Financial Business Act.pdf

Financial Business Act.pdf

Financial Business Act.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

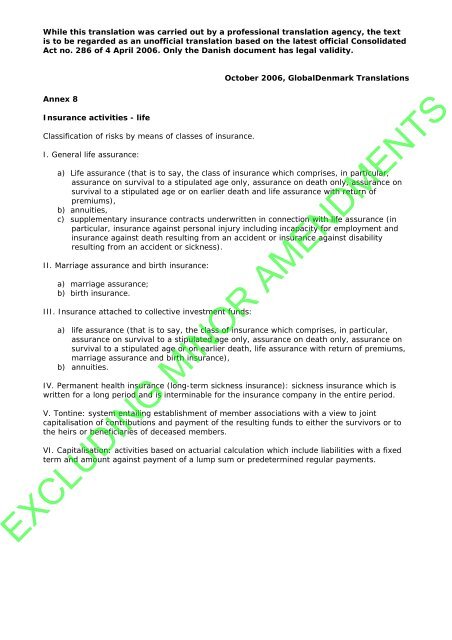

While this translation was carried out by a professional translation agency, the text<br />

is to be regarded as an unofficial translation based on the latest official Consolidated<br />

<strong>Act</strong> no. 286 of 4 April 2006. Only the Danish document has legal validity.<br />

Annex 8<br />

Insurance activities - life<br />

Classification of risks by means of classes of insurance.<br />

I. General life assurance:<br />

October 2006, GlobalDenmark Translations<br />

a) Life assurance (that is to say, the class of insurance which comprises, in particular,<br />

assurance on survival to a stipulated age only, assurance on death only, assurance on<br />

survival to a stipulated age or on earlier death and life assurance with return of<br />

premiums),<br />

b) annuities,<br />

c) supplementary insurance contracts underwritten in connection with life assurance (in<br />

particular, insurance against personal injury including incapacity for employment and<br />

insurance against death resulting from an accident or insurance against disability<br />

resulting from an accident or sickness).<br />

II. Marriage assurance and birth insurance:<br />

a) marriage assurance;<br />

b) birth insurance.<br />

III. Insurance attached to collective investment funds:<br />

a) life assurance (that is to say, the class of insurance which comprises, in particular,<br />

assurance on survival to a stipulated age only, assurance on death only, assurance on<br />

survival to a stipulated age or on earlier death, life assurance with return of premiums,<br />

marriage assurance and birth insurance),<br />

b) annuities.<br />

IV. Permanent health insurance (long-term sickness insurance): sickness insurance which is<br />

written for a long period and is interminable for the insurance company in the entire period.<br />

V. Tontine: system entailing establishment of member associations with a view to joint<br />

capitalisation of contributions and payment of the resulting funds to either the survivors or to<br />

the heirs or beneficiaries of deceased members.<br />

VI. Capitalisation: activities based on actuarial calculation which include liabilities with a fixed<br />

term and amount against payment of a lump sum or predetermined regular payments.<br />

EXCLUDING MINOR AMENDMENTS