Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Eurozone: BoP Leaves Euro Vulnerable<br />

• Despite the worsening of the eurozone debt<br />

crisis last November, foreign investors turned<br />

net buyers of bonds and notes in that month.<br />

• The fact that non-eurozone capital flows<br />

were not the cause of the bond crisis is not<br />

reassuring for the euro.<br />

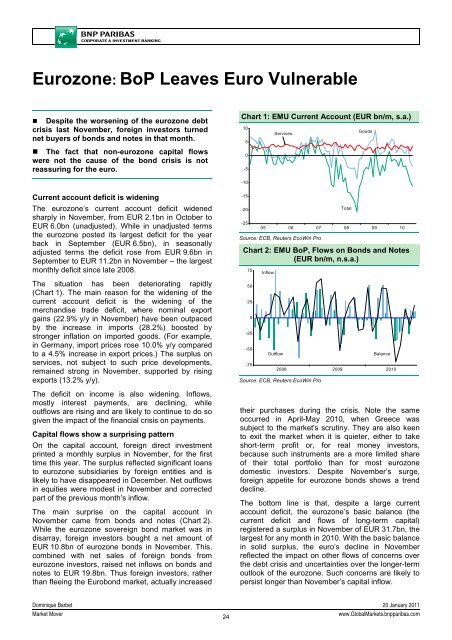

Chart 1: EMU Current Account (EUR bn/m, s.a.)<br />

10<br />

Goods<br />

Services<br />

5<br />

0<br />

-5<br />

-10<br />

Current account deficit is widening<br />

The eurozone’s current account deficit widened<br />

sharply in November, from EUR 2.1bn in October to<br />

EUR 6.0bn (unadjusted). While in unadjusted terms<br />

the eurozone posted its largest deficit for the year<br />

back in September (EUR 6.5bn), in seasonally<br />

adjusted terms the deficit rose from EUR 9.6bn in<br />

September to EUR 11.2bn in November – the largest<br />

monthly deficit since late 2008.<br />

The situation has been deteriorating rapidly<br />

(Chart 1). The main reason for the widening of the<br />

current account deficit is the widening of the<br />

merchandise trade deficit, where nominal export<br />

gains (22.9% y/y in November) have been outpaced<br />

by the increase in imports (28.2%) boosted by<br />

stronger inflation on imported goods. (For example,<br />

in Germany, import prices rose 10.0% y/y compared<br />

to a 4.5% increase in export prices.) The surplus on<br />

services, not subject to such price developments,<br />

remained strong in November, supported by rising<br />

exports (13.2% y/y).<br />

The deficit on income is also widening. Inflows,<br />

mostly interest payments, are declining, while<br />

outflows are rising and are likely to continue to do so<br />

given the impact of the financial crisis on payments.<br />

Capital flows show a surprising pattern<br />

On the capital account, foreign direct investment<br />

printed a monthly surplus in November, for the first<br />

time this year. The surplus reflected significant loans<br />

to eurozone subsidiaries by foreign entities and is<br />

likely to have disappeared in December. Net outflows<br />

in equities were modest in November and corrected<br />

part of the previous month’s inflow.<br />

The main surprise on the capital account in<br />

November came from bonds and notes (Chart 2).<br />

While the eurozone sovereign bond market was in<br />

disarray, foreign investors bought a net amount of<br />

EUR 10.8bn of eurozone bonds in November. This,<br />

combined with net sales of foreign bonds from<br />

eurozone investors, raised net inflows on bonds and<br />

notes to EUR 19.8bn. Thus foreign investors, rather<br />

than fleeing the Eurobond market, actually increased<br />

-15<br />

-20<br />

-25<br />

05 06 07 08 09 10<br />

Source: ECB, Reuters EcoWin Pro<br />

Total<br />

Chart 2: EMU BoP, Flows on Bonds and Notes<br />

(EUR bn/m, n.s.a.)<br />

75<br />

50<br />

25<br />

0<br />

-25<br />

-50<br />

-75<br />

Inflow<br />

Outflow<br />

2008 2009 2010<br />

Source: ECB, Reuters EcoWin Pro<br />

Balance<br />

their purchases during the crisis. Note the same<br />

occurred in April-May 2010, when Greece was<br />

subject to the market's scrutiny. They are also keen<br />

to exit the market when it is quieter, either to take<br />

short-term profit or, for real money investors,<br />

because such instruments are a more limited share<br />

of their total portfolio than for most eurozone<br />

domestic investors. Despite November’s surge,<br />

foreign appetite for eurozone bonds shows a trend<br />

decline.<br />

The bottom line is that, despite a large current<br />

account deficit, the eurozone’s basic balance (the<br />

current deficit and flows of long-term capital)<br />

registered a surplus in November of EUR 31.7bn, the<br />

largest for any month in 2010. With the basic balance<br />

in solid surplus, the euro’s decline in November<br />

reflected the impact on other flows of concerns over<br />

the debt crisis and uncertainties over the longer-term<br />

outlook of the eurozone. Such concerns are likely to<br />

persist longer than November’s capital inflow.<br />

Dominique Barbet 20 January 2011<br />

<strong>Market</strong> Mover<br />

24<br />

www.Global<strong>Market</strong>s.bnpparibas.com