Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

also means that, the more peripherals suffer, the<br />

more core will have to bear the burden.<br />

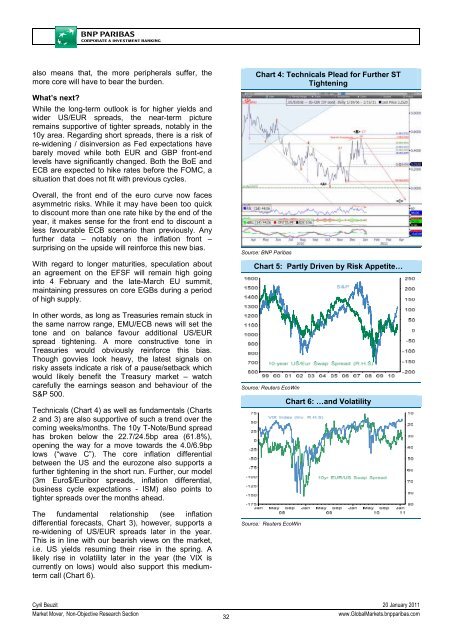

Chart 4: Technicals Plead for Further ST<br />

Tightening<br />

What’s next?<br />

While the long-term outlook is for higher yields and<br />

wider US/EUR spreads, the near-term picture<br />

remains supportive of tighter spreads, notably in the<br />

10y area. Regarding short spreads, there is a risk of<br />

re-widening / disinversion as Fed expectations have<br />

barely moved while both EUR and GBP front-end<br />

levels have significantly changed. Both the BoE and<br />

ECB are expected to hike rates before the FOMC, a<br />

situation that does not fit with previous cycles.<br />

Overall, the front end of the euro curve now faces<br />

asymmetric risks. While it may have been too quick<br />

to discount more than one rate hike by the end of the<br />

year, it makes sense for the front end to discount a<br />

less favourable ECB scenario than previously. Any<br />

further data – notably on the inflation front –<br />

surprising on the upside will reinforce this new bias.<br />

With regard to longer maturities, speculation about<br />

an agreement on the EFSF will remain high going<br />

into 4 February and the late-March EU summit,<br />

maintaining pressures on core EGBs during a period<br />

of high supply.<br />

In other words, as long as Treasuries remain stuck in<br />

the same narrow range, EMU/ECB news will set the<br />

tone and on balance favour additional US/EUR<br />

spread tightening. A more constructive tone in<br />

Treasuries would obviously reinforce this bias.<br />

Though govvies look heavy, the latest signals on<br />

risky assets indicate a risk of a pause/setback which<br />

would likely benefit the Treasury market – watch<br />

carefully the earnings season and behaviour of the<br />

S&P 500.<br />

Technicals (Chart 4) as well as fundamentals (Charts<br />

2 and 3) are also supportive of such a trend over the<br />

coming weeks/months. The 10y T-Note/Bund spread<br />

has broken below the 22.7/24.5bp area (61.8%),<br />

opening the way for a move towards the 4.0/6.9bp<br />

lows (“wave C”). The core inflation differential<br />

between the US and the eurozone also supports a<br />

further tightening in the short run. Further, our model<br />

(3m Euro$/Euribor spreads, inflation differential,<br />

business cycle expectations - ISM) also points to<br />

tighter spreads over the months ahead.<br />

The fundamental relationship (see inflation<br />

differential forecasts, Chart 3), however, supports a<br />

re-widening of US/EUR spreads later in the year.<br />

This is in line with our bearish views on the market,<br />

i.e. US yields resuming their rise in the spring. A<br />

likely rise in volatility later in the year (the VIX is<br />

currently on lows) would also support this mediumterm<br />

call (Chart 6).<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 5: Partly Driven by Risk Appetite…<br />

Source: Reuters EcoWin<br />

Source: Reuters EcoWin<br />

Chart 6: …and Volatility<br />

Cyril Beuzit 20 January 2011<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

32<br />

www.Global<strong>Market</strong>s.bnpparibas.com