View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Fixed income markets • Soo Boo Cheah, CFA • Suzanne Gaynor<br />

recede. Investors should shift their<br />

focus back to the strong fundamental<br />

stories. The Fed is also expected to<br />

step aside under these circumstances,<br />

and intervention premiums in<br />

Treasuries will gradually dissipate.<br />

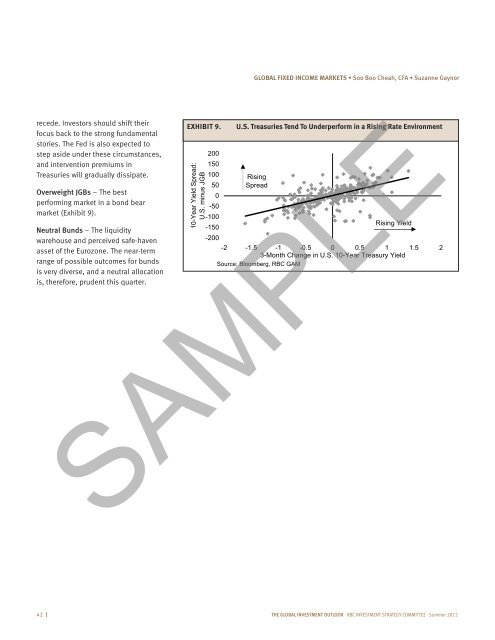

Overweight JGBs – The best<br />

performing market in a bond bear<br />

market (Exhibit 9).<br />

Neutral Bunds – The liquidity<br />

warehouse and perceived safe-haven<br />

asset of the Eurozone. The near-term<br />

range of possible outcomes for bunds<br />

is very diverse, and a neutral allocation<br />

is, therefore, prudent this quarter.<br />

Exhibit 9.<br />

10-Year Yield Spread:<br />

U.S. minus JGB<br />

200<br />

150<br />

100<br />

50<br />

0<br />

-50<br />

-100<br />

-150<br />

U.S. Treasuries Tend To Underperform in a Rising Rate Environment<br />

Rising<br />

Spread<br />

Rising Yield<br />

-200<br />

-2 -1.5 -1 -0.5 0 0.5 1 1.5 2<br />

3-Month Change in U.S. 10-Year Treasury Yield<br />

Source: Bloomberg, <strong>RBC</strong> GAM<br />

SAMPLE<br />

42 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012