Canadian Mining Industry Employment and Hiring Forecasts - MiHR

Canadian Mining Industry Employment and Hiring Forecasts - MiHR

Canadian Mining Industry Employment and Hiring Forecasts - MiHR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

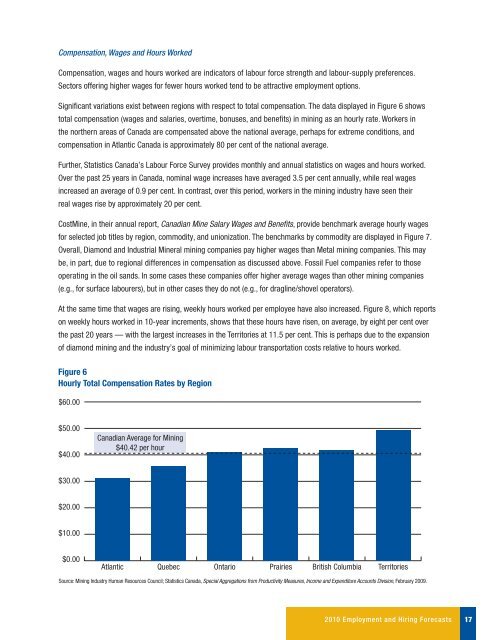

Compensation, Wages <strong>and</strong> Hours Worked<br />

Compensation, wages <strong>and</strong> hours worked are indicators of labour force strength <strong>and</strong> labour-supply preferences.<br />

Sectors offering higher wages for fewer hours worked tend to be attractive employment options.<br />

Significant variations exist between regions with respect to total compensation. The data displayed in Figure 6 shows<br />

total compensation (wages <strong>and</strong> salaries, overtime, bonuses, <strong>and</strong> benefits) in mining as an hourly rate. Workers in<br />

the northern areas of Canada are compensated above the national average, perhaps for extreme conditions, <strong>and</strong><br />

compensation in Atlantic Canada is approximately 80 per cent of the national average.<br />

Further, Statistics Canada’s Labour Force Survey provides monthly <strong>and</strong> annual statistics on wages <strong>and</strong> hours worked.<br />

Over the past 25 years in Canada, nominal wage increases have averaged 3.5 per cent annually, while real wages<br />

increased an average of 0.9 per cent. In contrast, over this period, workers in the mining industry have seen their<br />

real wages rise by approximately 20 per cent.<br />

CostMine, in their annual report, <strong>Canadian</strong> Mine Salary Wages <strong>and</strong> Benefits, provide benchmark average hourly wages<br />

for selected job titles by region, commodity, <strong>and</strong> unionization. The benchmarks by commodity are displayed in Figure 7.<br />

Overall, Diamond <strong>and</strong> Industrial Mineral mining companies pay higher wages than Metal mining companies. This may<br />

be, in part, due to regional differences in compensation as discussed above. Fossil Fuel companies refer to those<br />

operating in the oil s<strong>and</strong>s. In some cases these companies offer higher average wages than other mining companies<br />

(e.g., for surface labourers), but in other cases they do not (e.g., for dragline/shovel operators).<br />

At the same time that wages are rising, weekly hours worked per employee have also increased. Figure 8, which reports<br />

on weekly hours worked in 10-year increments, shows that these hours have risen, on average, by eight per cent over<br />

the past 20 years — with the largest increases in the Territories at 11.5 per cent. This is perhaps due to the expansion<br />

of diamond mining <strong>and</strong> the industry’s goal of minimizing labour transportation costs relative to hours worked.<br />

Figure 6<br />

Hourly Total Compensation Rates by Region<br />

$60.00<br />

$50.00<br />

$40.00<br />

<strong>Canadian</strong> Average for <strong>Mining</strong><br />

$40.42 per hour<br />

$30.00<br />

$20.00<br />

$10.00<br />

$0.00<br />

Atlantic<br />

Quebec<br />

Ontario<br />

Prairies<br />

British Columbia<br />

Territories<br />

Source: <strong>Mining</strong> <strong>Industry</strong> Human Resources Council; Statistics Canada, Special Aggregations from Productivity Measures, Income <strong>and</strong> Expenditure Accounts Division, February 2009.<br />

2010 <strong>Employment</strong> <strong>and</strong> <strong>Hiring</strong> <strong>Forecasts</strong><br />

17