Financial Business Act.pdf

Financial Business Act.pdf

Financial Business Act.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

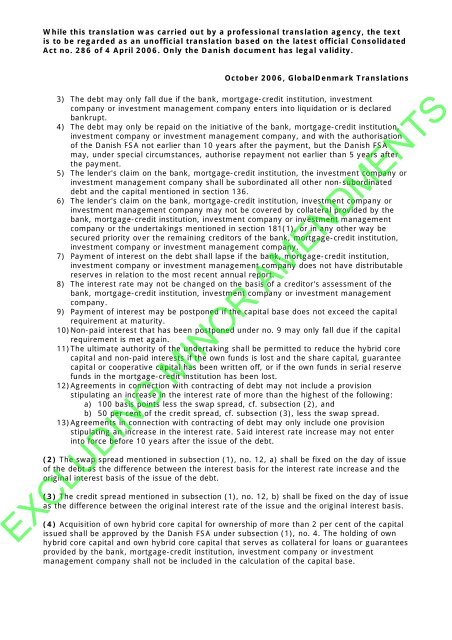

While this translation was carried out by a professional translation agency, the text<br />

is to be regarded as an unofficial translation based on the latest official Consolidated<br />

<strong>Act</strong> no. 286 of 4 April 2006. Only the Danish document has legal validity.<br />

October 2006, GlobalDenmark Translations<br />

3) The debt may only fall due if the bank, mortgage-credit institution, investment<br />

company or investment management company enters into liquidation or is declared<br />

bankrupt.<br />

4) The debt may only be repaid on the initiative of the bank, mortgage-credit institution,<br />

investment company or investment management company, and with the authorisation<br />

of the Danish FSA not earlier than 10 years after the payment, but the Danish FSA<br />

may, under special circumstances, authorise repayment not earlier than 5 years after<br />

the payment.<br />

5) The lender's claim on the bank, mortgage-credit institution, the investment company or<br />

investment management company shall be subordinated all other non-subordinated<br />

debt and the capital mentioned in section 136.<br />

6) The lender's claim on the bank, mortgage-credit institution, investment company or<br />

investment management company may not be covered by collateral provided by the<br />

bank, mortgage-credit institution, investment company or investment management<br />

company or the undertakings mentioned in section 181(1), or in any other way be<br />

secured priority over the remaining creditors of the bank, mortgage-credit institution,<br />

investment company or investment management company.<br />

7) Payment of interest on the debt shall lapse if the bank, mortgage-credit institution,<br />

investment company or investment management company does not have distributable<br />

reserves in relation to the most recent annual report.<br />

8) The interest rate may not be changed on the basis of a creditor's assessment of the<br />

bank, mortgage-credit institution, investment company or investment management<br />

company.<br />

9) Payment of interest may be postponed if the capital base does not exceed the capital<br />

requirement at maturity.<br />

10) Non-paid interest that has been postponed under no. 9 may only fall due if the capital<br />

requirement is met again.<br />

11) The ultimate authority of the undertaking shall be permitted to reduce the hybrid core<br />

capital and non-paid interests if the own funds is lost and the share capital, guarantee<br />

capital or cooperative capital has been written off, or if the own funds in serial reserve<br />

funds in the mortgage-credit institution has been lost.<br />

12) Agreements in connection with contracting of debt may not include a provision<br />

stipulating an increase in the interest rate of more than the highest of the following:<br />

a) 100 basis points less the swap spread, cf. subsection (2), and<br />

b) 50 per cent of the credit spread, cf. subsection (3), less the swap spread.<br />

13) Agreements in connection with contracting of debt may only include one provision<br />

stipulating an increase in the interest rate. Said interest rate increase may not enter<br />

into force before 10 years after the issue of the debt.<br />

(2) The swap spread mentioned in subsection (1), no. 12, a) shall be fixed on the day of issue<br />

of the debt as the difference between the interest basis for the interest rate increase and the<br />

original interest basis of the issue of the debt.<br />

(3) The credit spread mentioned in subsection (1), no. 12, b) shall be fixed on the day of issue<br />

as the difference between the original interest rate of the issue and the original interest basis.<br />

(4) Acquisition of own hybrid core capital for ownership of more than 2 per cent of the capital<br />

issued shall be approved by the Danish FSA under subsection (1), no. 4. The holding of own<br />

hybrid core capital and own hybrid core capital that serves as collateral for loans or guarantees<br />

provided by the bank, mortgage-credit institution, investment company or investment<br />

management company shall not be included in the calculation of the capital base.<br />

EXCLUDING MINOR AMENDMENTS