deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

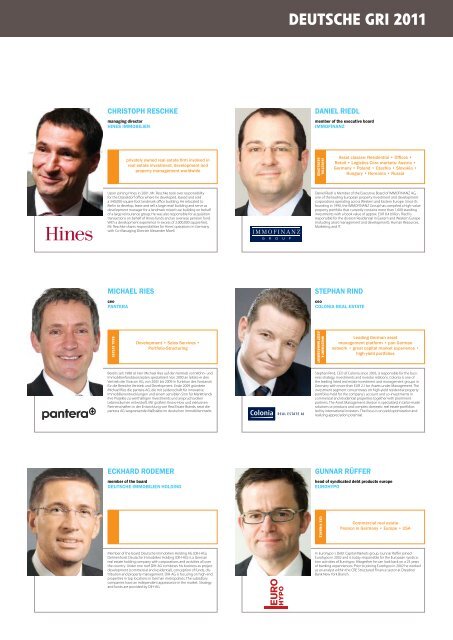

christOPh reschke<br />

managing director<br />

hines iMMObilien<br />

shekar.narasimhan@beekmanhelixindia.com<br />

privately owned real estate firm involved in<br />

real estate investment, development and<br />

property management worldwide<br />

Upon joining Hines in 2001, Mr. Reschke took over responsibility<br />

for the Düsseldorf office where he developed, leased and sold<br />

a 340,000-square-foot landmark office building. He relocated to<br />

Berlin to develop, lease and sell a large retail building and serve as<br />

development manager for a landmark mixed-use building on behalf<br />

of a large reinsurance group. He was also responsible for acquisition<br />

transactions on behalf of Hines funds and an overseas pension fund.<br />

With a development experience in excess of 2,000,000 square feet,<br />

Mr. Reschke shares responsibilities for Hines’ operations in Germany<br />

with Co-Managing Director Alexander Moell.<br />

Michael ries<br />

ceo<br />

Pantera<br />

shekar.narasimhan@beekmanhelixindia.com<br />

REAl ESTATE<br />

Development • Sales Services •<br />

Portfolio-Structuring<br />

Bereits seit 1988 ist Herr Michael Ries auf den Vertrieb von Wohn- und<br />

Immobilienfondskonzepten spezialisiert. Von 2000 an leitete er den<br />

Vertrieb der Vivacon AG, von 2005 bis 2009 in Funktion des Vorstands<br />

für die Bereiche Vertrieb und Development. Ende 2009 gründete<br />

Michael Ries die pantera AG, die mit Leidenschaft für innovative<br />

Immobilienentwicklungen und einem sensiblen Sinn für Markttrends<br />

ihre Projekte zu werthaltigen Investments und anspruchsvollen<br />

Lebensräumen entwickelt. Mit großem Know-How und exklusiven<br />

Partnerschaften in der Entwicklung von <strong>Real</strong> <strong>Estate</strong> Brands, setzt die<br />

pantera AG wegweisende Maßstäbe im <strong>deutsche</strong>n Immobilienmarkt.<br />

eckharD rODeMer<br />

member of the board<br />

Deutsche iMMObilien hOlDing<br />

shekar.narasimhan@beekmanhelixindia.com<br />

Member of the board Deutsche Immobilien Holding AG (DIH-AG),<br />

Delmenhorst Deutsche Immobilien Holding (DIH-AG) is a German<br />

real estate holding company with corporations and activities all over<br />

the country. Under one roof DIH-AG combines his business as project<br />

development (commercial and residential), conception of funds, distribution<br />

and property management. DIH-AG is focusing on high-end<br />

properties in top locations in German metropolises. The subsidiary<br />

companies have an independent appearance in the market. Strategy<br />

and funds are provided by DIH-AG.<br />

DEUTSCHE GRI <strong>2011</strong><br />

Daniel rieDl<br />

member of the executive board<br />

iMMOFinanz<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR,<br />

DEvElOPER<br />

Asset classes: Residential • Offices •<br />

Retail • Logistics Core markets: Austria •<br />

Germany • Poland • Czechia • Slovakia •<br />

Hungary • Romania • Russia<br />

Daniel Riedl is Member of the Executive Board of IMMOFINANZ AG,<br />

one of the leading European property investment and development<br />

corporations operating across Western and Eastern Europe. Since its<br />

founding in 1990, the IMMOFINANZ Group has compiled a high-value<br />

property portfolio that currently contains more than 1,600 standing<br />

investments with a book value of approx. EUR 8.4 billion. Riedl is<br />

responsible for the division Residential in Eastern and Western Europe<br />

(including asset management and development), Human Resources,<br />

Marketing and IT.<br />

stePhan rinD<br />

ceo<br />

cOlOnia real estate<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTMENT &<br />

ASSET MANAGEMENT<br />

Leading German asset<br />

management platform • pan German<br />

network • great capital market experience •<br />

high-yield portfolios<br />

Stephan Rind, CEO of Colonia since 2003, is responsible for the business<br />

strategy, investments and investor relations. Colonia is one of<br />

the leading listed real estate investment and management groups in<br />

Germany with more than EUR 2.1 bn Assets under Management. The<br />

investment segment concentrates on high-yield residential property<br />

portfolios held for the company’s account and co-investments in<br />

commercial and residential properties together with prominent<br />

partners. The Asset Management division is specialized in tailor-made<br />

solutions or products and complex domestic real estate portfolios<br />

led by international investors. The focus is on yield optimization and<br />

realizing appreciation potential.<br />

gunnar rüFFer<br />

head of syndicated debt products europe<br />

eurOhyPO<br />

shekar.narasimhan@beekmanhelixindia.com<br />

CRE FINANCE<br />

Commercial real estate<br />

finance in Germany • Europe • USA<br />

In Eurohypo`s Debt Capital Markets group, Gunnar Rüffer joined<br />

Eurohypo in 2002 and is today responsible for the European syndication<br />

activities of Eurohypo. Altogether he can look back on a 25 years<br />

of banking expenriences. Prior to joining Eurohypo in 2002 he worked<br />

as an analyst within the CRE Structured Finance sector at Dresdner<br />

Bank New York Branch.