The Australian Government's Innovation Report

The Australian Government's Innovation Report

The Australian Government's Innovation Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Enhancing industrial R&D<br />

R&D Tax Concession<br />

<strong>The</strong> R&D Tax Concession is the <strong>Australian</strong> Government’s principal mechanism to stimulate private sector<br />

expenditure on R&D. It has three elements:<br />

• 125% R&D Tax Concession – deductions of 125% of eligible expenditure incurred on eligible R&D<br />

activities from assessable income.<br />

• 175% Premium R&D Tax Concession – a higher level deduction for companies that have additional<br />

R&D expenditure for eligible labour-related expenditure above the previous three-year average.<br />

• R&D Tax Offset – assists small companies, especially those in tax loss, by providing an immediate<br />

benefit from the 125% R&D Tax Concession and the 175% Premium R&D Tax Concession by<br />

allowing them to cash out their benefit.<br />

At 30 June 2006, a total of 5830 companies were registered for the 2004-05 income year, with reported R&D<br />

expenditure totalling $7.79 billion, an increase in expenditure of 12.5% over 2003-04. <strong>The</strong> number of registrations<br />

was a record, increasing by 3.5% over the previous year and an average of 12% a year over the previous five years.<br />

A total of 67% of companies reported R&D expenditure of less than $500 000, comprising 10% of the total<br />

reported R&D expenditure. <strong>Report</strong>ed R&D activities valued greater than $10 million were undertaken by 2%<br />

of registrants and represented 49% of total reported R&D expenditure.<br />

Companies with a turnover of less than $5 million represented the largest single group of registrants (66%) for<br />

the R&D Tax Concession, while companies with a turnover of more than $50 million represented 14% of<br />

registrants.<br />

Take up of the R&D Tax Offset and 175% Premium Tax Concession elements<br />

At 30 June 2006, a total of 2465 companies had indicated the intention to claim the R&D Tax Offset for the 2004-05<br />

income year (made up of 2165 companies intending to claim the offset at the 125% rate and 300 companies<br />

intending to claim at the 175% premium rate).<br />

At 30 June 2006, a total of 1152 companies had indicated the intention to claim the 175% Incremental (Premium)<br />

R&D Tax Concession for 2004-05 (made up of 852 companies intending to claim the premium and 300<br />

companies intending to claim the offset at the 175% premium rate).<br />

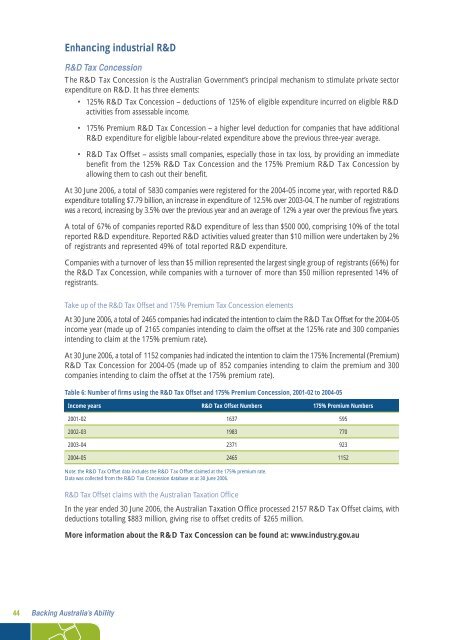

Table 6: Number of firms using the R&D Tax Offset and 175% Premium Concession, 2001-02 to 2004-05<br />

Income years R&D Tax Offset Numbers 175% Premium Numbers<br />

2001-02 1637 595<br />

2002-03 1983 770<br />

2003-04 2371 923<br />

2004-05 2465 1152<br />

Note: the R&D Tax Offset data includes the R&D Tax Offset claimed at the 175% premium rate.<br />

Data was collected from the R&D Tax Concession database as at 30 June 2006.<br />

R&D Tax Offset claims with the <strong>Australian</strong> Taxation Office<br />

In the year ended 30 June 2006, the <strong>Australian</strong> Taxation Office processed 2157 R&D Tax Offset claims, with<br />

deductions totalling $883 million, giving rise to offset credits of $265 million.<br />

More information about the R&D Tax Concession can be found at: www.industry.gov.au<br />

44 Backing Australia’s Ability

![[Tam] Uygula[ya] - Bilim, Teknoloji ve Ä°novasyon Politikaları TartıÅma ...](https://img.yumpu.com/36820041/1/184x260/tam-uygulaya-bilim-teknoloji-ve-anovasyon-politikalara-tartaama-.jpg?quality=85)