- 79 - 30. CATEGORIES AND FAIR VALUES OF FINANCIAL ASSETS AND LIABILITIES 30.1 Comparison of Carrying Values and Fair Values The carrying amounts and fair values of <strong>the</strong> categories of assets and liabilities presented in <strong>the</strong> con<strong>solid</strong>ated statements of financial position are shown below. 2012 2011 2010 Carrying Fair Carrying Fair Carrying Fair Notes Values Values Values Values Values Values Financial assets Loans and receivables: Cash and cash equivalents 6 P 3,019,984,213 P 3,019,984,213 P 1,720,748,062 P 1,720,748,062 P 1,620,114,468 P 1,620,114,468 Trade and o<strong>the</strong>r receivables - net 7 1,9<strong>17</strong>,927,407 1,9<strong>17</strong>,927,407 1,807,037,835 1,807,037,835 1,531,894,847 1,531,894,847 Advances to related parties 26 21,633,388 21,633,388 128,543,399 128,543,399 201,193,407 201,193,407 Refundable deposits <strong>17</strong> 21,754,661 21,754,661 13,651,421 13,651,421 12,386,030 12,386,030 Financial assets at FVTPL – Investments in bonds 8 - - 70,272,991 70,272,991 - - Available-for-sale financial assets: 9 Investments in bonds - - 51,994,367 51,994,367 138,606,153 138,606,153 Golf club shares – net 8,442,400 8,442,400 6,407,409 6,407,409 10,670,009 10,670,009 O<strong>the</strong>rs 634,127 634,127 1,474,118 1,474,118 1,436,518 1,436,518 P 4,990,376,196 P 4,990,376,196 P 3,800,129,602 P 3,800,129,602 P 3,516,301,432 P 3,516,301,432 Financial liabilities At amortized cost: Interest-bearing loans - net 15 P 571,666,922 P 571,666,922 P 779,398,755 P 779,398,755 P 989,502,559 P 989,502,559 Trade and o<strong>the</strong>r payables 16 563,429,613 563,429,613 495,511,929 495,511,929 442,663,550 442,663,550 Advances from related parties 26 11,629,819 11,629,819 115,790,251 115,790,251 168,911,611 168,911,611 Refundable deposits - net <strong>17</strong> 32,226,991 32,226,991 40,380,251 40,380,251 15,252,534 15,252,534 P 1,<strong>17</strong>8,953,045 P 1,<strong>17</strong>8,953,045 P 1,431,081,186 P 1,431,081,186 P 1,616,330,254 P 1,616,330,254 See Notes 2.5 and 2.10 for a description of <strong>the</strong> accounting policies for each category of financial instruments. A description of <strong>the</strong> Group’s risk management objectives and policies for financial instruments is provided in Note 31. 30.2 Fair Value Hierarchy The table below presents <strong>the</strong> hierarchy of fair value measurements used by <strong>the</strong> Group as of December 31, 2012, 2011 and 2010. Level 1 Level 2 Level 3 Total December 31, 2012 Financial assets at FVTPL P - P - P - P - AFS financial assets 9,076,527 - - 9,076,527 P 9,076,527 P - P - P 9,076,527 December 31, 2011 Financial assets at FVTPL P 70,272,991 P - P - P 70,272,991 AFS financial assets 58,938,767 - 937,127 59,875,894 P 129,211,758 P - P 937,127 P 130,148,885 December 31, 2010 AFS financial assets P 149,276,<strong>17</strong>4 P - P 1,436,518 P 150,712,692

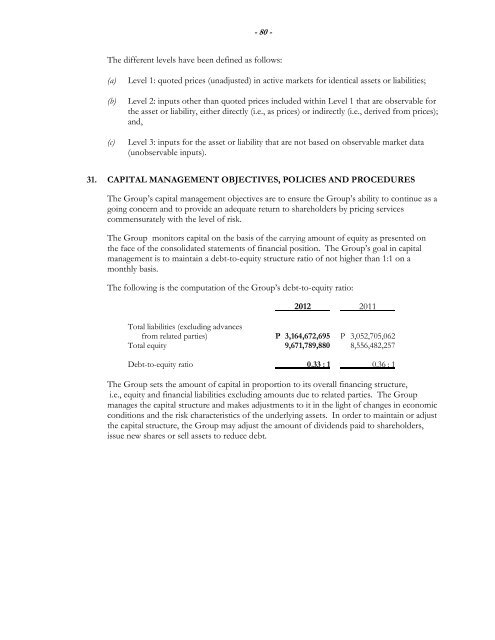

- 80 - The different levels have been defined as follows: (a) (b) (c) Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities; Level 2: inputs o<strong>the</strong>r than quoted prices <strong>inc</strong>luded within Level 1 that are observable for <strong>the</strong> asset or liability, ei<strong>the</strong>r directly (i.e., as prices) or indirectly (i.e., derived from prices); and, Level 3: inputs for <strong>the</strong> asset or liability that are not based on observable market data (unobservable inputs). 31. CAPITAL MANAGEMENT OBJECTIVES, POLICIES AND PROCEDURES The Group’s capital management objectives are to ensure <strong>the</strong> Group’s ability to continue as a going concern and to provide an adequate return to shareholders by pricing services commensurately with <strong>the</strong> level of risk. The Group monitors capital on <strong>the</strong> basis of <strong>the</strong> carrying amount of equity as presented on <strong>the</strong> face of <strong>the</strong> con<strong>solid</strong>ated statements of financial position. The Group’s goal in capital management is to maintain a debt-to-equity structure ratio of not higher than 1:1 on a monthly basis. The following is <strong>the</strong> computation of <strong>the</strong> Group’s debt-to-equity ratio: 2012 2011 Total liabilities (excluding advances from related parties) P 3,164,672,695 P 3,052,705,062 Total equity 9,671,789,880 8,556,482,257 Debt-to-equity ratio 0.33 : 1 0.36 : 1 The Group sets <strong>the</strong> amount of capital in proportion to its overall financing structure, i.e., equity and financial liabilities excluding amounts due to related parties. The Group manages <strong>the</strong> capital structure and makes adjustments to it in <strong>the</strong> light of changes in economic conditions and <strong>the</strong> risk characteristics of <strong>the</strong> underlying assets. In order to maintain or adjust <strong>the</strong> capital structure, <strong>the</strong> Group may adjust <strong>the</strong> amount of dividends paid to shareholders, issue new shares or sell assets to reduce debt.

- Page 1 and 2:

SOLID GROUP INC. April 30, 2013 THE

- Page 3 and 4:

12. Check whether the issuer: (a) h

- Page 5 and 6:

1 PART I. BUSINESS AND GENERAL INFO

- Page 7 and 8:

3 Solid Laguna Corporation (SLC) wa

- Page 9 and 10:

5 Status of any-publicly announced

- Page 11 and 12:

7 • Distributoship Agreement with

- Page 13 and 14:

9 Major Risks involved in the Busin

- Page 15 and 16:

11 reform. On August 13, 1997, Soli

- Page 17 and 18:

13 The above lease contracts are re

- Page 19 and 20:

15 The number of shareholders of re

- Page 21 and 22:

17 Item 6. Management’s Discussio

- Page 23 and 24:

19 2010 Revenue improved by 17% in

- Page 25 and 26:

21 broadband segment posted P267 mi

- Page 27 and 28:

23 Advances from related parties am

- Page 29 and 30:

25 Other operating income amounted

- Page 31 and 32:

27 Total assets reached P11,716 mil

- Page 33 and 34:

29 Cost of rentals amounted to P38

- Page 35 and 36:

31 Property, plant and equipment am

- Page 37 and 38:

33 thumb of 2 : 1 by achieving a cu

- Page 39 and 40:

35 vii. Causes for any Material Cha

- Page 41 and 42:

37 Principally due to additional co

- Page 43 and 44:

39 The decrease was mainly in relat

- Page 45 and 46:

41 Non-current trade and other rece

- Page 47 and 48:

43 Principally due to other compreh

- Page 49 and 50:

45 Increase was due to higher trade

- Page 51 and 52:

47 Cost of real estate sold - 37% d

- Page 53 and 54:

49 Mainly from higher commissions,

- Page 55 and 56:

51 The overall scope of the audit w

- Page 57 and 58:

53 Mr. Joseph Lim is the Founding C

- Page 59 and 60:

55 executive officers Susan L. Tan

- Page 61 and 62:

57 Common Lim, Elena S. 1,894 (dire

- Page 63 and 64:

59 2. The Company has no transactio

- Page 67 and 68:

62 SOLID GROUP, INC. INDEX TO FINAN

- Page 69 and 70:

64 INDEX TO EXHIBITS Form 17-A No.

- Page 71:

66 EXHIBIT 18 SUBSIDIARIES OF THE R

- Page 104 and 105:

- 2 - Notes 2012 2011 LIABILITIES A

- Page 106 and 107:

SOLID GROUP INC. AND SUBSIDIARIES C

- Page 108 and 109:

SOLID GROUP INC. AND SUBSIDIARIES C

- Page 110 and 111:

SOLID GROUP INC. AND SUBSIDIARIES N

- Page 112 and 113:

- 3 - (b) Mergers of Certain Subsid

- Page 114 and 115:

- 5 - 2.2 Adoption of New and Amend

- Page 116 and 117:

- 7 - (iii) Consolidation Standards

- Page 118 and 119:

- 9 - (vii) PAS 32 (Amendment), Fin

- Page 120 and 121:

- 11 - (c) PAS 32 (Amendment), Fina

- Page 122 and 123:

- 13 - 2.5 Financial Assets Financi

- Page 124 and 125:

- 15 - Non-compounding interest and

- Page 126 and 127:

- 17 - An item of property, plant a

- Page 128 and 129:

- 19 - If the business combination

- Page 130 and 131:

- 21 - (e) Sale of real estate - Re

- Page 132 and 133:

- 23 - Foreign currency gains and l

- Page 134 and 135:

- 25 - (b) Defined Contribution Pla

- Page 136 and 137:

- 27 - 2.23 Equity Capital stock re

- Page 138 and 139: - 29 - (d) Distinction Between Inve

- Page 140 and 141: - 31 - (d) Estimating Useful Lives

- Page 142 and 143: - 33 - (d) (e) Distribution segment

- Page 144 and 145: - 35 - The total segment balances p

- Page 146 and 147: - 37 - The net cash flows attributa

- Page 148 and 149: - 39 - Other receivables consist pr

- Page 150 and 151: - 41 - A reconciliation of the carr

- Page 152 and 153: - 43 - Borrowing costs incurred fro

- Page 154 and 155: A reconciliation of the carrying am

- Page 156 and 157: - 47 - The changes in the carrying

- Page 158 and 159: - 49 - Information relating to sign

- Page 160 and 161: - 51 - Other accrued expenses inclu

- Page 162 and 163: - 53 - 19. OTHER INCOME 19.1 Other

- Page 164 and 165: - 55 - These expenses are classifie

- Page 166 and 167: - 57 - 22.2 Post-employment Benefit

- Page 168 and 169: - 59 - For determination of the pos

- Page 170 and 171: - 61 - The reconciliation of tax on

- Page 172 and 173: - 63 - The net deferred tax liabili

- Page 174 and 175: - 65 - 24. EQUITY 24.1 Capital Stoc

- Page 176 and 177: - 67 - The Group’s outstanding re

- Page 178 and 179: - 69 - 26.5 Advances to and from Re

- Page 180 and 181: - 71 - 26.10 Key Management Personn

- Page 182 and 183: - 73 - (d) Gain on Sale of Assets S

- Page 184 and 185: - 75 - 28.9 Others As of December 3

- Page 186 and 187: - 77 - The Group’s management con

- Page 191 and 192: Supplementary Schedules SOLID GROUP

- Page 193 and 194: Solid Group Inc. and Subsidiaries S

- Page 195 and 196: Solid Group Inc. and Subsidiaries S

- Page 197 and 198: SOLID GROUP INC. Schedule I Reconci

- Page 199 and 200: SOLID GROUP INC. AND SUBSIDIARIES S

- Page 201 and 202: PAS 33 Earnings per Share a PAS 34

- Page 203: Solid Group Inc. and Subsidiaries S