Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ECB Inflation Performance: A Review<br />

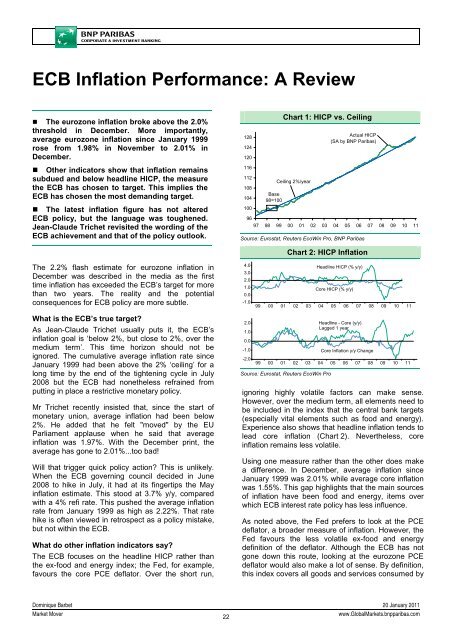

• The eurozone inflation broke above the 2.0%<br />

threshold in December. More importantly,<br />

average eurozone inflation since January 1999<br />

rose from 1.98% in November to 2.01% in<br />

December.<br />

• Other indicators show that inflation remains<br />

subdued and below headline HICP, the measure<br />

the ECB has chosen to target. This implies the<br />

ECB has chosen the most demanding target.<br />

• The latest inflation figure has not altered<br />

ECB policy, but the language was toughened.<br />

Jean-Claude Trichet revisited the wording of the<br />

ECB achievement and that of the policy outlook.<br />

128<br />

124<br />

120<br />

116<br />

112<br />

108<br />

104<br />

100<br />

Base<br />

98=100<br />

Chart 1: HICP vs. Ceiling<br />

Ceiling 2%/year<br />

Actual HICP<br />

(SA by <strong>BNP</strong> Paribas)<br />

96<br />

97 98 99 00 01 02 03 04 05 06 07 08 09 10 11<br />

Source: Eurostat, Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 2: HICP Inflation<br />

The 2.2% flash estimate for eurozone inflation in<br />

December was described in the media as the first<br />

time inflation has exceeded the ECB’s target for more<br />

than two years. The reality and the potential<br />

consequences for ECB policy are more subtle.<br />

What is the ECB’s true target?<br />

As Jean-Claude Trichet usually puts it, the ECB’s<br />

inflation goal is ‘below 2%, but close to 2%, over the<br />

medium term’. This time horizon should not be<br />

ignored. The cumulative average inflation rate since<br />

January 1999 had been above the 2% ‘ceiling’ for a<br />

long time by the end of the tightening cycle in July<br />

2008 but the ECB had nonetheless refrained from<br />

putting in place a restrictive monetary policy.<br />

Mr Trichet recently insisted that, since the start of<br />

monetary union, average inflation had been below<br />

2%. He added that he felt "moved" by the EU<br />

Parliament applause when he said that average<br />

inflation was 1.97%. With the December print, the<br />

average has gone to 2.01%...too bad!<br />

Will that trigger quick policy action? This is unlikely.<br />

When the ECB governing council decided in June<br />

2008 to hike in July, it had at its fingertips the May<br />

inflation estimate. This stood at 3.7% y/y, compared<br />

with a 4% refi rate. This pushed the average inflation<br />

rate from January 1999 as high as 2.22%. That rate<br />

hike is often viewed in retrospect as a policy mistake,<br />

but not within the ECB.<br />

What do other inflation indicators say?<br />

The ECB focuses on the headline HICP rather than<br />

the ex-food and energy index; the Fed, for example,<br />

favours the core PCE deflator. Over the short run,<br />

4.0 Headline HICP (% y/y)<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

Core HICP (% y/y)<br />

99 00 01 02 03 04 05 06 07 08 09 10 11<br />

99 00 01 02 03 04 05 06 07 08 09 10 11<br />

Source: Eurostat, Reuters EcoWin Pro<br />

Headline - Core (y/y)<br />

Lagged 1 year<br />

Core Inflation y/y Change<br />

ignoring highly volatile factors can make sense.<br />

However, over the medium term, all elements need to<br />

be included in the index that the central bank targets<br />

(especially vital elements such as food and energy).<br />

Experience also shows that headline inflation tends to<br />

lead core inflation (Chart 2). Nevertheless, core<br />

inflation remains less volatile.<br />

Using one measure rather than the other does make<br />

a difference. In December, average inflation since<br />

January 1999 was 2.01% while average core inflation<br />

was 1.55%. This gap highlights that the main sources<br />

of inflation have been food and energy, items over<br />

which ECB interest rate policy has less influence.<br />

As noted above, the Fed prefers to look at the PCE<br />

deflator, a broader measure of inflation. However, the<br />

Fed favours the less volatile ex-food and energy<br />

definition of the deflator. Although the ECB has not<br />

gone down this route, looking at the eurozone PCE<br />

deflator would also make a lot of sense. By definition,<br />

this index covers all goods and services consumed by<br />

Dominique Barbet 20 January 2011<br />

<strong>Market</strong> Mover<br />

22<br />

www.Global<strong>Market</strong>s.bnpparibas.com