deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CREATORS<br />

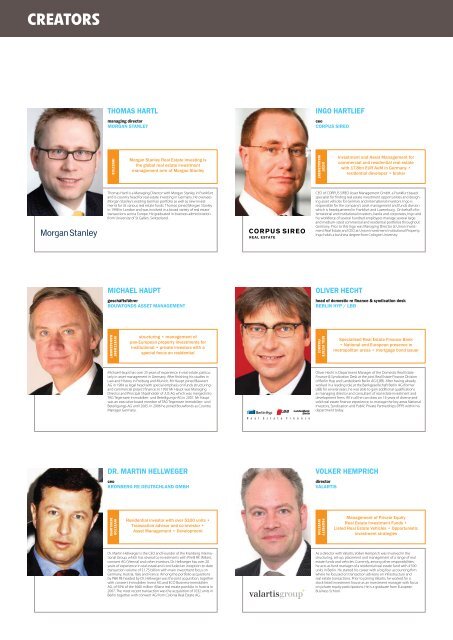

thOMas hartl<br />

managing director<br />

MOrgan stanley<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR<br />

Morgan Stanley <strong>Real</strong> <strong>Estate</strong> Investing is<br />

the global real estate investment<br />

management arm of Morgan Stanley<br />

Thomas Hartl is a Managing Director with Morgan Stanley in Frankfurt<br />

and is country head for real estate investing in Germany. He oversees<br />

Morgan Stanley’s existing German portfolio as well as new investments<br />

for its various real estate funds. Thomas joined Morgan Stanley<br />

in 1998 in London and was involved in a broad variety of real estate<br />

transactions across Europe. He graduated in business administration<br />

from University of St Gallen, Switzerland.<br />

Michael hauPt<br />

geschäftsführer<br />

bOuwFOnDs asset ManageMent<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTMENT<br />

MANAGEMENT<br />

structuring • management of<br />

pan-European property investments for<br />

institutional • private investors with a<br />

special focus on residential<br />

Michael Haupt has over 25 years of experience in real estate, particularly<br />

in asset management in Germany. After finishing his studies in<br />

Law and History in Freiburg and Munich, Mr Haupt joined Bauwert<br />

AG in 1984 as legal head with special emphasis on funds structuring<br />

and commercial project finance. In 1992 Mr Haupt was Managing<br />

Director and Principal Shareholder of JUS AG which was merged into<br />

TAG Tegernsee Immobilien- und Beteiligungs-AG in 2001. Mr Haupt<br />

was an executive board member of TAG Tegernsee Immobilien- und<br />

Beteiligungs-AG until 2005. In 2006 he joined Bouwfonds as Country<br />

Manager Germany.<br />

Dr. Martin hellweger<br />

ceo<br />

krOnberg re DeutschlanD gMbh<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR<br />

DEvElOPER<br />

Residential investor with over 5100 units •<br />

Transaction advisor and co-investor •<br />

Asset Management • Development<br />

Dr. Martin Hellweger is the CEO and Founder of the Kronberg International<br />

Group, which has several co-investments with Pirelli RE (Milan),<br />

conwert AG (Vienna) and other investors. Dr. Hellweger has over 20<br />

years of experience in real estate and concluded an inception-to-date<br />

transaction volume of $1.75 billion with main investment focus on<br />

Germany, Austria, Italy and France. Among the portfolio acquisitions<br />

by P&K RE headed by Dr. Hellweger was the joint acquisition, together<br />

with conwert Immobilien Invest AG and ECO Business-Immobilien<br />

AG, of 50% of the $660 million Allianz real estate portfolio in Austria in<br />

2007. The most recent transaction was the acquisition of 1032 units in<br />

Berlin together with conwert AG from Colonia <strong>Real</strong> <strong>Estate</strong> AG.<br />

ingO hartlieF<br />

ceo<br />

cOrPus sireO<br />

shekar.narasimhan@beekmanhelixindia.com<br />

ASSET<br />

MANAGEMENT<br />

Investment and Asset Management for<br />

commercial and residential real estate<br />

with 17.8bn EUR AuM in Germany •<br />

residential developer • broker<br />

CEO of CORPUS SIREO Asset Management GmbH, a Frankfurt based<br />

specialist for finding real estate investment opportunities and designing<br />

asset vehicles for German and international investors. Ingo is<br />

responsible for the company’s asset management and funds division<br />

which is headquartered in Frankfurt and Luxemburg . On behalf of international<br />

and institutional investors, banks and corporates, Ingo and<br />

his workforce of several hundred employees manage several large<br />

and medium-sized commercial and residential portfolios throughout<br />

Germany. Prior to this Ingo was Managing Director at Union Investment<br />

<strong>Real</strong> <strong>Estate</strong> and CEO at Union Investment Institutional Property.<br />

Ingo holds a business degree from Cologne University<br />

Oliver hecht<br />

head of domestic re finance & syndication desk<br />

berlin hyP / lbb<br />

shekar.narasimhan@beekmanhelixindia.com<br />

REAl ESTATE<br />

FINANCE<br />

Specialised <strong>Real</strong> <strong>Estate</strong> Finance Bank<br />

• National and European presence in<br />

metropolitan areas • mortgage bond issuer<br />

Oliver Hecht is Department Manager of the Domestic <strong>Real</strong> <strong>Estate</strong><br />

Finance & Syndication Desk at the joint <strong>Real</strong> <strong>Estate</strong> Finance Division<br />

of Berlin Hyp and Landesbank Berlin AG (LBB). After having already<br />

worked in a leading role at the Bankgesellschaft Berlin AG (former<br />

LBB) for several years, he was able to gain additional qualifications<br />

as managing director and consultant of real estate investment and<br />

development firms. All in all he can draw on 16 years of diverse and<br />

solid real estate finance experience, to manage the key areas National<br />

Investors, Syndication and Public Private Partnerships (PPP) within his<br />

department today.<br />

vOlker heMPrich<br />

director<br />

valartis<br />

shekar.narasimhan@beekmanhelixindia.com<br />

PROPERTY<br />

INvESTOR<br />

Management of Private Equity<br />

<strong>Real</strong> <strong>Estate</strong> Investment Funds •<br />

Listed <strong>Real</strong> <strong>Estate</strong> Vehicles • Opportunistic<br />

investment strategies<br />

As a director with Valartis, Volker Hemprich was involved in the<br />

structuring, set-up, placement and management of a range of real<br />

estate funds and vehicles. Currently, among other responsibilities,<br />

he acts as fund manager of a residential real estate fund with 4’500<br />

units in Berlin. He started his career with a big four accounting firm<br />

where he focused on transaction advisory on infrastructure and<br />

real estate transactions. Prior to joining Valartis, he worked for a<br />

stock listed investment house as an investment manager with focus<br />

on private equity participations. He is a graduate from European<br />

Business School.