View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Global Investment Outlook • Eric Lascelles • Daniel E. Chornous, CFA • John Richards<br />

the winter and spring, denting global<br />

growth. Fortunately, commodity prices<br />

are now easing. Fourth, European woes<br />

have re-intensified as angry voters<br />

bring rather less austerity-friendly<br />

politicians to the fore, just as forward<br />

progress becomes all the more urgent.<br />

European growth has been snuffed out.<br />

Fifth, the Chinese economy continues<br />

to decelerate due to the country’s<br />

moderating real estate market. Sixth,<br />

the global economy is simply incapable<br />

of outsized economic growth during<br />

the post-financial-crisis period. Prior<br />

brief spurts have repeatedly proven<br />

unsustainable.<br />

Steady aim<br />

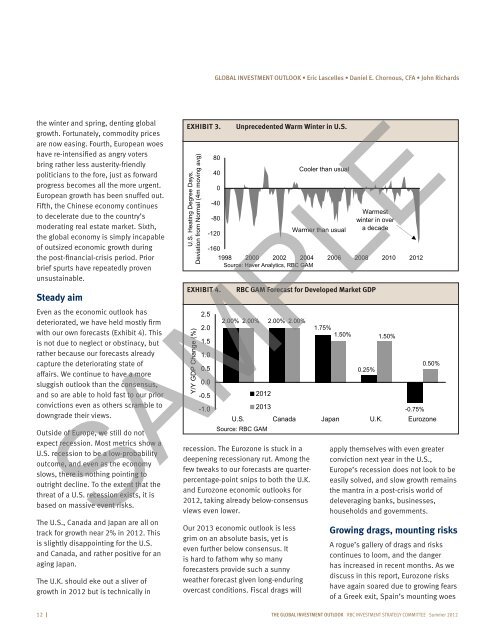

Even as the economic outlook has<br />

deteriorated, we have held mostly firm<br />

with our own forecasts (Exhibit 4). This<br />

is not due to neglect or obstinacy, but<br />

rather because our forecasts already<br />

capture the deteriorating state of<br />

affairs. We continue to have a more<br />

sluggish outlook than the consensus,<br />

and so are able to hold fast to our prior<br />

convictions even as others scramble to<br />

downgrade their views.<br />

Outside of Europe, we still do not<br />

expect recession. Most metrics show a<br />

U.S. recession to be a low-probability<br />

outcome, and even as the economy<br />

slows, there is nothing pointing to<br />

outright decline. To the extent that the<br />

threat of a U.S. recession exists, it is<br />

based on massive event risks.<br />

The U.S., Canada and Japan are all on<br />

track for growth near 2% in 2012. This<br />

is slightly disappointing for the U.S.<br />

and Canada, and rather positive for an<br />

aging Japan.<br />

The U.K. should eke out a sliver of<br />

growth in 2012 but is technically in<br />

EXHIBIT 3.<br />

U.S. Heating Degree Days,<br />

Deviation from Normal (4m moving avg)<br />

Y/Y GDP Change (%)<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

80<br />

40<br />

0<br />

-40<br />

-80<br />

-120<br />

-160<br />

EXHIBIT 4.<br />

Unprecedented Warm Winter in U.S.<br />

Cooler than usual<br />

Warmer than usual<br />

Warmest<br />

winter in over<br />

a decade<br />

1998 2000 2002 2004 2006 2008 2010 2012<br />

Source: Haver Analytics, <strong>RBC</strong> GAM<br />

<strong>RBC</strong> GAM Forecast for Developed Market GDP<br />

2.00% 2.00% 2.00% 2.00%<br />

2012<br />

2013<br />

1.75%<br />

1.50%<br />

0.25%<br />

1.50%<br />

-0.75%<br />

0.50%<br />

U.S. Canada Japan U.K. Eurozone<br />

Source: <strong>RBC</strong> GAM<br />

SAMPLE<br />

recession. The Eurozone is stuck in a<br />

deepening recessionary rut. Among the<br />

few tweaks to our forecasts are quarterpercentage-point<br />

snips to both the U.K.<br />

and Eurozone economic outlooks for<br />

2012, taking already below-consensus<br />

views even lower.<br />

Our 2013 economic outlook is less<br />

grim on an absolute basis, yet is<br />

even further below consensus. It<br />

is hard to fathom why so many<br />

forecasters provide such a sunny<br />

weather forecast given long-enduring<br />

overcast conditions. Fiscal drags will<br />

apply themselves with even greater<br />

conviction next year in the U.S.,<br />

Europe’s recession does not look to be<br />

easily solved, and slow growth remains<br />

the mantra in a post-crisis world of<br />

deleveraging banks, businesses,<br />

households and governments.<br />

Growing drags, mounting risks<br />

A rogue’s gallery of drags and risks<br />

continues to loom, and the danger<br />

has increased in recent months. As we<br />

discuss in this report, Eurozone risks<br />

have again soared due to growing fears<br />

of a Greek exit, Spain’s mounting woes<br />

12 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012