Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

upward trend evident since 2005 in the first part of<br />

this year. But following the latest leg of the rally,<br />

whether you assume the price moves higher from<br />

here, moves flat at current levels, or declines back to<br />

that trend, the levels reached in recent weeks imply<br />

our forecast for a peak in food HICP inflation of<br />

around 3.5% later this year now looks conservative.<br />

Accordingly, we have raised our forecast, with a peak<br />

rate of food inflation a pp higher in the second half of<br />

this year.<br />

…with indirect implications for core…<br />

The latest rally in soft commodity and oil prices has<br />

implications for ex-food, ex-energy inflation too.<br />

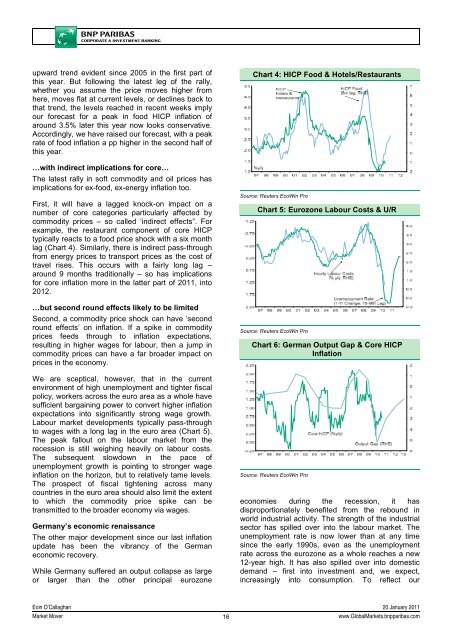

First, it will have a lagged knock-on impact on a<br />

number of core categories particularly affected by<br />

commodity prices – so called ‘indirect effects”. For<br />

example, the restaurant component of core HICP<br />

typically reacts to a food price shock with a six month<br />

lag (Chart 4). Similarly, there is indirect pass-through<br />

from energy prices to transport prices as the cost of<br />

travel rises. This occurs with a fairly long lag –<br />

around 9 months traditionally – so has implications<br />

for core inflation more in the latter part of 2011, into<br />

2012.<br />

…but second round effects likely to be limited<br />

Second, a commodity price shock can have ‘second<br />

round effects’ on inflation. If a spike in commodity<br />

prices feeds through to inflation expectations,<br />

resulting in higher wages for labour, then a jump in<br />

commodity prices can have a far broader impact on<br />

prices in the economy.<br />

We are sceptical, however, that in the current<br />

environment of high unemployment and tighter fiscal<br />

policy, workers across the euro area as a whole have<br />

sufficient bargaining power to convert higher inflation<br />

expectations into significantly strong wage growth.<br />

Labour market developments typically pass-through<br />

to wages with a long lag in the euro area (Chart 5).<br />

The peak fallout on the labour market from the<br />

recession is still weighing heavily on labour costs.<br />

The subsequent slowdown in the pace of<br />

unemployment growth is pointing to stronger wage<br />

inflation on the horizon, but to relatively tame levels.<br />

The prospect of fiscal tightening across many<br />

countries in the euro area should also limit the extent<br />

to which the commodity price spike can be<br />

transmitted to the broader economy via wages.<br />

Germany’s economic renaissance<br />

The other major development since our last inflation<br />

update has been the vibrancy of the German<br />

economic recovery.<br />

While Germany suffered an output collapse as large<br />

or larger than the other principal eurozone<br />

Chart 4: HICP Food & Hotels/Restaurants<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Eurozone Labour Costs & U/R<br />

Source: Reuters EcoWin Pro<br />

Chart 6: German Output Gap & Core HICP<br />

Inflation<br />

Source: Reuters EcoWin Pro<br />

economies during the recession, it has<br />

disproportionately benefited from the rebound in<br />

world industrial activity. The strength of the industrial<br />

sector has spilled over into the labour market. The<br />

unemployment rate is now lower than at any time<br />

since the early 1990s, even as the unemployment<br />

rate across the eurozone as a whole reaches a new<br />

12-year high. It has also spilled over into domestic<br />

demand – first into investment and, we expect,<br />

increasingly into consumption. To reflect our<br />

Eoin O’Callaghan 20 January 2011<br />

<strong>Market</strong> Mover<br />

16<br />

www.Global<strong>Market</strong>s.bnpparibas.com