SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

SEC Form 17-A: Annual Report - the solid group inc website

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

- 61 -<br />

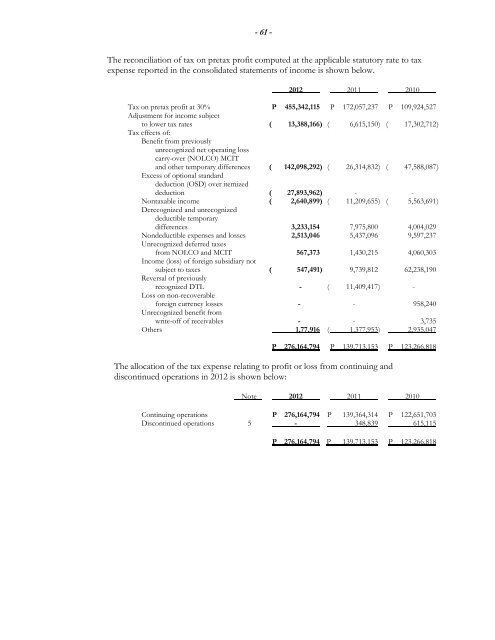

The reconciliation of tax on pretax profit computed at <strong>the</strong> applicable statutory rate to tax<br />

expense reported in <strong>the</strong> con<strong>solid</strong>ated statements of <strong>inc</strong>ome is shown below.<br />

2012 2011 2010<br />

Tax on pretax profit at 30% P 455,342,115 P <strong>17</strong>2,057,237 P 109,924,527<br />

Adjustment for <strong>inc</strong>ome subject<br />

to lower tax rates ( 13,388,166) ( 6,615,150) ( <strong>17</strong>,302,712 )<br />

Tax effects of:<br />

Benefit from previously<br />

unrecognized net operating loss<br />

carry-over (NOLCO) MCIT<br />

and o<strong>the</strong>r temporary differences ( 142,098,292) ( 26,314,832) ( 47,588,087 )<br />

Excess of optional standard<br />

deduction (OSD) over itemized<br />

deduction ( 27,893,962) - -<br />

Nontaxable <strong>inc</strong>ome ( 2,640,899) ( 11,209,655) ( 5,563,691 )<br />

Derecognized and unrecognized<br />

deductible temporary<br />

differences 3,233,154 7,975,800 4,004,029<br />

Nondeductible expenses and losses 2,513,046 5,437,096 9,597,237<br />

Unrecognized deferred taxes<br />

from NOLCO and MCIT 567,373 1,430,215 4,060,303<br />

Income (loss) of foreign subsidiary not<br />

subject to taxes ( 547,491) 9,739,812 62,238,190<br />

Reversal of previously<br />

recognized DTL - ( 11,409,4<strong>17</strong>) -<br />

Loss on non-recoverable<br />

foreign currency losses - - 958,240<br />

Unrecognized benefit from<br />

write-off of receivables - - 3,735<br />

O<strong>the</strong>rs 1,77,916 ( 1,377,953) 2,935,047<br />

P 276,164,794 P 139,713,153 P 123,266,818<br />

The allocation of <strong>the</strong> tax expense relating to profit or loss from continuing and<br />

discontinued operations in 2012 is shown below:<br />

Note 2012 2011 2010<br />

Continuing operations P 276,164,794 P 139,364,314 P 122,651,703<br />

Discontinued operations 5 - 348,839 615,115<br />

P 276,164,794 P 139,713,153 P 123,266,818