View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Investment Outlook • Eric Lascelles • Daniel E. Chornous, CFA • John Richards<br />

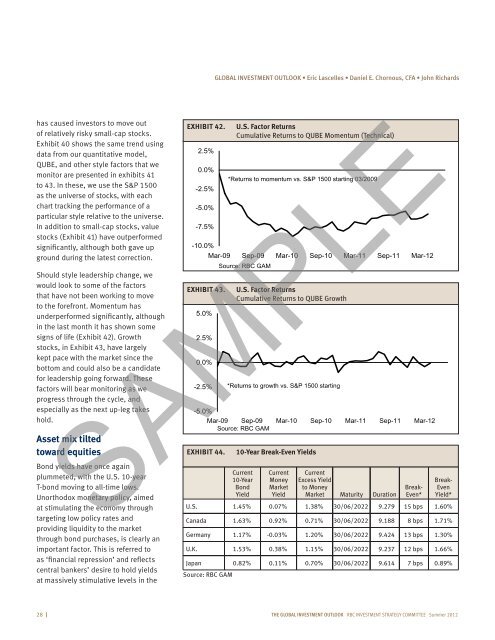

has caused investors to move out<br />

of relatively risky small-cap stocks.<br />

Exhibit 40 shows the same trend using<br />

data from our quantitative model,<br />

QUBE, and other style factors that we<br />

monitor are presented in exhibits 41<br />

to 43. In these, we use the S&P 1500<br />

as the universe of stocks, with each<br />

chart tracking the performance of a<br />

particular style relative to the universe.<br />

In addition to small-cap stocks, value<br />

stocks (Exhibit 41) have outperformed<br />

significantly, although both gave up<br />

ground during the latest correction.<br />

Should style leadership change, we<br />

would look to some of the factors<br />

that have not been working to move<br />

to the forefront. Momentum has<br />

underperformed significantly, although<br />

in the last month it has shown some<br />

signs of life (Exhibit 42). Growth<br />

stocks, in Exhibit 43, have largely<br />

kept pace with the market since the<br />

bottom and could also be a candidate<br />

for leadership going forward. These<br />

factors will bear monitoring as we<br />

progress through the cycle, and<br />

especially as the next up-leg takes<br />

hold.<br />

Asset mix tilted<br />

toward equities<br />

Bond yields have once again<br />

plummeted, with the U.S. 10-year<br />

T-bond moving to all-time lows.<br />

Unorthodox monetary policy, aimed<br />

at stimulating the economy through<br />

targeting low policy rates and<br />

providing liquidity to the market<br />

through bond purchases, is clearly an<br />

important factor. This is referred to<br />

as ‘financial repression’ and reflects<br />

central bankers’ desire to hold yields<br />

at massively stimulative levels in the<br />

EXHIBIT 42.<br />

2.5%<br />

0.0%<br />

-2.5%<br />

-5.0%<br />

-7.5%<br />

-10.0%<br />

EXHIBIT 43.<br />

5.0%<br />

2.5%<br />

0.0%<br />

-2.5%<br />

U.S. Factor Returns<br />

Cumulative Returns to QUBE Momentum (Technical)<br />

*Returns to momentum vs. S&P 1500 starting 03/2009<br />

Mar-09 Sep-09 Mar-10 Sep-10 Mar-11 Sep-11 Mar-12<br />

Source: <strong>RBC</strong> GAM<br />

U.S. Factor Returns<br />

Cumulative Returns to QUBE Growth<br />

*Returns to growth vs. S&P 1500 starting<br />

-5.0%<br />

Mar-09 Sep-09 Mar-10 Sep-10 Mar-11 Sep-11 Mar-12<br />

Source: <strong>RBC</strong> GAM<br />

SAMPLE<br />

EXHIBIT 44.<br />

10-Year Break-Even Yields<br />

Current<br />

10-Year<br />

Bond<br />

Yield<br />

Current<br />

Money<br />

Market<br />

Yield<br />

Current<br />

Excess Yield<br />

to Money<br />

Market Maturity Duration<br />

Break-<br />

Even*<br />

Break-<br />

Even<br />

Yield*<br />

U.S. 1.45% 0.07% 1.38% 30/06/2022 9.279 15 bps 1.60%<br />

Canada 1.63% 0.92% 0.71% 30/06/2022 9.188 8 bps 1.71%<br />

Germany 1.17% -0.03% 1.20% 30/06/2022 9.424 13 bps 1.30%<br />

U.K. 1.53% 0.38% 1.15% 30/06/2022 9.237 12 bps 1.66%<br />

Japan 0.82% 0.11% 0.70% 30/06/2022 9.614 7 bps 0.89%<br />

Source: <strong>RBC</strong> GAM<br />

28 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012