deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

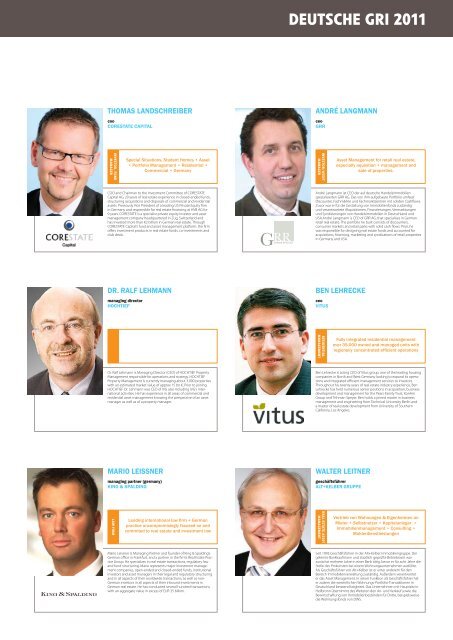

thOMas lanDschreiber<br />

coo<br />

cOrestate caPital<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR, FUND<br />

MANAGER<br />

Special Situations, Student Homes • Asset<br />

• Portfolio Management • Residential •<br />

Commercial • Germany<br />

COO and Chairman to the Investment Committee of CORESTATE<br />

Capital AG. 20 years of real estate experience in closed-ended funds,<br />

structuring acquisitions and disposals of commercial and residential<br />

assets. Previously Vice President of a leading US Private Equity firm<br />

in Germany and responsible for real estate financing at HVB AG for<br />

9 years. CORESTATE is a specialist private equity investor and asset<br />

management company headquartered in Zug, Switzerland and<br />

has invested more than €2 billion in German real estate. Through<br />

CORESTATE Capital’s fund and asset management platform, the firm<br />

offers investment products in real estate funds, co-investments and<br />

club deals.<br />

Dr. ralF lehMann<br />

managing director<br />

hOchtieF<br />

shekar.narasimhan@beekmanhelixindia.com<br />

Dr. Ralf Lehmann is Managing Director (CEO) of HOCHTIEF Property<br />

Management responsible for operations and strategy. HOCHTIEF<br />

Property Management is currently managing about 3.000 properties<br />

with an estimated market value of approx 15 bn €. Prior to joining<br />

HOCHTIEF Dr. Lehmann was CEO of IVG also including IVG’s international<br />

activities. He has experience in all areas of commercial and<br />

residential asset management knowing the perspective of an asset<br />

manager as well as of a property manager.<br />

MariO leissner<br />

managing partner (germany)<br />

king & sPalDing<br />

shekar.narasimhan@beekmanhelixindia.com<br />

lAW FIRM<br />

Leading international law firm + German<br />

practice uncompromisingly focused on and<br />

commited to real estate and investment law<br />

Mario Leissner is Managing Partner and founder of King & Spalding’s<br />

German office in Frankfurt, and a partner in the firm’s <strong>Real</strong> <strong>Estate</strong> Practice<br />

Group. He specializes in real estate transactions, regulatory law<br />

and fund structuring. Mario represents major investment management<br />

companies, open-ended and closed-ended funds, institutional<br />

investors and asset managers in their legal and regulatory structuring<br />

and in all aspects of their worldwide transactions, as well as non-<br />

German investors in all aspects of their inbound investments in<br />

German real estate. He has conducted several hundred transactions<br />

with an aggregate value in excess of EUR 35 billion.<br />

GERMAN RETAIL REIT<br />

DEUTSCHE GRI <strong>2011</strong><br />

anDré langMann<br />

ceo<br />

grr<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR/ASSET<br />

MANAGER<br />

Asset Management for retail real estate,<br />

especially aquisition • management and<br />

sale of properties.<br />

André Langmann ist CEO der auf <strong>deutsche</strong> Handelsimmobilien<br />

spezialisierten GRR AG. Das von ihm aufgebaute Portfolio umfasst<br />

Discounter, Fachmärkte und Fachmarktzentren mit soliden Cashflows.<br />

Zuvor war er für die Gestaltung von Immobilienfonds zuständig<br />

und verantwortete Akquisitionen, Finanzierungen, Vermarktungen<br />

und Syndizierungen von Handelsimmobilien in Deutschland und<br />

USA.André Langmann is CEO of GRR AG, that specialises in German<br />

retail real estate. The portfolio he built consists of discounters,<br />

consumer markets and retail parks with solid cash flows. Prior, he<br />

was responsible for designing real estate funds and accounted for<br />

acquisitions, financing, marketing and syndications of retail properties<br />

in Germany and USA.<br />

ben lehrecke<br />

ceo<br />

vitus<br />

shekar.narasimhan@beekmanhelixindia.com<br />

RESIDENTIAl<br />

MANAGEMENT<br />

Fully integrated residential management<br />

over 35,000 owned and managed units with<br />

regionally concentrated efficient operations<br />

Ben Lehrecke is acting CEO of Vitus group, one of the leading housing<br />

companies in North and West Germany looking to expand its operations<br />

and integrated efficient management services to investors.<br />

Throughout his twenty years of real estate industry experience, Ben<br />

Lehrecke has held numerous senior positions in acquisition, business<br />

development and management for the Pears Family Trust, KanAm<br />

Group and Tishman Speyer. Ben holds a joined master in business<br />

management and engineering from Technical University Berlin and<br />

a master of real estate development from University of Southern<br />

California, Los Angeles.<br />

walter leitner<br />

geschäftsführer<br />

alt+kelber gruPPe<br />

shekar.narasimhan@beekmanhelixindia.com<br />

REAl ESTATE ASSET<br />

MANAGEMENT<br />

Vertrieb von Wohnungen & Eigenheimen an<br />

Mieter • Selbstnutzer • Kapitalanleger •<br />

Immobilienmanagement • Consulting •<br />

Maklerdienstleistungen<br />

Seit 1993 Geschäftsführer in der Alt+Kelber Immobiliengruppe. Der<br />

gelernte Bankkaufmann und staatlich geprüfte Betriebswirt war<br />

zunächst mehrere Jahre in einer Bank tätig, bevor er für acht Jahre die<br />

Stelle des Prokuristen bei einem Wohnungsunternehmen ausfüllte.<br />

Als Geschäftsführer von Alt+Kelber ist er unter anderem für den<br />

Bereich Immobilienverwaltung zuständig. Außerdem verantwortet<br />

er das Asset Management. In seiner Funktion als Geschäftsführer hat<br />

er zudem die wesentlichen Wohnungs-Portfolio-Transaktionen in<br />

Deutschland beratend begleitet. Das Unternehmen mit Hauptsitz in<br />

Heilbronn übernimmt des Weiteren den An- und Verkauf sowie die<br />

Bewirtschaftung von Immobilienbeständen für Dritte, beispielsweise<br />

die Wohnungsfonds von DWS.