deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

deutsche gri 2011 - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

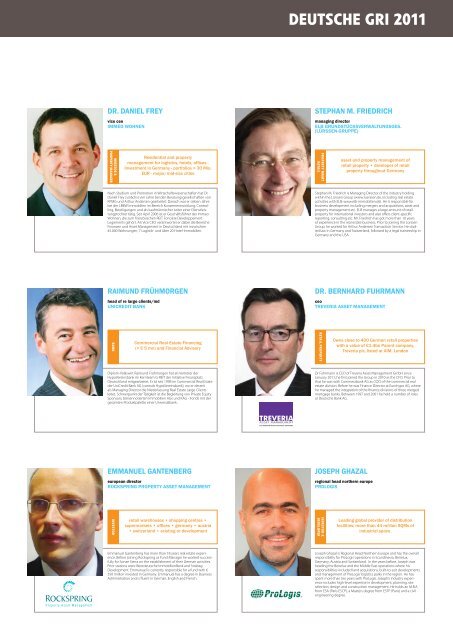

Dr. Daniel Frey<br />

vice ceo<br />

iMMeO wOhnen<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR &<br />

PROPERTY MANAGER<br />

Residential and property<br />

management for logistics, hotels, offices -<br />

Investment in Germany - portfolios > 30 Mio.<br />

EUR - major/mid-size cities<br />

Nach Studium und Promotion in Wirtschaftswissenschaften hat Dr.<br />

Daniel Frey zunächst vier Jahre bei den Beratungsgesellschaften von<br />

KPMG und Arthur Andersen gearbeitet. Danach war er sieben Jahre<br />

bei der LBBW Immobilien im Bereich Konzernentwicklung, Controlling,<br />

Beteiligungen und als kaufmännischer Leiter einer Dienstleistungstochter<br />

tätig. Seit April 2006 ist er Geschäftsführer der Immeo<br />

Wohnen, die zum französischen REIT Foncière Développement<br />

Logements gehört. Als Vice CEO verantwortet er dabei die Bereiche<br />

Finanzen und Asset Management in Deutschland mit inzwischen<br />

45.000 Wohnungen, 7 Logistik- und über 20 Hotel-Immobilien.<br />

raiMunD FrühMOrgen<br />

head of re large clients/md<br />

unicreDit bank<br />

shekar.narasimhan@beekmanhelixindia.com<br />

BANK<br />

Commercial <strong>Real</strong> <strong>Estate</strong> Financing<br />

(> € 5 mn) and Financial Advisory<br />

Diplom-Volkswirt Raimund Frühmorgen hat als Vertreter der<br />

HypoVereinsbank im Kernteam G-REIT der Initiative Finanzplatz<br />

Deutschland mitgearbeitet. Er ist seit 1998 im Commercial <strong>Real</strong> <strong>Estate</strong><br />

der UniCredit Bank AG (vormals HypoVereinsbank), wo er derzeit<br />

als Managing Director die Niederlassung <strong>Real</strong> <strong>Estate</strong> Large Clients<br />

leitet. Schwerpunkt der Tätigkeit ist die Begleitung von Private Equity<br />

Sponsors, börsennotierten Immobilien AGs und KAG - Fonds mit der<br />

gesamten Produktpalette einer Universalbank.<br />

eMManuel gantenberg<br />

european director<br />

rOcksPring PrOPerty asset ManageMent<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR<br />

retail warehouses • shopping centres •<br />

supermarkets • offices • germany • austria<br />

• switzerland • existing or development<br />

Emmanuel Gantenberg has more than 18 years real estate experience.<br />

Before joining Rockspring as Fund Manager he worked successfully<br />

for Sonae Sierra on the establishment of their German activities.<br />

Prior stations were West<strong>deutsche</strong> ImmobilienBank and Strabag<br />

Development. Emmanuel is currently responsible for a fund with €<br />

550 million invested in Germany. Emmanuel has a degree in Business<br />

Administration and is fluent in German, English and French.<br />

TREVERIA<br />

ASSET MANAGEMENT<br />

THE GERMAN RETAIL PROPERTY COMPANY<br />

DEUTSCHE GRI <strong>2011</strong><br />

stePhan M. FrieDrich<br />

managing director<br />

elb grunDstücksverwaltungsges.<br />

(lürssen-gruPPe)<br />

shekar.narasimhan@beekmanhelixindia.com<br />

PROPERTY MGMT<br />

RETAIl<br />

asset and property management of<br />

retail property • developer of retail<br />

property throughout Germany<br />

Stephan M. Friedrich is Managing Director of the industry holding<br />

within the Lürssen Group (www.luerssen.de, including real estate<br />

activities with ELB: www.elb-immobilien.de). He is responsible for<br />

business development including mergers and acquisitions, asset and<br />

property management etc. ELB manages a large amount of retail<br />

property for international investors and also offers client-specific<br />

reporting, consulting etc. Mr. Friedrich has got more than 10 years<br />

of experience in the real estate business. Prior to joining the Lürssen<br />

Group, he worked for Arthur Andersen Transaction Service. He studied<br />

law in Germany and Switzerland, followed by a legal traineeship in<br />

Germany and the USA.<br />

Dr. bernharD FuhrMann<br />

ceo<br />

treveria asset ManageMent<br />

shekar.narasimhan@beekmanhelixindia.com<br />

RETAIl PROPERTY<br />

Owns close to 400 German retail properties<br />

with a value of €1.4bn Parent company,<br />

Treveria plc, listed at AIM, London<br />

Dr Fuhrmann is CEO of Treveria Asset Management GmbH since<br />

January <strong>2011</strong>; he first joined the Group in 2010 as the CFO. Prior to<br />

that he was with Commerzbank AG as COO of the commercial real<br />

estate division. Before he was Finance Director at Eurohypo AG, where<br />

he managed the integration of the finance divisions of three merged<br />

mortgage banks. Between 1997 and 2001 he held a number of roles<br />

at Deutsche Bank AG.<br />

JOsePh ghazal<br />

regional head northern europe<br />

PrOlOgis<br />

shekar.narasimhan@beekmanhelixindia.com<br />

INvESTOR &<br />

DEvElOPER<br />

Leading global provider of distribution<br />

facilities; more than 44 million SQMs of<br />

industrial space.<br />

Joseph Ghazal is Regional Head Northern Europe and has the overall<br />

responsibility for ProLogis’ operations in Scandinavia, Benelux,<br />

Germany, Austria and Switzerland. In the years before, Joseph was<br />

heading the Benelux and the Middle East operations where his<br />

responsibilities included land acquisitions, built-to-suit developments<br />

and management of ProLogis’ logistics parks in the region. He has<br />

spent more than ten years with ProLogis. Joseph’s industry experience<br />

includes high-level expertise in development, planning, site<br />

selection, design and construction management. He holds an M.B.A<br />

from ESA (Paris ESCP), a Masters degree from ESTP (Paris) and a civil<br />

engineering degree.