Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Orders from abroad (not part of the headline core<br />

figure) were down 17.8% in November, but this<br />

reflects negative payback for the 16.0% gain posted<br />

in October. When averaged out, the level for<br />

overseas orders in October-November is 9.1% higher<br />

than in Q3. While the large-lot orders posted in<br />

October make it hard to say with confidence that<br />

overseas demand is accelerating again, Asian<br />

demand for capital goods is likely to pick up given the<br />

recovery in global manufacturing. On this score, the<br />

latest data for machine tool orders show Asian<br />

demand, led by China, on the rise again.<br />

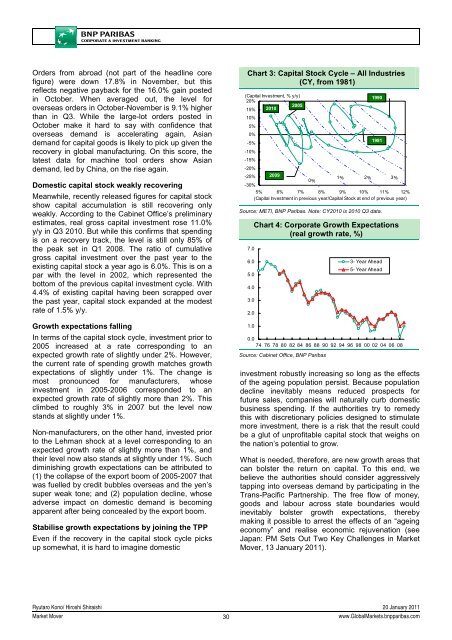

Domestic capital stock weakly recovering<br />

Meanwhile, recently released figures for capital stock<br />

show capital accumulation is still recovering only<br />

weakly. According to the Cabinet Office’s preliminary<br />

estimates, real gross capital investment rose 11.0%<br />

y/y in Q3 2010. But while this confirms that spending<br />

is on a recovery track, the level is still only 85% of<br />

the peak set in Q1 2008. The ratio of cumulative<br />

gross capital investment over the past year to the<br />

existing capital stock a year ago is 6.0%. This is on a<br />

par with the level in 2002, which represented the<br />

bottom of the previous capital investment cycle. With<br />

4.4% of existing capital having been scrapped over<br />

the past year, capital stock expanded at the modest<br />

rate of 1.5% y/y.<br />

Growth expectations falling<br />

In terms of the capital stock cycle, investment prior to<br />

2005 increased at a rate corresponding to an<br />

expected growth rate of slightly under 2%. However,<br />

the current rate of spending growth matches growth<br />

expectations of slightly under 1%. The change is<br />

most pronounced for manufacturers, whose<br />

investment in 2005-2006 corresponded to an<br />

expected growth rate of slightly more than 2%. This<br />

climbed to roughly 3% in 2007 but the level now<br />

stands at slightly under 1%.<br />

Non-manufacturers, on the other hand, invested prior<br />

to the Lehman shock at a level corresponding to an<br />

expected growth rate of slightly more than 1%, and<br />

their level now also stands at slightly under 1%. Such<br />

diminishing growth expectations can be attributed to<br />

(1) the collapse of the export boom of 2005-2007 that<br />

was fuelled by credit bubbles overseas and the yen’s<br />

super weak tone; and (2) population decline, whose<br />

adverse impact on domestic demand is becoming<br />

apparent after being concealed by the export boom.<br />

Stabilise growth expectations by joining the TPP<br />

Even if the recovery in the capital stock cycle picks<br />

up somewhat, it is hard to imagine domestic<br />

Chart 3: Capital Stock Cycle – All Industries<br />

(CY, from 1981)<br />

(Capital Investment, % y/y)<br />

20%<br />

1990<br />

15% 2010<br />

2005<br />

10%<br />

5%<br />

0%<br />

-5%<br />

1981<br />

-10%<br />

-15%<br />

-20%<br />

-25% 2009<br />

0<br />

1 2 3<br />

-30%<br />

5% 6% 7% 8% 9% 10% 11% 12%<br />

(Capital Investment in previous year/Capital Stock at end of previous year)<br />

Source: METI, <strong>BNP</strong> Paribas. Note: CY2010 is 2010 Q3 data.<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

Chart 4: Corporate Growth Expectations<br />

(real growth rate, %)<br />

0.0<br />

74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08<br />

Source: Cabinet Office, <strong>BNP</strong> Paribas<br />

3- Year Ahead<br />

5- Year Ahead<br />

investment robustly increasing so long as the effects<br />

of the ageing population persist. Because population<br />

decline inevitably means reduced prospects for<br />

future sales, companies will naturally curb domestic<br />

business spending. If the authorities try to remedy<br />

this with discretionary policies designed to stimulate<br />

more investment, there is a risk that the result could<br />

be a glut of unprofitable capital stock that weighs on<br />

the nation’s potential to grow.<br />

What is needed, therefore, are new growth areas that<br />

can bolster the return on capital. To this end, we<br />

believe the authorities should consider aggressively<br />

tapping into overseas demand by participating in the<br />

Trans-Pacific Partnership. The free flow of money,<br />

goods and labour across state boundaries would<br />

inevitably bolster growth expectations, thereby<br />

making it possible to arrest the effects of an “ageing<br />

economy” and realise economic rejuvenation (see<br />

Japan: PM Sets Out Two Key Challenges in <strong>Market</strong><br />

Mover, 13 January 2011).<br />

Ryutaro Kono/ Hiroshi Shiraishi 20 January 2011<br />

<strong>Market</strong> Mover<br />

30<br />

www.Global<strong>Market</strong>s.bnpparibas.com