View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Fixed income markets • Soo Boo Cheah, CFA • Suzanne Gaynor<br />

our view that both economies are<br />

in better shape than suggested by<br />

their bond markets. For Germany,<br />

the U.K. and Japan, yield forecasts<br />

have been slightly lowered to reflect<br />

shifts in the political and economic<br />

landscape. In the near term, the threat<br />

of even lower yields is real should<br />

the European debacle worsen. The<br />

initial reaction would be for investors<br />

to flee to government bond markets<br />

outside Europe until aggressive<br />

policy steps bring yields into line with<br />

fundamentals. This could be a long<br />

work-out period and non-European<br />

government-bond markets are the most<br />

likely beneficiaries.<br />

Given the headwinds facing global<br />

governments, we expect major central<br />

banks to keep monetary policy<br />

accommodative. The ECB is likely<br />

to cut its short-term rate further to<br />

0.50% from the current 1.00%, and<br />

to implement further non-traditional<br />

monetary stimulus. At home, however,<br />

we expect the Bank of Canada to<br />

tighten its policy rate within the next 12<br />

months because the bank is concerned<br />

about excessive consumer debt,<br />

especially in home mortgages.<br />

We recognize that bond yields are far<br />

too low and that we are potentially<br />

in the last phase of the 30-year bull<br />

market for bonds. However, near-term<br />

uncertainties would suggest that we<br />

should not totally give up on bond<br />

allocations just yet since there is still<br />

the potential for a final surge in prices.<br />

We are also cognizant that<br />

policymakers will likely implement<br />

further measures to hold down yields.<br />

Taking all factors into consideration,<br />

we expect the market to wade through<br />

the current impasse and eventually<br />

Exhibit 6.<br />

Predicted minus Actual (%)<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

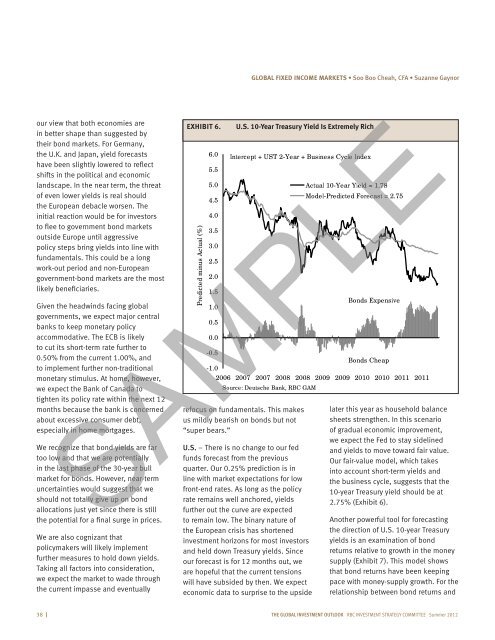

U.S. 10-Year Treasury Yield Is Extremely Rich<br />

Intercept + UST 2-Year + Business Cycle Index<br />

Actual 10-Year Yield = 1.78<br />

Model-Predicted Forecast = 2.75<br />

Bonds Expensive<br />

-0.5<br />

Bonds Cheap<br />

-1.0<br />

2006 2007 2007 2008 2008 2009 2009 2010 2010 2011 2011<br />

Source: Deutsche Bank, <strong>RBC</strong> GAM<br />

refocus on fundamentals. This makes<br />

us mildly bearish on bonds but not<br />

“super bears.”<br />

U.S. – There is no change to our fed<br />

funds forecast from the previous<br />

quarter. Our 0.25% prediction is in<br />

line with market expectations for low<br />

front-end rates. As long as the policy<br />

rate remains well anchored, yields<br />

further out the curve are expected<br />

to remain low. The binary nature of<br />

the European crisis has shortened<br />

investment horizons for most investors<br />

and held down Treasury yields. Since<br />

our forecast is for 12 months out, we<br />

are hopeful that the current tensions<br />

will have subsided by then. We expect<br />

economic data to surprise to the upside<br />

later this year as household balance<br />

sheets strengthen. In this scenario<br />

of gradual economic improvement,<br />

we expect the Fed to stay sidelined<br />

and yields to move toward fair value.<br />

Our fair-value model, which takes<br />

into account short-term yields and<br />

the business cycle, suggests that the<br />

10-year Treasury yield should be at<br />

2.75% (Exhibit 6).<br />

SAMPLE<br />

Another powerful tool for forecasting<br />

the direction of U.S. 10-year Treasury<br />

yields is an examination of bond<br />

returns relative to growth in the money<br />

supply (Exhibit 7). This model shows<br />

that bond returns have been keeping<br />

pace with money-supply growth. For the<br />

relationship between bond returns and<br />

38 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012