deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

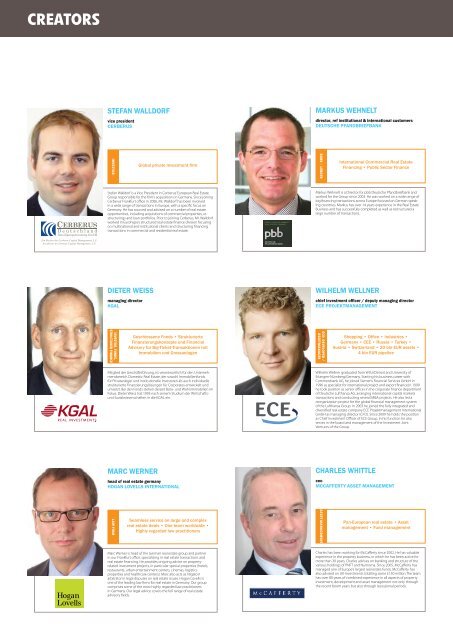

CREATORS<br />

steFan wallDOrF<br />

vice president<br />

cerberus<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR<br />

Dieter weiss<br />

managing director<br />

kgal<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR, FUNDS,<br />

STRUCTURED FINANCE<br />

Geschlossene Fonds • Strukturierte<br />

Finanzierungskonzepte und Financial<br />

Advisory für Big-Ticket-Transaktionen mit<br />

Immobilien und Grossanlagen<br />

Mitglied der Geschäftsführung, ist verantwortlich für den Unternehmensbereich<br />

Domestic <strong>Real</strong> <strong>Estate</strong>, der sowohl Immobilienfonds<br />

für Privatanleger und institutionelle Investoren als auch individuelle<br />

strukturierte Finanzierungslösungen für Corporates entwickelt und<br />

umsetzt. Bei den Fonds stehen derzeit Büro- und Wohnimmobilien im<br />

Fokus. Dieter Weiss trat 1993 nach seinem Studium der Wirtschafts-<br />

und Sozialwissenschaften in die KGAL ein.<br />

Marc werner<br />

head of real estate germany<br />

hOgan lOvells internatiOnal<br />

shekar.narasimhan@beekmanhelixindia.com<br />

lAW FIRM<br />

<strong>Global</strong> private investment firm<br />

Stefan Walldorf is a Vice President in Cerberus’ European <strong>Real</strong> <strong>Estate</strong><br />

Group responsible for the firm’s acquisitions in Germany. Since joining<br />

Cerberus’ Frankfurt office in 2006, Mr. Walldorf has been involved<br />

in a wide range of transactions in Europe, with a specific focus on<br />

Germany. He has sourced and advised on a number of real estate<br />

opportunities, including acquisitions of commercial properties, restructurings<br />

and loan portfolios. Prior to joining Cerberus, Mr. Walldorf<br />

worked in Eurohypo’s structured real estate finance division focusing<br />

on multinational and institutional clients and structuring financing<br />

transactions in commercial and residential real estate.<br />

Seamless service on large and complex<br />

real estate deals • One team worldwide •<br />

Highly regarded law practitioners<br />

Marc Werner is head of the German real estate group and partner<br />

in our Frankfurt office, specializing in real estate transactions and<br />

real estate financing. He provides ongoing advice on propertyrelated<br />

investment projects, in particular special properties (hotels,<br />

restaurants, urban entertainment centers, cinemas, logistics<br />

properties and healthcare centers). Marc also acts as litigator/<br />

arbitrator in legal disputes on real estate issues. Hogan Lovells is<br />

one of the leading law firms for real estate in Germany. Our group<br />

comprises some of the most highly regarded law practitioners<br />

in Germany. Our legal advice covers the full range of real estate<br />

advisory fields.<br />

Markus wehnelt<br />

director, ref institutional & international customers<br />

Deutsche PFanDbrieFbank<br />

shekar.narasimhan@beekmanhelixindia.com<br />

BANK - lENDER<br />

International Commercial <strong>Real</strong> <strong>Estate</strong><br />

Financing • Public Sector Finance<br />

Markus Wehnelt is a Director for pbb Deutsche Pfandbriefbank and<br />

worked for the Group since 2003. He was worked on a wide range of<br />

big financing transactions across Europe focused on German speaking<br />

countries. Markus has over 14 years experience in the <strong>Real</strong> <strong>Estate</strong><br />

Business and has successfully completed as well as restructured a<br />

large number of transactions.<br />

wilhelM wellner<br />

chief investment officer / deputy managing director<br />

ece PrOJektManageMent<br />

shekar.narasimhan@beekmanhelixindia.com<br />

ECE: DEvElOPER /<br />

ASSETMANAGER<br />

Shopping • Office • Industries •<br />

Germany • CEE • Russia • Turkey •<br />

Austria • Switzerland • 20 bln EUR assets •<br />

4 bln EUR pipeline<br />

Wilhelm Wellner graduated from WSU/Detroit and University of<br />

Erlangen-Nürnberg/Germany. Starting his business career with<br />

Commerzbank AG, he joined Siemens Financial Services GmbH in<br />

1996 as specialist for international project and export finance.In 1999<br />

he took position as senior officer in the corporate finance department<br />

of Deutsche Lufthansa AG, arranging international capital markets<br />

transactions and conducting several M&A projects. He also led a<br />

reorganization project for the global financial management system<br />

of the Lufthansa Group. In 2003 he joined the fully integrated and<br />

diversified real estate company ECE Projektmanagement International<br />

GmbH as managing director (CFO). Since 2009 he holds the position<br />

as Chief Investment Officer of ECE Group. In his function he also<br />

serves in the board and management of the Investment Joint<br />

Ventures of the Group.<br />

charles whittle<br />

ceo<br />

MccaFFerty asset ManageMent<br />

shekar.narasimhan@beekmanhelixindia.com<br />

ASSET MANAGEMENT<br />

Pan-European real estate • Asset<br />

management • Fund management<br />

Charles has been working for McCafferty since 2002. He has valuable<br />

experience in the property business, in which he has been active for<br />

more than 30 years. Charles advises on banking and structure of the<br />

various holdings of PNFT and Numisma. Since 2005, McCafferty has<br />

managed one of Europe’s largest real estate funds. McCafferty has<br />

also advised on UK investments totalling some £150 million.The team<br />

has over 80 years of combined experience in all aspects of property<br />

investment, development and asset management not only through<br />

the recent boom years but also through recessional periods.