Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MBS: Stay Long<br />

• We recommend staying long the mortgage<br />

basis. Valuations remain reasonable and the<br />

carry in back months is attractive, fully<br />

reflecting the slowdown in speeds.<br />

• In a rally, servicer convexity costs keep<br />

primary rates in check and in a sell-off<br />

incremental extension is low. If rates remain<br />

range bound as we expect, the curve hedged<br />

carry (adding back convexity costs) remains<br />

formidable in this low yield environment.<br />

• We continue to like going up in coupon into<br />

5s through 6s due to the attractive carry.<br />

15s/30s appear to be on the richer side.<br />

• Investors considering front sequentials off<br />

CK collateral may also find value in similar<br />

bonds off FG collateral, given that FG 4.5s are<br />

trading 9 ticks below parity while CKs 4 ticks.<br />

• STRATEGY: Long MBS, Long UIC.<br />

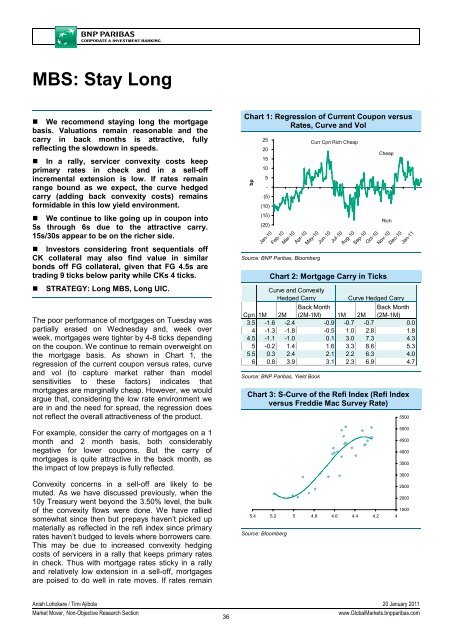

The poor performance of mortgages on Tuesday was<br />

partially erased on Wednesday and, week over<br />

week, mortgages were tighter by 4-8 ticks depending<br />

on the coupon. We continue to remain overweight on<br />

the mortgage basis. As shown in Chart 1, the<br />

regression of the current coupon versus rates, curve<br />

and vol (to capture market rather than model<br />

sensitivities to these factors) indicates that<br />

mortgages are marginally cheap. However, we would<br />

argue that, considering the low rate environment we<br />

are in and the need for spread, the regression does<br />

not reflect the overall attractiveness of the product.<br />

Chart 1: Regression of Current Coupon versus<br />

<strong>Rate</strong>s, Curve and Vol<br />

bp<br />

25<br />

20<br />

15<br />

10<br />

5<br />

-<br />

(5)<br />

(10)<br />

(15)<br />

(20)<br />

Jan-10<br />

Feb-10<br />

Source: <strong>BNP</strong> Paribas, Bloomberg<br />

Curr Cpn Rich Cheap<br />

Mar-10<br />

Apr-10<br />

May-10<br />

Jun-10<br />

Jul-10<br />

Aug-10<br />

Sep-10<br />

Oct-10<br />

Cheap<br />

Chart 2: Mortgage Carry in Ticks<br />

Curve and Convexity<br />

Hedged Carry<br />

Rich<br />

Nov-10<br />

Dec-10<br />

Jan-11<br />

Curve Hedged Carry<br />

Cpn 1M 2M<br />

Back Month<br />

(2M-1M) 1M 2M<br />

Back Month<br />

(2M-1M)<br />

3.5 -1.6 -2.4 -0.9 -0.7 -0.7 0.0<br />

4 -1.3 -1.8 -0.5 1.0 2.8 1.8<br />

4.5 -1.1 -1.0 0.1 3.0 7.3 4.3<br />

5 -0.2 1.4 1.6 3.3 8.6 5.3<br />

5.5 0.3 2.4 2.1 2.2 6.3 4.0<br />

6 0.8 3.9 3.1 2.3 6.9 4.7<br />

Source: <strong>BNP</strong> Paribas, Yield Book<br />

Chart 3: S-Curve of the Refi Index (Refi Index<br />

versus Freddie Mac Survey <strong>Rate</strong>)<br />

5500<br />

For example, consider the carry of mortgages on a 1<br />

month and 2 month basis, both considerably<br />

negative for lower coupons. But the carry of<br />

mortgages is quite attractive in the back month, as<br />

the impact of low prepays is fully reflected.<br />

Convexity concerns in a sell-off are likely to be<br />

muted. As we have discussed previously, when the<br />

10y Treasury went beyond the 3.50% level, the bulk<br />

of the convexity flows were done. We have rallied<br />

somewhat since then but prepays haven’t picked up<br />

materially as reflected in the refi index since primary<br />

rates haven’t budged to levels where borrowers care.<br />

This may be due to increased convexity hedging<br />

costs of servicers in a rally that keeps primary rates<br />

in check. Thus with mortgage rates sticky in a rally<br />

and relatively low extension in a sell-off, mortgages<br />

are poised to do well in rate moves. If rates remain<br />

5.4<br />

5.2<br />

Source: Bloomberg<br />

5<br />

4.8<br />

4.6<br />

4.4<br />

4.2<br />

5000<br />

4500<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

4<br />

Anish Lohokare / Timi Ajibola 20 January 2011<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

36<br />

www.Global<strong>Market</strong>s.bnpparibas.com