View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Recommended Asset Mix<br />

...Continued from previous page<br />

(i.e.: 7.5% above its benchmark of 55%<br />

and part way toward its upper limit of<br />

70% for equities), that would imply<br />

a tactical shift of + 5.02% to 25.02%<br />

for the Very Conservative profile (i.e.:<br />

a proportionate adjustment above the<br />

benchmark equity setting of 20% within<br />

the allowed range of +/- 15%).<br />

The value-added of tactical strategies<br />

are, of course, dependent on the<br />

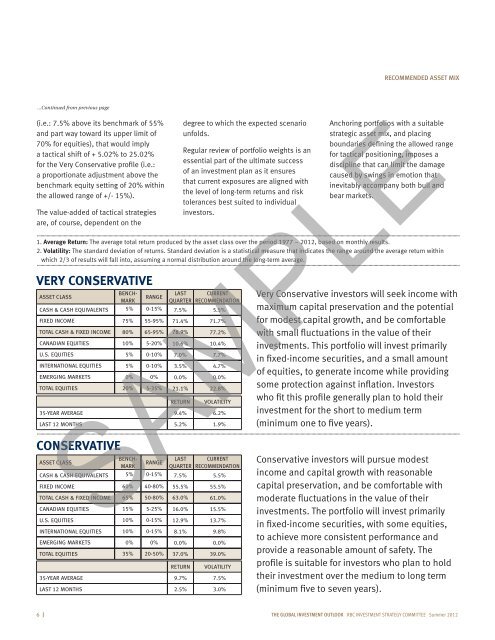

Very conservative<br />

Asset Class<br />

Range<br />

Last Current<br />

quarter recommendation<br />

Cash & Cash Equivalents 5% 0-15% 7.5% 5.5%<br />

Fixed Income 75% 55-95% 71.4% 71.7%<br />

Total Cash & Fixed Income 80% 65-95% 78.9% 77.2%<br />

Canadian Equities 10% 5-20% 10.6% 10.4%<br />

U.S. Equities 5% 0-10% 7.0% 7.7%<br />

International Equities 5% 0-10% 3.5% 4.7%<br />

Emerging markets 0% 0% 0.0% 0.0%<br />

Total Equities 20% 5-35% 21.1% 22.8%<br />

Conservative<br />

Asset Class<br />

Benchmark<br />

Benchmark<br />

Range<br />

Return<br />

Last Current<br />

quarter recommendation<br />

Cash & Cash Equivalents 5% 0-15% 7.5% 5.5%<br />

Fixed Income 60% 40-80% 55.5% 55.5%<br />

Total Cash & Fixed Income 65% 50-80% 63.0% 61.0%<br />

Canadian Equities 15% 5-25% 16.0% 15.5%<br />

U.S. Equities 10% 0-15% 12.9% 13.7%<br />

International Equities 10% 0-15% 8.1% 9.8%<br />

emerging markets 0% 0% 0.0% 0.0%<br />

Total Equities 35% 20-50% 37.0% 39.0%<br />

degree to which the expected scenario<br />

unfolds.<br />

Regular review of portfolio weights is an<br />

essential part of the ultimate success<br />

of an investment plan as it ensures<br />

that current exposures are aligned with<br />

the level of long-term returns and risk<br />

tolerances best suited to individual<br />

investors.<br />

1. Average Return: The average total return produced by the asset class over the period 1977 – 2012, based on monthly results.<br />

2. Volatility: The standard deviation of returns. Standard deviation is a statistical measure that indicates the range around the average return within<br />

which 2/3 of results will fall into, assuming a normal distribution around the long-term average.<br />

Volatility<br />

35-year average 9.4% 6.2%<br />

Last 12 months 5.2% 1.9%<br />

Anchoring portfolios with a suitable<br />

strategic asset mix, and placing<br />

boundaries defining the allowed range<br />

for tactical positioning, imposes a<br />

discipline that can limit the damage<br />

caused by swings in emotion that<br />

inevitably accompany both bull and<br />

bear markets.<br />

Very Conservative investors will seek income with<br />

maximum capital preservation and the potential<br />

for modest capital growth, and be comfortable<br />

with small fluctuations in the value of their<br />

investments. This portfolio will invest primarily<br />

in fixed-income securities, and a small amount<br />

of equities, to generate income while providing<br />

some protection against inflation. Investors<br />

who fit this profile generally plan to hold their<br />

investment for the short to medium term<br />

(minimum one to five years).<br />

SAMPLE<br />

Return<br />

Volatility<br />

35-year average 9.7% 7.5%<br />

Last 12 months 2.5% 3.0%<br />

Conservative investors will pursue modest<br />

income and capital growth with reasonable<br />

capital preservation, and be comfortable with<br />

moderate fluctuations in the value of their<br />

investments. The portfolio will invest primarily<br />

in fixed-income securities, with some equities,<br />

to achieve more consistent performance and<br />

provide a reasonable amount of safety. The<br />

profile is suitable for investors who plan to hold<br />

their investment over the medium to long term<br />

(minimum five to seven years).<br />

6 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012