Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

this juncture, we believe that looking at the FMCI<br />

rather than just at interest rates has become more<br />

important.<br />

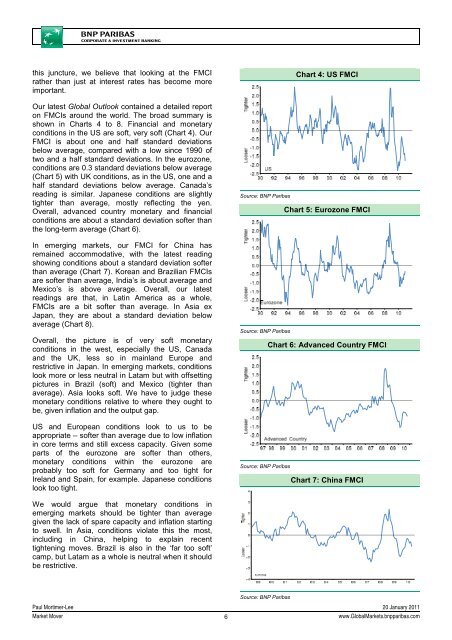

Our latest Global Outlook contained a detailed report<br />

on FMCIs around the world. The broad summary is<br />

shown in Charts 4 to 8. Financial and monetary<br />

conditions in the US are soft, very soft (Chart 4). Our<br />

FMCI is about one and half standard deviations<br />

below average, compared with a low since 1990 of<br />

two and a half standard deviations. In the eurozone,<br />

conditions are 0.3 standard deviations below average<br />

(Chart 5) with UK conditions, as in the US, one and a<br />

half standard deviations below average. Canada’s<br />

reading is similar. Japanese conditions are slightly<br />

tighter than average, mostly reflecting the yen.<br />

Overall, advanced country monetary and financial<br />

conditions are about a standard deviation softer than<br />

the long-term average (Chart 6).<br />

In emerging markets, our FMCI for China has<br />

remained accommodative, with the latest reading<br />

showing conditions about a standard deviation softer<br />

than average (Chart 7). Korean and Brazilian FMCIs<br />

are softer than average, India’s is about average and<br />

Mexico’s is above average. Overall, our latest<br />

readings are that, in Latin America as a whole,<br />

FMCIs are a bit softer than average. In Asia ex<br />

Japan, they are about a standard deviation below<br />

average (Chart 8).<br />

Overall, the picture is of very soft monetary<br />

conditions in the west, especially the US, Canada<br />

and the UK, less so in mainland Europe and<br />

restrictive in Japan. In emerging markets, conditions<br />

look more or less neutral in Latam but with offsetting<br />

pictures in Brazil (soft) and Mexico (tighter than<br />

average). Asia looks soft. We have to judge these<br />

monetary conditions relative to where they ought to<br />

be, given inflation and the output gap.<br />

US and European conditions look to us to be<br />

appropriate – softer than average due to low inflation<br />

in core terms and still excess capacity. Given some<br />

parts of the eurozone are softer than others,<br />

monetary conditions within the eurozone are<br />

probably too soft for Germany and too tight for<br />

Ireland and Spain, for example. Japanese conditions<br />

look too tight.<br />

Source: <strong>BNP</strong> Paribas<br />

Source: <strong>BNP</strong> Paribas<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 4: US FMCI<br />

Chart 5: Eurozone FMCI<br />

Chart 6: Advanced Country FMCI<br />

Chart 7: China FMCI<br />

We would argue that monetary conditions in<br />

emerging markets should be tighter than average<br />

given the lack of spare capacity and inflation starting<br />

to swell. In Asia, conditions violate this the most,<br />

including in China, helping to explain recent<br />

tightening moves. Brazil is also in the ‘far too soft’<br />

camp, but Latam as a whole is neutral when it should<br />

be restrictive.<br />

Source: <strong>BNP</strong> Paribas<br />

Paul Mortimer-Lee 20 January 2011<br />

<strong>Market</strong> Mover<br />

6<br />

www.Global<strong>Market</strong>s.bnpparibas.com