Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

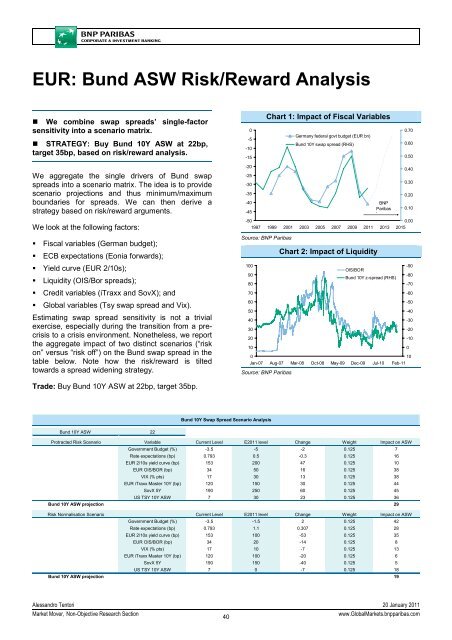

EUR: Bund ASW Risk/Reward Analysis<br />

• We combine swap spreads’ single-factor<br />

sensitivity into a scenario matrix.<br />

• STRATEGY: Buy Bund 10Y ASW at 22bp,<br />

target 35bp, based on risk/reward analysis.<br />

0<br />

-5<br />

-10<br />

-15<br />

Chart 1: Impact of Fiscal Variables<br />

Germany federal govt budget (EUR bn)<br />

Bund 10Y swap spread (RHS)<br />

0.70<br />

0.60<br />

0.50<br />

We aggregate the single drivers of Bund swap<br />

spreads into a scenario matrix. The idea is to provide<br />

scenario projections and thus minimum/maximum<br />

boundaries for spreads. We can then derive a<br />

strategy based on risk/reward arguments.<br />

We look at the following factors:<br />

• Fiscal variables (German budget);<br />

• ECB expectations (Eonia forwards);<br />

• Yield curve (EUR 2/10s);<br />

• Liquidity (OIS/Bor spreads);<br />

• Credit variables (iTraxx and SovX); and<br />

• Global variables (Tsy swap spread and Vix).<br />

Estimating swap spread sensitivity is not a trivial<br />

exercise, especially during the transition from a precrisis<br />

to a crisis environment. Nonetheless, we report<br />

the aggregate impact of two distinct scenarios (“risk<br />

on” versus “risk off”) on the Bund swap spread in the<br />

table below. Note how the risk/reward is tilted<br />

towards a spread widening strategy.<br />

-20<br />

0.40<br />

-25<br />

-30<br />

0.30<br />

-35<br />

0.20<br />

-40<br />

<strong>BNP</strong><br />

-45<br />

Paribas 0.10<br />

f<br />

-50<br />

0.00<br />

1997 1999 2001 2003 2005 2007 2009 2011 2013 2015<br />

Source: <strong>BNP</strong> Paribas<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

Chart 2: Impact of Liquidity<br />

OIS/BOR<br />

Bund 10Y z-spread (RHS)<br />

0<br />

10<br />

Jan-07 Aug-07 Mar-08 Oct-08 May-09 Dec-09 Jul-10 Feb-11<br />

Source: <strong>BNP</strong> Paribas<br />

-90<br />

-80<br />

-70<br />

-60<br />

-50<br />

-40<br />

-30<br />

-20<br />

-10<br />

0<br />

Trade: Buy Bund 10Y ASW at 22bp, target 35bp.<br />

Bund 10Y Swap Spread Scenario Analysis<br />

Bund 10Y ASW 22<br />

Protracted Risk Scenario Variable Current Level E2011 level Change Weight Impact on ASW<br />

Government Budget (%) -3.5 -5 -2 0.125 7<br />

<strong>Rate</strong> expectations (bp) 0.793 0.5 -0.3 0.125 16<br />

EUR 2/10s yield curve (bp) 153 200 47 0.125 10<br />

EUR OIS/BOR (bp) 34 50 16 0.125 38<br />

VIX (% pts) 17 30 13 0.125 38<br />

EUR iTraxx Master 10Y (bp) 120 150 30 0.125 44<br />

SovX 5Y 190 250 60 0.125 45<br />

US TSY 10Y ASW 7 30 23 0.125 36<br />

Bund 10Y ASW projection 29<br />

Risk Normalisation Scenario Current Level E2011 level Change Weight Impact on ASW<br />

Government Budget (%) -3.5 -1.5 2 0.125 42<br />

<strong>Rate</strong> expectations (bp) 0.793 1.1 0.307 0.125 28<br />

EUR 2/10s yield curve (bp) 153 100 -53 0.125 35<br />

EUR OIS/BOR (bp) 34 20 -14 0.125 8<br />

VIX (% pts) 17 10 -7 0.125 13<br />

EUR iTraxx Master 10Y (bp) 120 100 -20 0.125 6<br />

SovX 5Y 190 150 -40 0.125 5<br />

US TSY 10Y ASW 7 0 -7 0.125 18<br />

Bund 10Y ASW projection 19<br />

Alessandro Tentori 20 January 2011<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

40<br />

www.Global<strong>Market</strong>s.bnpparibas.com