Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

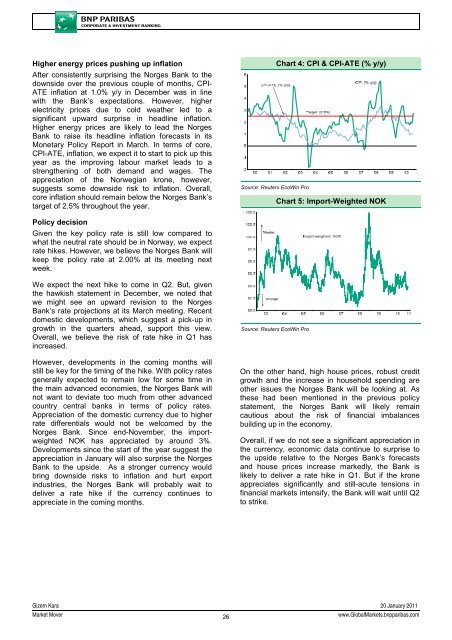

Higher energy prices pushing up inflation<br />

After consistently surprising the Norges Bank to the<br />

downside over the previous couple of months, CPI-<br />

ATE inflation at 1.0% y/y in December was in line<br />

with the Bank’s expectations. However, higher<br />

electricity prices due to cold weather led to a<br />

significant upward surprise in headline inflation.<br />

Higher energy prices are likely to lead the Norges<br />

Bank to raise its headline inflation forecasts in its<br />

Monetary Policy Report in March. In terms of core,<br />

CPI-ATE, inflation, we expect it to start to pick up this<br />

year as the improving labour market leads to a<br />

strengthening of both demand and wages. The<br />

appreciation of the Norwegian krone, however,<br />

suggests some downside risk to inflation. Overall,<br />

core inflation should remain below the Norges Bank’s<br />

target of 2.5% throughout the year.<br />

Source: Reuters EcoWin Pro<br />

Chart 4: CPI & CPI-ATE (% y/y)<br />

Chart 5: Import-Weighted NOK<br />

Policy decision<br />

Given the key policy rate is still low compared to<br />

what the neutral rate should be in Norway, we expect<br />

rate hikes. However, we believe the Norges Bank will<br />

keep the policy rate at 2.00% at its meeting next<br />

week.<br />

We expect the next hike to come in Q2. But, given<br />

the hawkish statement in December, we noted that<br />

we might see an upward revision to the Norges<br />

Bank’s rate projections at its March meeting. Recent<br />

domestic developments, which suggest a pick-up in<br />

growth in the quarters ahead, support this view.<br />

Overall, we believe the risk of rate hike in Q1 has<br />

increased.<br />

However, developments in the coming months will<br />

still be key for the timing of the hike. With policy rates<br />

generally expected to remain low for some time in<br />

the main advanced economies, the Norges Bank will<br />

not want to deviate too much from other advanced<br />

country central banks in terms of policy rates.<br />

Appreciation of the domestic currency due to higher<br />

rate differentials would not be welcomed by the<br />

Norges Bank. Since end-November, the importweighted<br />

NOK has appreciated by around 3%.<br />

Developments since the start of the year suggest the<br />

appreciation in January will also surprise the Norges<br />

Bank to the upside. As a stronger currency would<br />

bring downside risks to inflation and hurt export<br />

industries, the Norges Bank will probably wait to<br />

deliver a rate hike if the currency continues to<br />

appreciate in the coming months.<br />

Source: Reuters EcoWin Pro<br />

On the other hand, high house prices, robust credit<br />

growth and the increase in household spending are<br />

other issues the Norges Bank will be looking at. As<br />

these had been mentioned in the previous policy<br />

statement, the Norges Bank will likely remain<br />

cautious about the risk of financial imbalances<br />

building up in the economy.<br />

Overall, if we do not see a significant appreciation in<br />

the currency, economic data continue to surprise to<br />

the upside relative to the Norges Bank’s forecasts<br />

and house prices increase markedly, the Bank is<br />

likely to deliver a rate hike in Q1. But if the krone<br />

appreciates significantly and still-acute tensions in<br />

financial markets intensify, the Bank will wait until Q2<br />

to strike.<br />

Gizem Kara 20 January 2011<br />

<strong>Market</strong> Mover<br />

26<br />

www.Global<strong>Market</strong>s.bnpparibas.com