retirement plan assets were withdrawn in 2012 s<strong>inc</strong>e<br />

all of <strong>the</strong> employees were terminated during such year. Accordingly, SBC’s plan assets had a<br />

nil balance as of December 31, 2012.<br />

23. TAXES<br />

23.1 Registration with Economic Zone Authorities and Fil-Dragon Taxation<br />

(a)<br />

Registration with Clark Development Corporation (CDC)<br />

Kita, a subsidiary, is registered with CDC under RA 7227, The Bases Conversion and<br />

Development Act of 1992, as amended under RA 9400, An Act Amending RA 7227, as<br />

Amended, O<strong>the</strong>rwise Known as <strong>the</strong> Bases Conversion and Development Act of 1992, and for O<strong>the</strong>r<br />

Purposes. As a registered business enterprise within <strong>the</strong> Clark Freeport Zone, Kita is<br />

exempted from national and local taxes and is entitled to tax and duty free importation<br />

of raw materials, equipment, household and personal items. In lieu of said taxes, Kita is<br />

subject to a 5% preferential tax rate on its registered activities. However, <strong>the</strong> 30%<br />

Regular Corporate Income Tax (RCIT) tax rate is applied to <strong>inc</strong>ome coming from<br />

sources o<strong>the</strong>r than Kita’s registered activities.<br />

(b)<br />

Registration with Philippine Economic Zone Authority (PEZA)<br />

SMC is registered with <strong>the</strong> PEZA as an Ecozone Facilities Enterprise at <strong>the</strong> Laguna<br />

International Industrial Park – Special Economic Zone (LIIP – SEZ). As an Ecozone<br />

Facilities Enterprise, SMC shall lease its building in LIIP – SEZ to PEZA-registered<br />

export enterprises located <strong>the</strong>rein. SMC is subject to 5% tax on gross <strong>inc</strong>ome earned<br />

on such facilities in lieu of all national and local taxes.