View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

View Sample PDF - RBC Direct Investing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Outlook – U.S.<br />

Ray Mawhinney<br />

Senior V.P. & Senior Portfolio Manager<br />

<strong>RBC</strong> Global Asset Management Inc.<br />

U.S. markets were under significant<br />

pressure during May after moving<br />

sideways through the first two months<br />

of the quarter. For the three-month<br />

period as a whole, the S&P 500<br />

fell about 5%, though it is still up<br />

significantly from the early-October<br />

lows. Investor sentiment has turned<br />

decidedly negative after the surprising<br />

results of the Greek election, a<br />

continuing slowdown in economic<br />

activity in China and other emerging<br />

economies, and widespread economic<br />

weakness in the Eurozone. While U.S<br />

economic data has been relatively<br />

decent over the period, the probability<br />

of Greece giving up the euro has<br />

increased dramatically and, as a result,<br />

global stock markets have moved down<br />

to reflect the rising odds of defaults<br />

and a breakdown of the Eurozone.<br />

At the moment, the main fear driving<br />

markets is that, with global growth<br />

slowing, a credit event in Europe<br />

could push the world into a recession<br />

much like the one experienced after<br />

the bankruptcy of Lehman Brothers<br />

in 2008. Given these fears, sectors<br />

most tied to global growth, such as<br />

Materials, Industrials and Energy, have<br />

underperformed significantly relative<br />

to domestically linked sectors with<br />

relatively stable cash flows, such as<br />

Utilities, Telecommunication Services,<br />

Consumer Staples and Health Care. In<br />

the Financials sector, shares of global<br />

U.S. banks have faltered lately, but for<br />

the sector as a whole, capital levels<br />

are good, loan growth is picking up<br />

and dividends have been reinstated or<br />

raised. In the Information Technology<br />

sector, the build-out of the mobile<br />

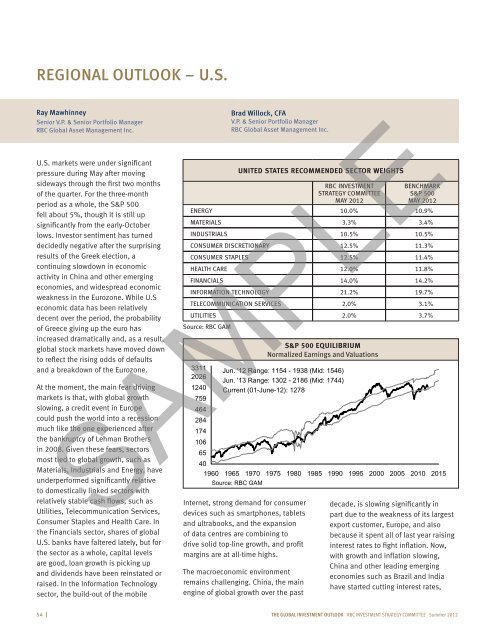

United States Recommended Sector Weights<br />

<strong>RBC</strong> Investment<br />

Strategy Committee<br />

May 2012<br />

Benchmark<br />

S&P 500<br />

May 2012<br />

Energy 10.0% 10.9%<br />

Materials 3.3% 3.4%<br />

Industrials 10.5% 10.5%<br />

Consumer Discretionary 12.5% 11.3%<br />

Consumer Staples 12.5% 11.4%<br />

Health Care 12.0% 11.8%<br />

Financials 14.0% 14.2%<br />

Information Technology 21.2% 19.7%<br />

Telecommunication Services 2.0% 3.1%<br />

Utilities 2.0% 3.7%<br />

Source: <strong>RBC</strong> GAM<br />

3311<br />

2026<br />

1240<br />

759<br />

464<br />

284<br />

174<br />

106<br />

65<br />

Brad Willock, CFA<br />

V.P. & Senior Portfolio Manager<br />

<strong>RBC</strong> Global Asset Management Inc.<br />

Jun. '12 Range: 1154 - 1938 (Mid: 1546)<br />

Jun. '13 Range: 1302 - 2186 (Mid: 1744)<br />

Current (01-June-12): 1278<br />

40<br />

1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015<br />

Source: <strong>RBC</strong> GAM<br />

Internet, strong demand for consumer<br />

devices such as smartphones, tablets<br />

and ultrabooks, and the expansion<br />

of data centres are combining to<br />

drive solid top-line growth, and profit<br />

margins are at all-time highs.<br />

The macroeconomic environment<br />

remains challenging. China, the main<br />

engine of global growth over the past<br />

S&P 500 Equilibrium<br />

Normalized Earnings and Valuations<br />

SAMPLE<br />

decade, is slowing significantly in<br />

part due to the weakness of its largest<br />

export customer, Europe, and also<br />

because it spent all of last year raising<br />

interest rates to fight inflation. Now,<br />

with growth and inflation slowing,<br />

China and other leading emerging<br />

economies such as Brazil and India<br />

have started cutting interest rates,<br />

54 I The global investment outlook <strong>RBC</strong> INVESTMENT Strategy coMMITTEE Summer 2012