SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

- 77 -<br />

The Group’s management considers that all <strong>the</strong> above financial assets that are not impaired<br />

or past due at <strong>the</strong> end of each reporting period are of good credit quality.<br />

(a)<br />

Cash and Cash Equivalents, FVTPL and AFS Financial Assets<br />

The credit risk for cash and cash equivalents, FVTPL and AFS financial assets in <strong>the</strong><br />

con<strong>solid</strong>ated statements of financial position, is considered negligible, s<strong>inc</strong>e <strong>the</strong><br />

counterparties are reputable banks with high quality external credit ratings.<br />

(b)<br />

Trade and O<strong>the</strong>r Receivables<br />

Except for trade receivables arising from real estate sales, none of <strong>the</strong> financial assets<br />

are secured by collateral or o<strong>the</strong>r credit enhancements. Trade receivables are secured<br />

by industrial lots and condominium units sold to buyers and are covered by postdated<br />

checks.<br />

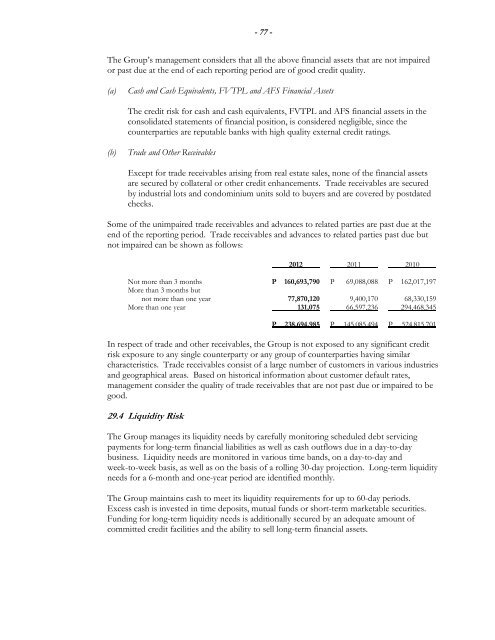

Some of <strong>the</strong> unimpaired trade receivables and advances to related parties are past due at <strong>the</strong><br />

end of <strong>the</strong> reporting period. Trade receivables and advances to related parties past due but<br />

not impaired can be shown as follows:<br />

2012 2011 2010<br />

Not more than 3 months P 160,693,790 P 69,088,088 P 162,0<strong>17</strong>,197<br />

More than 3 months but<br />

not more than one year 77,870,120 9,400,<strong>17</strong>0 68,330,159<br />

More than one year 131,075 66,597,236 294,468,345<br />

P 238,694,985 P 145,085,494 P 524,815,701<br />

In respect of trade and o<strong>the</strong>r receivables, <strong>the</strong> Group is not exposed to any significant credit<br />

risk exposure to any single counterparty or any <strong>group</strong> of counterparties having similar<br />

characteristics. Trade receivables consist of a large number of customers in various industries<br />

and geographical areas. Based on historical information about customer default rates,<br />

management consider <strong>the</strong> quality of trade receivables that are not past due or impaired to be<br />

good.<br />

29.4 Liquidity Risk<br />

The Group manages its liquidity needs by carefully monitoring scheduled debt servicing<br />

payments for long-term financial liabilities as well as cash outflows due in a day-to-day<br />

business. Liquidity needs are monitored in various time bands, on a day-to-day and<br />

week-to-week basis, as well as on <strong>the</strong> basis of a rolling 30-day projection. Long-term liquidity<br />

needs for a 6-month and one-year period are identified monthly.<br />

The Group maintains cash to meet its liquidity requirements for up to 60-day periods.<br />

Excess cash is invested in time deposits, mutual funds or short-term marketable securities.<br />

Funding for long-term liquidity needs is additionally secured by an adequate amount of<br />

committed credit facilities and <strong>the</strong> ability to sell long-term financial assets.