SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 41 -<br />

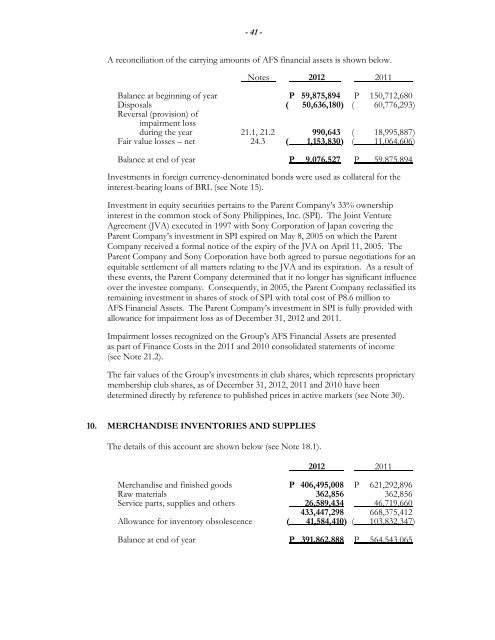

A reconciliation of <strong>the</strong> carrying amounts of AFS financial assets is shown below.<br />

Notes 2012 2011<br />

Balance at beginning of year<br />

Disposals<br />

P 59,875,894 P<br />

( 50,636,180) (<br />

150,712,680<br />

60,776,293 )<br />

Reversal (provision) of<br />

impairment loss<br />

during <strong>the</strong> year<br />

Fair value losses – net<br />

21.1, 21.2<br />

24.3 (<br />

990,643 (<br />

1,153,830 ) (<br />

18,995,887 )<br />

11,064,606 )<br />

Balance at end of year P 9,076,527 P 59,875,894<br />

Investments in foreign currency-denominated bonds were used as collateral for <strong>the</strong><br />

interest-bearing loans of BRL (see Note 15).<br />

Investment in equity securities pertains to <strong>the</strong> Parent Company’s 33% ownership<br />

interest in <strong>the</strong> common stock of Sony Philippines, Inc. (SPI). The Joint Venture<br />

Agreement (JVA) executed in 1997 with Sony Corporation of Japan covering <strong>the</strong><br />

Parent Company’s investment in SPI expired on May 8, 2005 on which <strong>the</strong> Parent<br />

Company received a formal notice of <strong>the</strong> expiry of <strong>the</strong> JVA on April 11, 2005. The<br />

Parent Company and Sony Corporation have both agreed to pursue negotiations for an<br />

equitable settlement of all matters relating to <strong>the</strong> JVA and its expiration. As a result of<br />

<strong>the</strong>se events, <strong>the</strong> Parent Company determined that it no longer has significant influence<br />

over <strong>the</strong> investee company. Consequently, in 2005, <strong>the</strong> Parent Company reclassified its<br />

remaining investment in shares of stock of SPI with total cost of P8.6 million to<br />

AFS Financial Assets. The Parent Company’s investment in SPI is fully provided with<br />

allowance for impairment loss as of December 31, 2012 and 2011.<br />

Impairment losses recognized on <strong>the</strong> Group’s AFS Financial Assets are presented<br />

as part of Finance Costs in <strong>the</strong> 2011 and 2010 con<strong>solid</strong>ated statements of <strong>inc</strong>ome<br />

(see Note 21.2).<br />

The fair values of <strong>the</strong> Group’s investments in club shares, which represents proprietary<br />

membership club shares, as of December 31, 2012, 2011 and 2010 have been<br />

determined directly by reference to published prices in active markets (see Note 30).<br />

10. MERCHANDISE INVENTORIES AND SUPPLIES<br />

The details of this account are shown below (see Note 18.1).<br />

2012 2011<br />

Merchandise and finished goods P 406,495,008 P 621,292,896<br />

Raw materials 362,856 362,856<br />

Service parts, supplies and o<strong>the</strong>rs 26,589,434 46,719,660<br />

433,447,298 668,375,412<br />

Allowance for inventory obsolescence ( 41,584,410) ( 103,832,347 )<br />

Balance at end of year P 391,862,888 P 564,543,065