deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

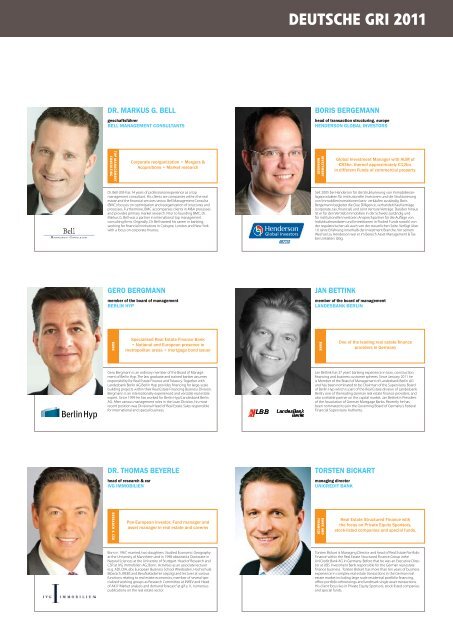

Dr. Markus g. bell<br />

geschaftsführer<br />

bell ManageMent cOnsultants<br />

shekar.narasimhan@beekmanhelixindia.com<br />

TOP MANAGEMENT<br />

CONSUlTING<br />

Corporate reorganization • Mergers &<br />

Acquisitions • Market research<br />

Dr. Bell (39) has 14 years of professional experience as a top<br />

management consultant. His clients are companies within the real<br />

estate and the financial services sector. Bell Management Consulta<br />

(BMC) focuses on optimization and reorganization of structures and<br />

processes. Furthermore, BMC accompanies clients in M&A processes<br />

and provides primary market research. Prior to founding BMC, Dr.<br />

Markus G. Bell was a partner in international top management<br />

consulting firms. Originally, Dr. Bell started his career in banking,<br />

working for financial institutions in Cologne, London and New York<br />

with a focus on corporate finance.<br />

gerO bergMann<br />

member of the board of management<br />

berlin hyP<br />

shekar.narasimhan@beekmanhelixindia.com<br />

BANK<br />

Specialised <strong>Real</strong> <strong>Estate</strong> Finance Bank<br />

• National and European presence in<br />

metropolitan areas • mortgage bond issuer<br />

Gero Bergmann is an ordinary member of the Board of Management<br />

of Berlin Hyp. The law graduate and trained banker assumes<br />

responsibility for <strong>Real</strong> <strong>Estate</strong> Finance and Treasury. Together with<br />

Landesbank Berlin AG Berlin Hyp provides financing for large-scale<br />

building projects within their <strong>Real</strong> <strong>Estate</strong> Financing Business Division.<br />

Bergmann is an internationally experienced and versatile real estate<br />

expert. Since 1999 he has worked for Berlin Hyp/Landesbank Berlin<br />

AG. After various management roles in the Loan Division, his most<br />

recent position was Divisional Head of <strong>Real</strong> <strong>Estate</strong> Sales responsible<br />

for international and special business.<br />

Dr. thOMas beyerle<br />

head of research & csr<br />

ivg iMMObilien<br />

shekar.narasimhan@beekmanhelixindia.com<br />

RESEARCH & CSR<br />

Pan-European investor, Fund manager and<br />

asset manager in real estate and caverns<br />

Born in 1967, married, two daughters. Studied Economic Geography<br />

at the University of Mannheim and in 1998 obtained a Doctorate in<br />

Natural Sciences at the University of Stuttgart. Head of Research and<br />

CSR at IVG Immobilien AG, Bonn. Activities as an associate lecturer<br />

(e.g. ADI, DIA, ebs European Business School Wiesbaden, Hochschule<br />

Biberach, IREBS and Berufsakademie Leipzig) and lecturer at various<br />

functions relating to real estate economics, member of several specialized<br />

working groups as Research Committee at INREV and Head<br />

of AK II “Market analysis and demand forecast” at gif e. V., numerous<br />

publications on the real estate sector.<br />

DEUTSCHE GRI <strong>2011</strong><br />

bOris bergeMann<br />

head of transaction structuring, europe<br />

henDersOn glObal investOrs<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTMENT<br />

MANAGER<br />

<strong>Global</strong> Investment Manager with AUM of<br />

€83bn. thereof approximately €12bn.<br />

in different Funds of commercial property.<br />

Seit 2005 bei Henderson für die Strukturierung von Immobilienanlageprodukten<br />

für institutionelle Investoren und die Strukturierung<br />

von Immobilieninvestitionen bzw- verkäufen zuständig. Boris<br />

Bergemann begleitet die Due Dilligence, verhandelt Kaufverträge<br />

(corporate, tax, financial) und Joint Venture Verträge. Darüber hinaus<br />

ist er für den Vertrieb Immobilien in der Schweiz zuständig und<br />

für institutionelle Investoren Ansprechpartner für die Auflage von<br />

Individualmandaten und Investitionen in Pooled Funds sowohl von<br />

der regulatorischen als auch von der steuerlichen Seite. Verfügt über<br />

10 Jahre Erfahrung innerhalb der Investment Branche. Vor seinem<br />

Wechsel zu Henderson war er im Bereich Asset Management & Tax<br />

bei Linklaters tätig.<br />

Jan bettink<br />

member of the board of management<br />

lanDesbank berlin<br />

shekar.narasimhan@beekmanhelixindia.com<br />

BANK<br />

One of the leading real estate finance<br />

providers in Germany<br />

Jan Bettink has 37 years’ banking experience in loan, construction<br />

financing and business customer spheres. Since January <strong>2011</strong> he<br />

is Member of the Board of Management of Landesbank Berlin AG<br />

and has been nominated to be Chairman of the Supervisory Board<br />

of Berlin Hyp which is part of the <strong>Real</strong> <strong>Estate</strong> division of Landesbank<br />

Berlin, one of the leading German real estate finance providers, and<br />

also a reliable partner on the capital market. Jan Bettink is President<br />

of the Association of German Mortgage Banks. Recently he has<br />

been nominated to join the Governing Board of Germany’s Federal<br />

Financial Supervisory Authority.<br />

tOrsten bickart<br />

managing director<br />

unicreDit bank<br />

shekar.narasimhan@beekmanhelixindia.com<br />

BANK AND<br />

FINANCER<br />

<strong>Real</strong> <strong>Estate</strong> Structured Finance with<br />

the focus on Private Equity Sponsors,<br />

stock-listed companies and special funds.<br />

Torsten Bickart is Managing Director and head of <strong>Real</strong> <strong>Estate</strong> Portfolio<br />

Finance within the <strong>Real</strong> <strong>Estate</strong> Structured Finance Group inthe<br />

UniCredit Bank AG in Germany. Before that he was an Executive Director<br />

at UBS Investment Bank responsible for the German real estate<br />

finance business. Torsten Bickart has more than ten years of business<br />

experience in complex real estate transactions in the German real<br />

estate market including large scale residential portfolio financing,<br />

office portfolio refinancings and landmark single asset transactions.<br />

His client focus lies in Private Equity Sponsors, stock-listed companies<br />

and special funds.